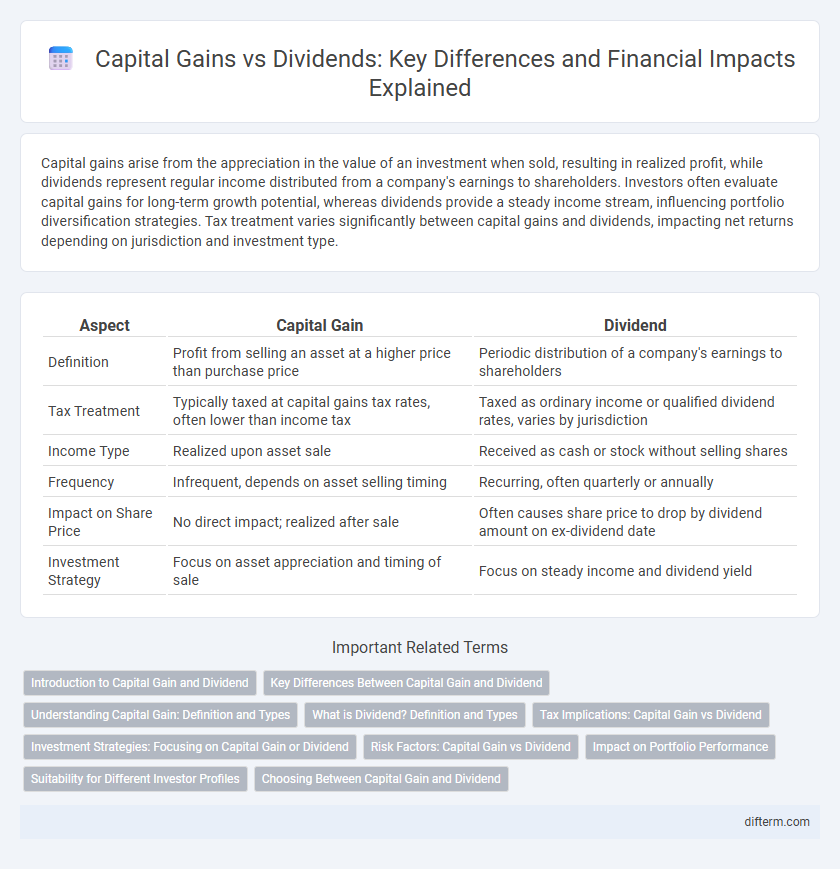

Capital gains arise from the appreciation in the value of an investment when sold, resulting in realized profit, while dividends represent regular income distributed from a company's earnings to shareholders. Investors often evaluate capital gains for long-term growth potential, whereas dividends provide a steady income stream, influencing portfolio diversification strategies. Tax treatment varies significantly between capital gains and dividends, impacting net returns depending on jurisdiction and investment type.

Table of Comparison

| Aspect | Capital Gain | Dividend |

|---|---|---|

| Definition | Profit from selling an asset at a higher price than purchase price | Periodic distribution of a company's earnings to shareholders |

| Tax Treatment | Typically taxed at capital gains tax rates, often lower than income tax | Taxed as ordinary income or qualified dividend rates, varies by jurisdiction |

| Income Type | Realized upon asset sale | Received as cash or stock without selling shares |

| Frequency | Infrequent, depends on asset selling timing | Recurring, often quarterly or annually |

| Impact on Share Price | No direct impact; realized after sale | Often causes share price to drop by dividend amount on ex-dividend date |

| Investment Strategy | Focus on asset appreciation and timing of sale | Focus on steady income and dividend yield |

Introduction to Capital Gain and Dividend

Capital gain represents the profit realized from the sale of an asset such as stocks, bonds, or real estate, and is calculated as the difference between the sale price and the original purchase price. Dividends are periodic payments made to shareholders from a company's earnings, providing a steady income stream without selling the asset. Understanding the distinction between capital gains, which depend on market transactions, and dividends, which are income distributions, is essential for effective investment strategy and tax planning.

Key Differences Between Capital Gain and Dividend

Capital gain represents the profit earned from selling an asset like stocks or real estate at a higher price than the purchase price, whereas dividends are periodic payments made by companies to shareholders from profits or retained earnings. Capital gains are typically taxed at different rates depending on the holding period, categorized as short-term or long-term gains, while dividends may be qualified or non-qualified and taxed accordingly. Investors often consider capital gains for growth potential and dividends for steady income, impacting portfolio strategy and tax planning.

Understanding Capital Gain: Definition and Types

Capital gain refers to the profit realized from the sale of an asset like stocks, bonds, or real estate, where the selling price exceeds the original purchase price. There are two primary types of capital gains: short-term, realized from assets held for one year or less and taxed at ordinary income rates, and long-term, from assets held over one year and typically taxed at lower rates. Understanding these distinctions helps investors optimize tax liabilities and make informed portfolio decisions.

What is Dividend? Definition and Types

Dividend is a distribution of a portion of a company's earnings to its shareholders, typically in the form of cash or additional stock. Common types of dividends include cash dividends, stock dividends, property dividends, and special dividends, each varying in payout method and frequency. Understanding dividend types helps investors assess income potential and tax implications within their investment portfolio.

Tax Implications: Capital Gain vs Dividend

Capital gains are typically taxed at a lower rate than dividends, making them more tax-efficient for long-term investors. Qualified dividends may receive favorable tax treatment, but ordinary dividends are often taxed as regular income, which can result in higher tax liabilities. Understanding the specific tax brackets and holding periods for capital gains versus dividend income is essential for optimizing after-tax returns.

Investment Strategies: Focusing on Capital Gain or Dividend

Investors prioritizing capital gains target assets with high growth potential, seeking profit through price appreciation over time, often favoring stocks or real estate holdings. Dividend-focused strategies emphasize consistent income streams from dividends, appealing to those needing steady cash flow and preference for lower volatility investments. Balancing capital gains and dividends optimizes portfolio diversification, aligning with individual risk tolerance and financial goals.

Risk Factors: Capital Gain vs Dividend

Capital gains are subject to market volatility, making their risk highly dependent on asset price fluctuations, whereas dividends provide more stable income but face risks from company profitability and dividend policy changes. Capital gains carry the potential for higher returns with increased exposure to market downturns, while dividends offer consistent cash flow but can be cut during economic distress. Understanding the risk profiles of capital gains and dividends helps investors balance growth potential against income stability in portfolio management.

Impact on Portfolio Performance

Capital gains generally provide higher long-term returns and tax efficiency, positively impacting portfolio performance by allowing reinvestment growth. Dividends offer steady income, enhancing portfolio stability and reducing volatility, which is ideal for income-focused investors. Balancing capital gains and dividends in a portfolio optimizes growth potential while managing risk and cash flow needs.

Suitability for Different Investor Profiles

Capital gains suit investors with a higher risk tolerance seeking long-term growth through asset appreciation, often benefiting from favorable tax treatment on held investments. Dividends appeal to conservative investors or those needing regular income, providing steady cash flow and potentially lower volatility. Portfolio strategies often blend both to balance growth objectives with income requirements, aligning with diverse investor risk profiles and financial goals.

Choosing Between Capital Gain and Dividend

Choosing between capital gains and dividends depends on an investor's tax situation, income needs, and investment goals. Capital gains often offer favorable tax treatment when assets are held long-term, while dividends provide regular income but may be taxed at higher ordinary income rates. Evaluating portfolio diversification, liquidity requirements, and risk tolerance helps determine the optimal balance between growth and income strategies.

Capital Gain vs Dividend Infographic

difterm.com

difterm.com