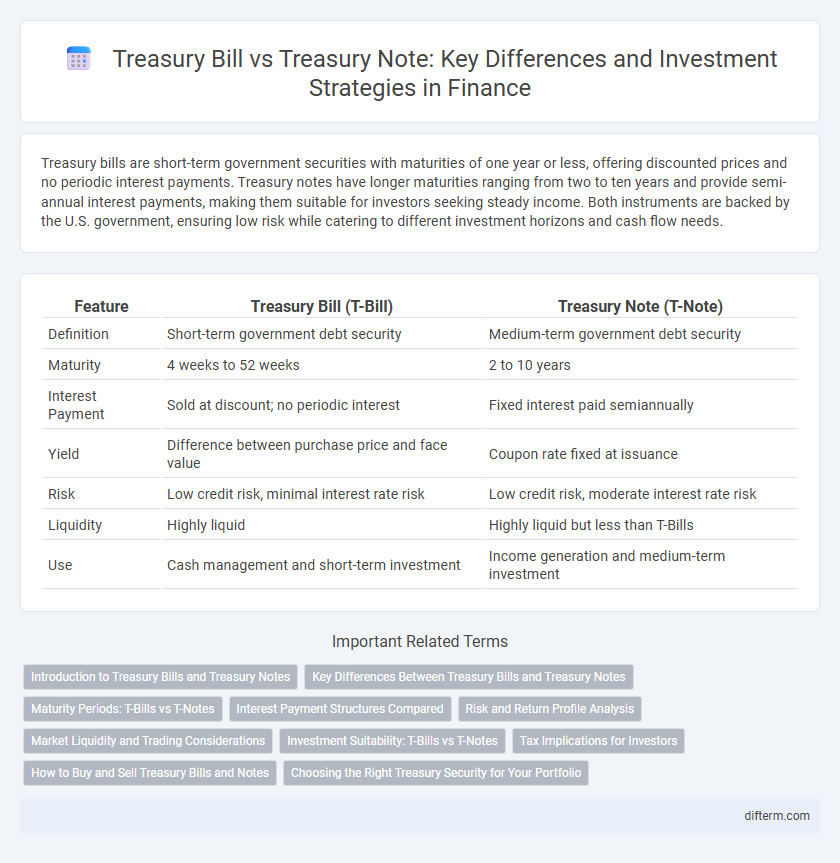

Treasury bills are short-term government securities with maturities of one year or less, offering discounted prices and no periodic interest payments. Treasury notes have longer maturities ranging from two to ten years and provide semi-annual interest payments, making them suitable for investors seeking steady income. Both instruments are backed by the U.S. government, ensuring low risk while catering to different investment horizons and cash flow needs.

Table of Comparison

| Feature | Treasury Bill (T-Bill) | Treasury Note (T-Note) |

|---|---|---|

| Definition | Short-term government debt security | Medium-term government debt security |

| Maturity | 4 weeks to 52 weeks | 2 to 10 years |

| Interest Payment | Sold at discount; no periodic interest | Fixed interest paid semiannually |

| Yield | Difference between purchase price and face value | Coupon rate fixed at issuance |

| Risk | Low credit risk, minimal interest rate risk | Low credit risk, moderate interest rate risk |

| Liquidity | Highly liquid | Highly liquid but less than T-Bills |

| Use | Cash management and short-term investment | Income generation and medium-term investment |

Introduction to Treasury Bills and Treasury Notes

Treasury bills (T-bills) are short-term government securities with maturities ranging from a few days to one year, issued at a discount and redeemed at face value, offering investors a low-risk investment option. Treasury notes (T-notes) have longer maturities, typically from two to ten years, paying semi-annual interest and returning the principal at maturity, making them suitable for investors seeking steady income. Both instruments are backed by the U.S. government, providing secure investment opportunities with differing liquidity and yield characteristics.

Key Differences Between Treasury Bills and Treasury Notes

Treasury bills (T-bills) are short-term government securities with maturities of one year or less, sold at a discount and redeemed at face value without periodic interest payments. Treasury notes (T-notes) have longer maturities ranging from two to ten years, pay fixed semi-annual interest, and are issued at or near par value. The primary differences include maturity length, interest payment structure, and typical investment goals tied to liquidity and yield.

Maturity Periods: T-Bills vs T-Notes

Treasury bills (T-Bills) have short-term maturity periods ranging from a few days up to one year, making them highly liquid and ideal for short-term investment strategies. Treasury notes (T-Notes), however, feature medium-term maturities between 2 and 10 years, offering a balance between income generation and principal preservation. The difference in maturity periods significantly impacts yield, risk profile, and suitability within diverse portfolio allocations.

Interest Payment Structures Compared

Treasury bills are short-term government securities issued at a discount and mature at face value, providing no periodic interest payments but generating returns through capital gains. Treasury notes, on the other hand, are medium-term securities that pay fixed semiannual interest coupons throughout their maturity period, typically ranging from 2 to 10 years. The fundamental difference in interest payment structures makes Treasury bills better suited for investors seeking lump-sum returns, while Treasury notes appeal to those preferring steady income streams.

Risk and Return Profile Analysis

Treasury bills (T-bills) are short-term government securities with maturities of one year or less, offering lower yields but minimal risk due to their high liquidity and government backing. Treasury notes (T-notes) have longer maturities ranging from two to ten years, providing higher yields in exchange for increased interest rate and inflation risks. The return profile of T-bills is less volatile with predictable short-term gains, while T-notes carry more risk but potentially greater returns over time due to their extended duration.

Market Liquidity and Trading Considerations

Treasury bills (T-bills) offer higher market liquidity due to their shorter maturities, making them more attractive for traders seeking quick turnover and lower interest rate risk. Treasury notes (T-notes) generally provide longer maturities, which can result in lower liquidity but offer stable income through periodic interest payments. Market participants prioritize T-bills for cash management and short-term investments, while T-notes appeal to investors targeting consistent yields and moderate duration exposure.

Investment Suitability: T-Bills vs T-Notes

Treasury bills (T-Bills) are short-term government securities with maturities of one year or less, making them ideal for conservative investors seeking liquidity and minimal risk. Treasury notes (T-Notes) have maturities ranging from two to ten years, offering higher yields suitable for investors targeting moderate risk and stable income over a longer horizon. Both T-Bills and T-Notes provide credit safety backed by the U.S. government, but investment suitability depends on the investor's time horizon and income preferences.

Tax Implications for Investors

Treasury bills (T-bills) are short-term government securities that mature in one year or less, and their interest income is exempt from state and local income taxes but subject to federal income tax. Treasury notes (T-notes), which mature between two and ten years, also have interest payments subject to federal income tax, with principal and interest exempt from state and local taxes. Investors should evaluate their state tax situation since both T-bills and T-notes offer federal tax advantages but differ in maturity and income payment structures affecting tax planning.

How to Buy and Sell Treasury Bills and Notes

To buy Treasury bills and notes, investors can participate through TreasuryDirect, a government platform offering direct purchase at auction, or use a brokerage account for secondary market transactions. Selling Treasury securities involves placing an order via a broker or directly on TreasuryDirect for notes that have been held, while bills are typically held to maturity due to their short-term nature. Prices and yields fluctuate in the secondary market, making timing and market conditions crucial factors when deciding to sell prior to maturity.

Choosing the Right Treasury Security for Your Portfolio

Choosing between Treasury bills and Treasury notes depends on your investment horizon and income needs; Treasury bills offer short-term maturities up to one year with zero-coupon returns, ideal for liquidity and capital preservation. Treasury notes provide semiannual interest payments and maturities ranging from two to ten years, suitable for investors seeking steady income and moderate-term investments. Assessing market conditions, interest rate trends, and tax considerations helps optimize portfolio diversification and risk management when selecting the appropriate Treasury security.

Treasury bill vs Treasury note Infographic

difterm.com

difterm.com