The yield curve represents the relationship between interest rates and different maturities of government bonds, reflecting market expectations for future interest rates and economic activity. The swap curve, on the other hand, is derived from interest rate swaps and often serves as a benchmark for pricing corporate debt and managing interest rate risk. Comparing the yield curve and swap curve reveals variations caused by credit risk, liquidity, and market supply-demand dynamics, influencing investment and hedging strategies.

Table of Comparison

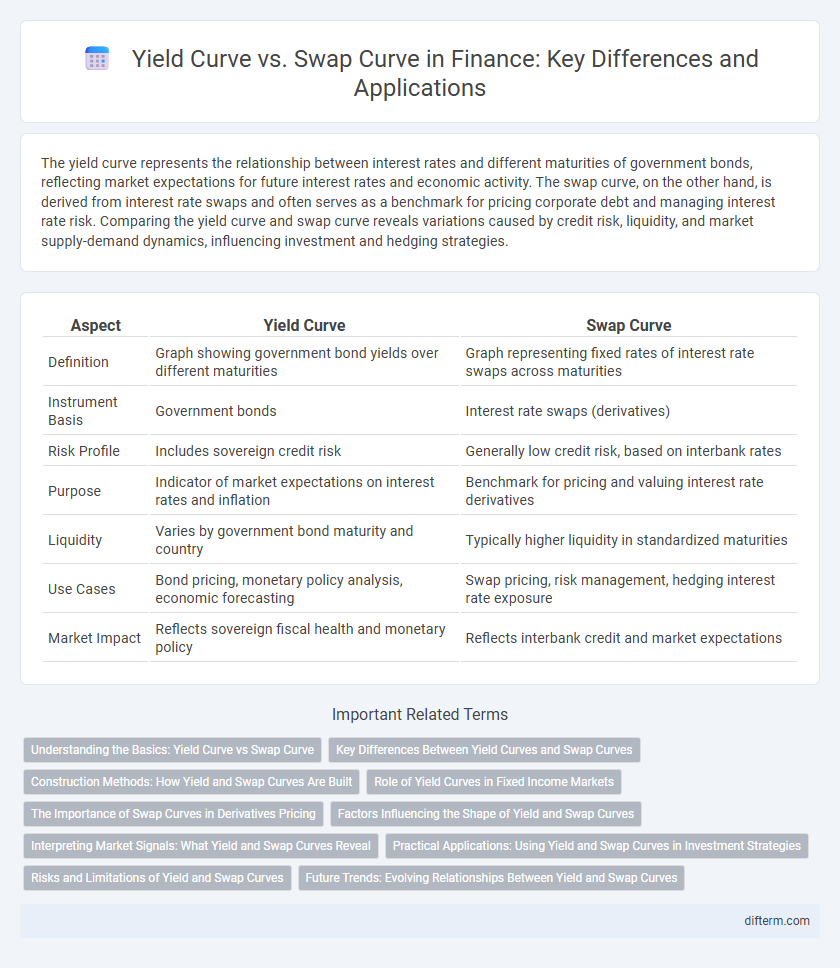

| Aspect | Yield Curve | Swap Curve |

|---|---|---|

| Definition | Graph showing government bond yields over different maturities | Graph representing fixed rates of interest rate swaps across maturities |

| Instrument Basis | Government bonds | Interest rate swaps (derivatives) |

| Risk Profile | Includes sovereign credit risk | Generally low credit risk, based on interbank rates |

| Purpose | Indicator of market expectations on interest rates and inflation | Benchmark for pricing and valuing interest rate derivatives |

| Liquidity | Varies by government bond maturity and country | Typically higher liquidity in standardized maturities |

| Use Cases | Bond pricing, monetary policy analysis, economic forecasting | Swap pricing, risk management, hedging interest rate exposure |

| Market Impact | Reflects sovereign fiscal health and monetary policy | Reflects interbank credit and market expectations |

Understanding the Basics: Yield Curve vs Swap Curve

The yield curve represents interest rates of government bonds across different maturities, reflecting the risk-free rate and market expectations for economic growth. The swap curve is derived from interest rate swap rates, incorporating credit risk and serving as a benchmark for pricing corporate debt and derivatives. Comparing both curves helps investors assess risk premiums and interpret market sentiment on future interest rate movements.

Key Differences Between Yield Curves and Swap Curves

Yield curves represent government bond yields across different maturities, reflecting risk-free rates and general economic expectations, while swap curves are derived from interest rate swap rates, incorporating credit risk and liquidity premiums. Yield curves are primarily used to gauge sovereign credit conditions and benchmark fixed income products, whereas swap curves serve as benchmarks for pricing corporate debt and interest rate derivatives. The divergence between the two curves often signals market sentiment on credit risk, monetary policy impact, and investor demand dynamics in the fixed income market.

Construction Methods: How Yield and Swap Curves Are Built

Yield curves are constructed using the yields of government bonds across various maturities, often employing bootstrapping techniques to derive zero-coupon yields for precise term structure representation. Swap curves are generated by stripping fixed and floating rates from interest rate swap contracts, utilizing market swap rates to construct a curve that reflects the credit and liquidity premiums embedded in interbank lending. Both curves rely on interpolation methods like cubic splines or linear interpolation to smooth rate transitions between observed maturities, ensuring accurate valuation and risk management.

Role of Yield Curves in Fixed Income Markets

Yield curves represent government bond yields plotted against maturity dates, serving as benchmarks for assessing interest rate risk and economic expectations in fixed income markets. Swap curves, derived from interest rate swaps, provide a more accurate measure of credit and liquidity risk for pricing corporate debt and derivatives. The yield curve's role includes guiding investment decisions, pricing bonds, and managing portfolio risk through interest rate forecasts.

The Importance of Swap Curves in Derivatives Pricing

Swap curves serve as critical benchmarks in derivatives pricing, reflecting market expectations for interest rates over various maturities more accurately than traditional yield curves. Unlike government bond yield curves, swap curves incorporate credit risk and liquidity premiums, making them essential for valuing interest rate swaps and other derivative instruments. Market participants rely on swap curves to price risk, hedge interest rate exposure, and conduct accurate financial modeling in complex derivatives markets.

Factors Influencing the Shape of Yield and Swap Curves

The shape of yield and swap curves is influenced primarily by interest rate expectations, credit risk, and liquidity premiums. Central bank policies and inflation forecasts directly affect the yield curve by altering long-term bond yields, while swap curves respond more to counterparty credit risk and market demand for interest rate swaps. Market sentiment and economic outlook also play critical roles in shaping both curves, reflecting investors' risk tolerance and expectations for future economic conditions.

Interpreting Market Signals: What Yield and Swap Curves Reveal

Yield curves reflect government bond yields across maturities, revealing market expectations of interest rates, inflation, and economic growth; a steep yield curve often signals optimism, while an inverted curve may indicate recession fears. Swap curves, based on interest rate swaps, incorporate credit risk and liquidity premiums, making them critical for pricing corporate debt and managing interest rate risk. Comparing these curves allows analysts to gauge risk sentiment, detect arbitrage opportunities, and better understand the underlying dynamics influencing borrowing costs and investment strategies.

Practical Applications: Using Yield and Swap Curves in Investment Strategies

Yield curves provide crucial insights into government bond yields across maturities, guiding investors in assessing interest rate risk and economic outlook when constructing fixed-income portfolios. Swap curves, reflecting the cost of exchanging fixed for floating rates, offer benchmarks for pricing and managing interest rate derivatives, enabling hedging against rate volatility. Combining yield and swap curves enhances investment strategies by facilitating relative value analysis and optimizing duration positioning in diverse market conditions.

Risks and Limitations of Yield and Swap Curves

Yield curves and swap curves both provide critical insights into interest rate expectations but come with inherent risks and limitations. Yield curves, derived from government bonds, are influenced by credit risk, liquidity constraints, and market supply-demand imbalances, potentially distorting interest rate signals. Swap curves, while reflecting broader credit risk through counterparty exposure and less regulated markets, may suffer from lower transparency and susceptibility to market manipulation or systemic risks in derivative markets.

Future Trends: Evolving Relationships Between Yield and Swap Curves

Future trends indicate an increasing divergence between yield curves and swap curves as central bank policies and credit risk perceptions evolve. The yield curve, reflecting government bond yields, may decouple from swap curves driven by interbank credit risk and liquidity conditions. Market participants should monitor these shifting dynamics for implications on interest rate risk management and derivative pricing.

yield curve vs swap curve Infographic

difterm.com

difterm.com