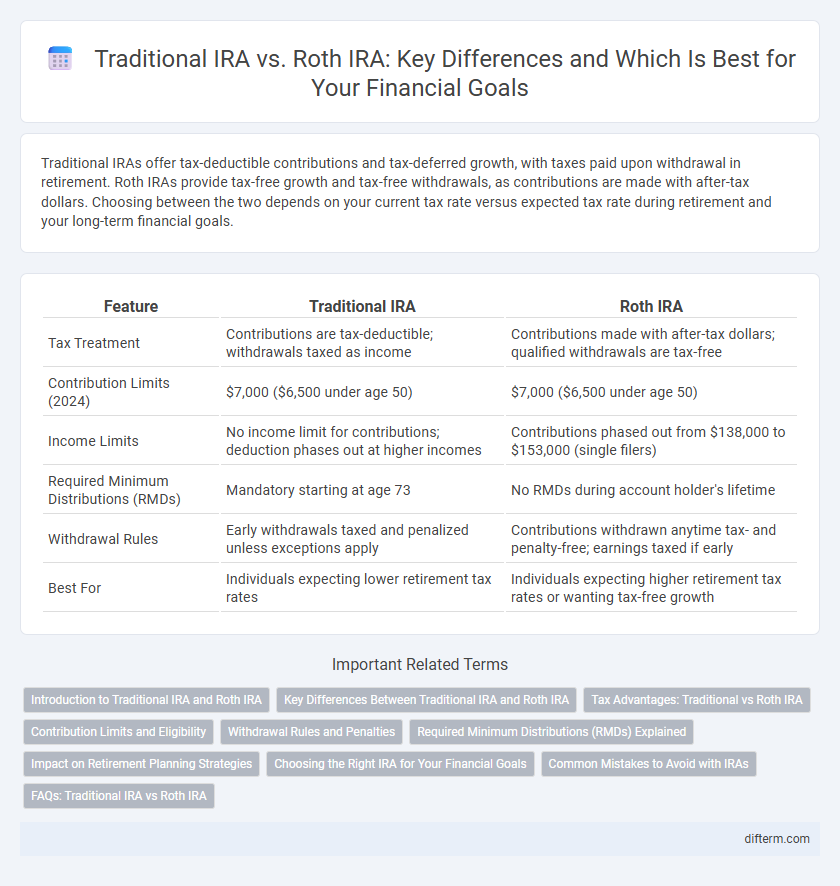

Traditional IRAs offer tax-deductible contributions and tax-deferred growth, with taxes paid upon withdrawal in retirement. Roth IRAs provide tax-free growth and tax-free withdrawals, as contributions are made with after-tax dollars. Choosing between the two depends on your current tax rate versus expected tax rate during retirement and your long-term financial goals.

Table of Comparison

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax Treatment | Contributions are tax-deductible; withdrawals taxed as income | Contributions made with after-tax dollars; qualified withdrawals are tax-free |

| Contribution Limits (2024) | $7,000 ($6,500 under age 50) | $7,000 ($6,500 under age 50) |

| Income Limits | No income limit for contributions; deduction phases out at higher incomes | Contributions phased out from $138,000 to $153,000 (single filers) |

| Required Minimum Distributions (RMDs) | Mandatory starting at age 73 | No RMDs during account holder's lifetime |

| Withdrawal Rules | Early withdrawals taxed and penalized unless exceptions apply | Contributions withdrawn anytime tax- and penalty-free; earnings taxed if early |

| Best For | Individuals expecting lower retirement tax rates | Individuals expecting higher retirement tax rates or wanting tax-free growth |

Introduction to Traditional IRA and Roth IRA

Traditional IRA allows individuals to contribute pre-tax income, offering tax-deferred growth until withdrawal, typically during retirement. Roth IRA contributions are made with after-tax dollars, enabling qualified withdrawals to be tax-free, including both contributions and earnings. Both accounts serve as critical retirement savings tools but differ primarily in their tax treatment and withdrawal rules.

Key Differences Between Traditional IRA and Roth IRA

Traditional IRA contributions are typically tax-deductible, lowering taxable income in the year of contribution, while Roth IRA contributions are made with after-tax dollars and grow tax-free. Withdrawals from a Traditional IRA during retirement are taxed as ordinary income, whereas qualified withdrawals from a Roth IRA are tax-exempt, offering potential tax advantages based on individual circumstances. Required Minimum Distributions (RMDs) apply to Traditional IRAs starting at age 73, but Roth IRAs have no RMDs during the original owner's lifetime, providing greater flexibility for estate planning.

Tax Advantages: Traditional vs Roth IRA

Traditional IRAs offer tax-deductible contributions that reduce current taxable income, with taxes paid upon withdrawal in retirement, while Roth IRAs provide no upfront tax deduction but allow for tax-free withdrawals of contributions and earnings after age 59 1/2. The choice between the two hinges on expected future tax rates: Traditional IRAs benefit those anticipating lower tax brackets in retirement, whereas Roth IRAs favor individuals expecting higher taxes or preferring tax diversification. For high-income earners or those seeking tax-free growth, Roth IRAs can offer significant long-term advantages despite the lack of immediate tax breaks.

Contribution Limits and Eligibility

Traditional IRA contribution limits for 2024 are $6,500, or $7,500 for individuals aged 50 and older, with eligibility available to anyone under 70 1/2 with earned income. Roth IRA contributions share the same limits but phase out at higher income levels, beginning at $146,000 for single filers and $230,000 for joint filers in 2024. Eligibility for a Roth IRA depends on modified adjusted gross income (MAGI), while Traditional IRA contributions may be fully, partially, or non-deductible depending on income and participation in an employer-sponsored retirement plan.

Withdrawal Rules and Penalties

Traditional IRA withdrawals are taxed as ordinary income and required minimum distributions (RMDs) must begin at age 73, with penalties for early withdrawals before age 59 1/2 unless exceptions apply. Roth IRA contributions can be withdrawn tax- and penalty-free anytime, while earnings are tax-free only after the account is five years old and the account holder reaches 59 1/2, with penalties on non-qualified distributions. Early withdrawals from both accounts without qualifying reasons typically incur a 10% penalty in addition to taxes, emphasizing the importance of understanding specific withdrawal rules.

Required Minimum Distributions (RMDs) Explained

Traditional IRAs mandate Required Minimum Distributions (RMDs) starting at age 73, compelling account holders to withdraw a specific minimum amount annually to avoid penalties. Roth IRAs, in contrast, do not require RMDs during the account holder's lifetime, allowing tax-free growth and greater flexibility in estate planning. Understanding RMD rules is crucial for retirement planning, as failing to take RMDs from a Traditional IRA can result in a 25% excise tax on the amount not distributed.

Impact on Retirement Planning Strategies

Traditional IRAs offer tax-deferred growth with contributions often tax-deductible, lowering taxable income in retirement planning, while withdrawals are taxed as ordinary income. Roth IRAs provide tax-free growth and tax-free withdrawals, beneficial for investors anticipating higher future tax rates or seeking tax diversification in retirement income. Strategic retirement planning leverages the tax treatment differences of both IRAs to balance current tax benefits with long-term, tax-free income potential.

Choosing the Right IRA for Your Financial Goals

Selecting the right IRA depends on your current tax bracket and future income expectations, with Traditional IRAs offering tax-deferred growth and immediate tax deductions, while Roth IRAs provide tax-free withdrawals in retirement. Consider your anticipated retirement tax rate; if you expect to be in a higher bracket later, Roth IRAs may maximize after-tax returns. Evaluate contribution limits, income eligibility, and required minimum distributions to align your IRA choice with long-term financial objectives.

Common Mistakes to Avoid with IRAs

Failing to contribute the maximum allowable amount each year limits the potential for tax-advantaged growth in both Traditional and Roth IRAs. Confusing the tax treatment by withdrawing earnings too early from a Roth IRA can result in costly penalties and lost benefits. Neglecting to consider income limits and required minimum distributions (RMDs) for Traditional IRAs often leads to unexpected tax liabilities and reduced retirement savings.

FAQs: Traditional IRA vs Roth IRA

Traditional IRA contributions are tax-deductible, lowering taxable income in the contribution year, while Roth IRA contributions are made with after-tax dollars, offering tax-free withdrawals during retirement. Traditional IRAs require minimum distributions starting at age 73, whereas Roth IRAs have no mandatory withdrawals. Withdrawal rules differ as well: Traditional IRA withdrawals before age 59 1/2 may incur penalties and taxes, but Roth IRA contributions can be withdrawn anytime tax- and penalty-free.

Traditional IRA vs Roth IRA Infographic

difterm.com

difterm.com