Yield to maturity (YTM) represents the total return an investor can expect if a bond is held until it matures, accounting for all interest payments and the difference between purchase price and par value. Yield to call (YTC) calculates the return assuming the bond is called by the issuer before maturity, often at a premium price, which can affect overall profitability. Investors compare YTM and YTC to assess potential risks and rewards, especially for callable bonds where the issuer may redeem the bond early.

Table of Comparison

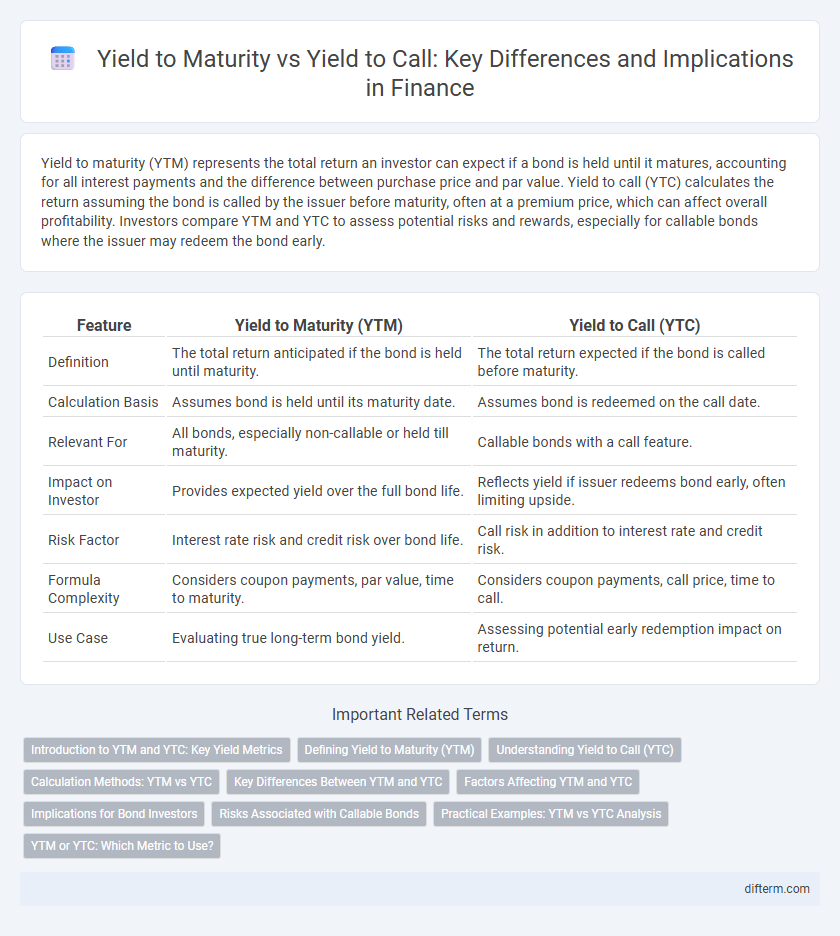

| Feature | Yield to Maturity (YTM) | Yield to Call (YTC) |

|---|---|---|

| Definition | The total return anticipated if the bond is held until maturity. | The total return expected if the bond is called before maturity. |

| Calculation Basis | Assumes bond is held until its maturity date. | Assumes bond is redeemed on the call date. |

| Relevant For | All bonds, especially non-callable or held till maturity. | Callable bonds with a call feature. |

| Impact on Investor | Provides expected yield over the full bond life. | Reflects yield if issuer redeems bond early, often limiting upside. |

| Risk Factor | Interest rate risk and credit risk over bond life. | Call risk in addition to interest rate and credit risk. |

| Formula Complexity | Considers coupon payments, par value, time to maturity. | Considers coupon payments, call price, time to call. |

| Use Case | Evaluating true long-term bond yield. | Assessing potential early redemption impact on return. |

Introduction to YTM and YTC: Key Yield Metrics

Yield to Maturity (YTM) measures the total return an investor can expect if a bond is held until it matures, factoring in the bond's current market price, coupon payments, and time to maturity. Yield to Call (YTC) estimates the yield assuming the bond is called before maturity, typically at the earliest call date, which affects the income and timing of cash flows. Both metrics are essential for evaluating callable and non-callable bonds, helping investors assess potential returns and risks associated with interest rate changes and issuer call options.

Defining Yield to Maturity (YTM)

Yield to Maturity (YTM) represents the total return anticipated on a bond if held until it matures, incorporating all coupon payments and the difference between the purchase price and face value. It assumes that all coupons are reinvested at the same rate as the YTM and accounts for the time value of money. YTM is essential for investors to evaluate the bond's profitability compared to Yield to Call (YTC), which considers early redemption scenarios.

Understanding Yield to Call (YTC)

Yield to Call (YTC) measures the return on a callable bond if the issuer redeems it before maturity, reflecting the bondholder's yield assuming the bond is called at the earliest call date. Unlike Yield to Maturity (YTM), which calculates yield based on holding the bond until its maturity date, YTC accounts for the potential early redemption risk that can affect the bond's cash flow and profitability. Investors use YTC to assess callable bonds, especially when interest rates decline, making early call more likely and altering expected returns compared to YTM projections.

Calculation Methods: YTM vs YTC

Yield to maturity (YTM) is calculated by solving the present value of all future bond coupon payments and principal repayment, discounted at a rate that equates the bond's current market price to the sum of these cash flows. Yield to call (YTC) uses a similar approach but only considers cash flows up to the call date, including the call price instead of the maturity value. Both calculations require iterative methods or financial calculators, as the discount rate is found by equating the present value of expected cash flows to the bond price.

Key Differences Between YTM and YTC

Yield to maturity (YTM) measures the total return anticipated on a bond if held until it matures, reflecting the bond's current market price, coupon payments, and time to maturity. Yield to call (YTC) calculates the return assuming the bond is called before maturity at the earliest call date, incorporating call premium and shortening the investment horizon. Key differences lie in their time frames, with YTM based on full maturity and YTC on the call date, and in potential price adjustments due to call features influencing investor yield expectations.

Factors Affecting YTM and YTC

Yield to maturity (YTM) and yield to call (YTC) are influenced by key factors such as interest rate movements, bond price volatility, call provisions, and time to maturity or call date. Changes in prevailing interest rates directly affect YTM by altering the bond's market price, while callable bonds introduce reinvestment risk and potential early redemption impacting YTC calculations. Credit quality, bond coupon rates, and call premiums also play crucial roles in determining the relative attractiveness and yield differences between YTM and YTC.

Implications for Bond Investors

Yield to maturity (YTM) measures the total return an investor can expect if a bond is held until it matures, reflecting all coupon payments and the capital gain or loss. Yield to call (YTC) applies when a bond can be called before maturity, indicating the return if the issuer redeems the bond early, which often limits upside potential in rising interest rate environments. Investors must analyze both YTM and YTC to accurately assess risk, potential income, and reinvestment timing, especially with callable bonds that may lead to reinvestment at lower rates.

Risks Associated with Callable Bonds

Yield to maturity (YTM) calculates the total return if a bond is held until it matures, while yield to call (YTC) estimates the return if the bond is redeemed by the issuer before maturity. Callable bonds carry reinvestment risk because issuers typically call bonds when interest rates decline, forcing investors to reinvest at lower rates. Investors in callable bonds face uncertainty in cash flows and potential loss of income, making YTC a critical measure for assessing the bond's risk profile.

Practical Examples: YTM vs YTC Analysis

Yield to maturity (YTM) calculates the total return of a bond held until its maturity date, assuming all payments are made as scheduled, while yield to call (YTC) estimates the yield if the bond is called before maturity, often at a premium price. For example, a callable bond with a 5% coupon and a call date in 5 years might show a YTM of 4.5% over 10 years but a YTC of 5.2% if called early, impacting investor decisions on expected returns and risk. Analyzing YTM versus YTC enables investors to assess potential gains or losses depending on bond call provisions and market interest rates.

YTM or YTC: Which Metric to Use?

Yield to maturity (YTM) measures the total return an investor can expect if the bond is held until maturity, while yield to call (YTC) calculates the return if the bond is called before maturity. Investors should prioritize YTM when the bond is unlikely to be called, reflecting the true long-term yield, whereas YTC is essential for bonds with high call risk or when interest rates decline. Evaluating both metrics helps in making informed decisions by balancing potential returns against the issuer's call provisions and market conditions.

Yield to maturity vs yield to call Infographic

difterm.com

difterm.com