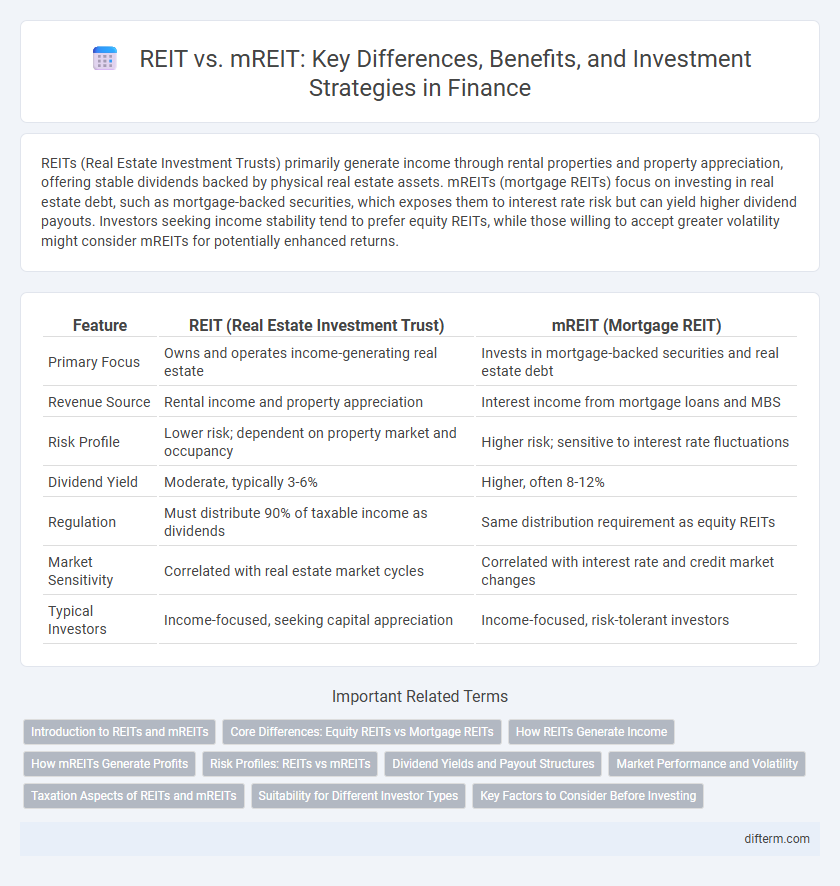

REITs (Real Estate Investment Trusts) primarily generate income through rental properties and property appreciation, offering stable dividends backed by physical real estate assets. mREITs (mortgage REITs) focus on investing in real estate debt, such as mortgage-backed securities, which exposes them to interest rate risk but can yield higher dividend payouts. Investors seeking income stability tend to prefer equity REITs, while those willing to accept greater volatility might consider mREITs for potentially enhanced returns.

Table of Comparison

| Feature | REIT (Real Estate Investment Trust) | mREIT (Mortgage REIT) |

|---|---|---|

| Primary Focus | Owns and operates income-generating real estate | Invests in mortgage-backed securities and real estate debt |

| Revenue Source | Rental income and property appreciation | Interest income from mortgage loans and MBS |

| Risk Profile | Lower risk; dependent on property market and occupancy | Higher risk; sensitive to interest rate fluctuations |

| Dividend Yield | Moderate, typically 3-6% | Higher, often 8-12% |

| Regulation | Must distribute 90% of taxable income as dividends | Same distribution requirement as equity REITs |

| Market Sensitivity | Correlated with real estate market cycles | Correlated with interest rate and credit market changes |

| Typical Investors | Income-focused, seeking capital appreciation | Income-focused, risk-tolerant investors |

Introduction to REITs and mREITs

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate, offering investors access to real estate assets with liquidity similar to stocks. Mortgage REITs (mREITs) specialize in investing in real estate mortgages and mortgage-backed securities, generating income primarily from the interest earned on these financial assets. Both REITs and mREITs provide high dividend yields but differ in their underlying assets and risk profiles, with REITs focusing on property ownership and mREITs on real estate debt.

Core Differences: Equity REITs vs Mortgage REITs

Equity REITs primarily invest in physical real estate properties, generating income through rental payments and property appreciation, while mortgage REITs (mREITs) focus on investing in real estate debt, earning revenue mainly from the interest on mortgage loans and mortgage-backed securities. Equity REITs offer investors exposure to tangible assets like commercial or residential buildings, whereas mREITs provide indirect real estate exposure through financial instruments. The risk profile differs as equity REITs are affected by property market conditions, while mREITs are more sensitive to interest rate fluctuations and credit risk.

How REITs Generate Income

REITs generate income primarily through leasing commercial properties such as office buildings, retail centers, and apartments, collecting rental payments from tenants. They also earn revenue by selling properties at a profit and reinvesting capital gains into new real estate assets. Mortgage REITs (mREITs) differ by generating income from interest earned on mortgage loans and mortgage-backed securities rather than direct property ownership.

How mREITs Generate Profits

mREITs generate profits primarily by borrowing capital at short-term interest rates and investing in longer-term mortgage-backed securities, earning income from the spread. They actively manage interest rate risk and leverage to enhance returns while distributing most of their taxable income as dividends. This strategy differentiates mREITs from traditional equity REITs, which primarily generate revenue from property rents.

Risk Profiles: REITs vs mREITs

REITs primarily invest in income-generating real estate properties, offering relatively stable cash flows and lower volatility compared to mREITs, which focus on mortgage-backed securities and are more sensitive to interest rate fluctuations and credit risks. The leverage employed by mREITs amplifies both potential returns and risks, leading to higher price volatility and susceptibility to market downturns. Investors seeking steadier income streams may prefer traditional REITs, while those willing to accept greater risk for potentially higher yields might consider mREITs.

Dividend Yields and Payout Structures

REITs typically offer stable dividend yields ranging from 3% to 6%, driven by rental income from property assets, whereas mREITs often provide higher yields, sometimes exceeding 10%, due to their focus on mortgage-backed securities and interest rate spreads. The payout structure of REITs is primarily derived from consistent rental cash flows, whereas mREIT dividends fluctuate more, reflecting changes in mortgage interest rates and prepayment risks. Investors seeking steady income may prefer equity REITs for predictable dividends, while those targeting higher returns with increased risk might opt for mREITs.

Market Performance and Volatility

REITs (Real Estate Investment Trusts) typically demonstrate steadier market performance with lower volatility due to their diversified property portfolios and rental income streams. mREITs (Mortgage REITs) often exhibit higher volatility as their earnings are closely tied to interest rate fluctuations and mortgage-backed securities market dynamics. Historical data indicates REITs provide more consistent dividend yields, whereas mREITs can offer higher returns but with increased risk exposure during market stress.

Taxation Aspects of REITs and mREITs

Real Estate Investment Trusts (REITs) benefit from a unique tax structure that exempts them from corporate income tax if they distribute at least 90% of taxable income as dividends to shareholders, resulting in a single level of taxation. Mortgage REITs (mREITs), which invest primarily in real estate debt, face distinct tax implications where their income largely comes from interest, subject to ordinary income tax rates, and they must also distribute at least 90% of taxable income. Shareholders of both REITs and mREITs are taxed on dividends as ordinary income, though certain qualified dividends from equity REITs may be eligible for lower tax rates, impacting after-tax returns.

Suitability for Different Investor Types

REITs typically suit long-term investors seeking steady income through property ownership with lower risk exposure, as they invest directly in physical real estate assets. mREITs attract investors comfortable with higher risk and volatility, aiming for greater returns by investing in mortgage-backed securities and mortgage loans. Conservative investors prioritize REITs for income stability, while aggressive investors favor mREITs for the potential of higher yields and capital appreciation.

Key Factors to Consider Before Investing

REITs (Real Estate Investment Trusts) primarily invest in physical properties, offering stable income through rent and potential capital appreciation, while mREITs (mortgage REITs) focus on investing in real estate debt, generating returns from interest rate spreads. Key factors to consider before investing include sensitivity to interest rate fluctuations, with mREITs being more volatile due to their reliance on mortgage-backed securities, and the economic environment affecting property values and rental income for equity REITs. Investors must also evaluate dividend yield consistency, management quality, and the underlying asset portfolio's risk exposure to align with their risk tolerance and income objectives.

REIT vs mREIT Infographic

difterm.com

difterm.com