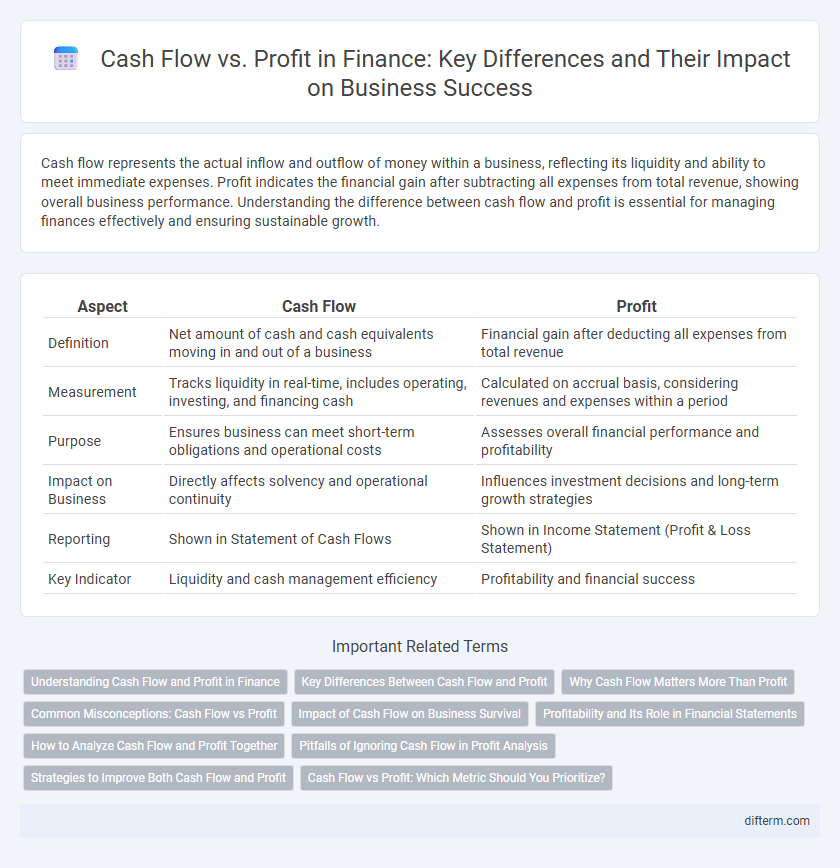

Cash flow represents the actual inflow and outflow of money within a business, reflecting its liquidity and ability to meet immediate expenses. Profit indicates the financial gain after subtracting all expenses from total revenue, showing overall business performance. Understanding the difference between cash flow and profit is essential for managing finances effectively and ensuring sustainable growth.

Table of Comparison

| Aspect | Cash Flow | Profit |

|---|---|---|

| Definition | Net amount of cash and cash equivalents moving in and out of a business | Financial gain after deducting all expenses from total revenue |

| Measurement | Tracks liquidity in real-time, includes operating, investing, and financing cash | Calculated on accrual basis, considering revenues and expenses within a period |

| Purpose | Ensures business can meet short-term obligations and operational costs | Assesses overall financial performance and profitability |

| Impact on Business | Directly affects solvency and operational continuity | Influences investment decisions and long-term growth strategies |

| Reporting | Shown in Statement of Cash Flows | Shown in Income Statement (Profit & Loss Statement) |

| Key Indicator | Liquidity and cash management efficiency | Profitability and financial success |

Understanding Cash Flow and Profit in Finance

Cash flow represents the actual inflow and outflow of cash within a business, reflecting its liquidity and ability to meet immediate financial obligations. Profit, on the other hand, is the net income calculated after deducting all expenses from total revenue, indicating overall financial performance but not necessarily available cash. Understanding the distinction between cash flow and profit is crucial for effective financial management, ensuring solvency and guiding investment decisions.

Key Differences Between Cash Flow and Profit

Cash flow represents the actual inflow and outflow of cash within a business during a specific period, highlighting liquidity and operational efficiency. Profit, calculated as total revenue minus total expenses, reflects the overall financial performance and profitability but does not account for timing differences in cash transactions. Key differences include cash flow's impact on a company's ability to meet short-term obligations versus profit's role in measuring long-term financial success.

Why Cash Flow Matters More Than Profit

Cash flow represents the actual liquidity a business has to cover expenses, invest, and sustain operations, whereas profit is an accounting measure that can include non-cash items. Positive cash flow ensures solvency and operational stability, making it a more immediate indicator of financial health. Companies with strong cash flow can avoid insolvency even when profits are low or negative.

Common Misconceptions: Cash Flow vs Profit

Cash flow and profit are often confused, but they represent different financial concepts essential for business health. Profit measures the difference between total revenue and expenses over a period, reflecting overall profitability, while cash flow tracks the actual inflow and outflow of cash, highlighting liquidity. Misunderstanding these differences can lead to poor financial decisions, as a profitable company may still face cash shortages that threaten operations.

Impact of Cash Flow on Business Survival

Positive cash flow ensures a business can meet its immediate financial obligations, such as paying suppliers, employees, and operating expenses, directly affecting day-to-day survival. Unlike profit, which indicates long-term financial health, consistent cash flow maintains liquidity and prevents insolvency risks. Effective cash flow management enables businesses to avoid disruptions, seize growth opportunities, and sustain operations during economic fluctuations.

Profitability and Its Role in Financial Statements

Profitability measures a company's ability to generate earnings relative to expenses and is a key indicator on financial statements such as the income statement. Unlike cash flow, which tracks actual cash movement, profitability reflects the overall financial performance during a period by showing net income. Accurate assessment of profitability helps investors and management understand the viability and efficiency of business operations over time.

How to Analyze Cash Flow and Profit Together

Analyzing cash flow and profit together provides a comprehensive view of a company's financial health by highlighting liquidity and profitability metrics simultaneously. Cash flow statements reveal the timing and magnitude of cash movements, helping identify potential short-term solvent issues even if the profit and loss statement reports positive earnings. Cross-referencing net income with operating cash flow highlights discrepancies from non-cash expenses, enabling more accurate assessments of sustainable business performance and investment capacity.

Pitfalls of Ignoring Cash Flow in Profit Analysis

Ignoring cash flow in profit analysis can lead to liquidity crises despite apparent profitability, as profits do not account for the timing of cash inflows and outflows. Companies might report strong net income while facing insufficient cash to cover operational expenses, debt obligations, or capital investments. Misjudging liquidity by focusing solely on profit can result in insolvency risks and hinder sustainable business growth.

Strategies to Improve Both Cash Flow and Profit

Implement effective cash flow management by accelerating receivables through prompt invoicing and offering early payment discounts, while negotiating extended payment terms with suppliers to maintain liquidity. Enhance profitability by reducing operational costs via process automation and optimizing pricing strategies based on market demand and competition analysis. Regular financial forecasting and monitoring key performance indicators help align cash flow improvement efforts with profit maximization goals.

Cash Flow vs Profit: Which Metric Should You Prioritize?

Cash flow provides a real-time snapshot of liquidity, highlighting a company's ability to meet immediate obligations, while profit indicates overall financial performance after expenses are deducted. Prioritizing cash flow is crucial for maintaining solvency and operational stability, especially for businesses with tight cash reserves. However, analyzing profit remains essential for long-term growth and investment decisions, making a balanced evaluation of both metrics key for comprehensive financial management.

Cash flow vs Profit Infographic

difterm.com

difterm.com