Soft credit inquiries do not impact your credit score and are typically used for pre-approvals or background checks, allowing lenders to review your credit report without your explicit permission. Hard credit inquiries occur when you apply for credit and give consent, potentially lowering your credit score slightly as they indicate active credit-seeking behavior. Monitoring the type and frequency of inquiries is crucial in managing and maintaining a healthy credit profile.

Table of Comparison

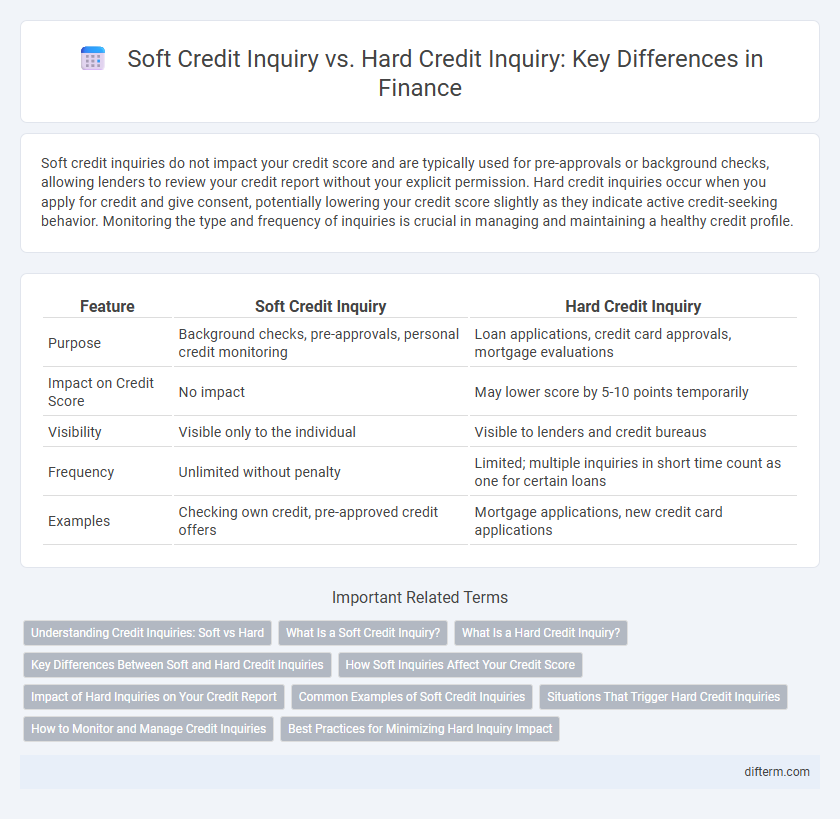

| Feature | Soft Credit Inquiry | Hard Credit Inquiry |

|---|---|---|

| Purpose | Background checks, pre-approvals, personal credit monitoring | Loan applications, credit card approvals, mortgage evaluations |

| Impact on Credit Score | No impact | May lower score by 5-10 points temporarily |

| Visibility | Visible only to the individual | Visible to lenders and credit bureaus |

| Frequency | Unlimited without penalty | Limited; multiple inquiries in short time count as one for certain loans |

| Examples | Checking own credit, pre-approved credit offers | Mortgage applications, new credit card applications |

Understanding Credit Inquiries: Soft vs Hard

Soft credit inquiries occur when a lender or individual checks your credit report without impacting your credit score, often during pre-approval or background checks. Hard credit inquiries happen when you apply for credit, such as loans or credit cards, and can lower your credit score temporarily by indicating increased risk to lenders. Monitoring the frequency and type of credit inquiries is crucial for maintaining a strong credit profile and securing favorable financial terms.

What Is a Soft Credit Inquiry?

A soft credit inquiry occurs when a person or company checks your credit report for non-lending purposes, such as pre-approved credit offers, background checks, or personal credit monitoring. Unlike hard credit inquiries, soft inquiries do not impact your credit score or remain visible only to you on your credit report. Understanding the distinction between soft and hard inquiries helps maintain control over your credit profile while exploring financial opportunities.

What Is a Hard Credit Inquiry?

A hard credit inquiry occurs when a lender or creditor reviews your credit report as part of a decision-making process for a loan, mortgage, or credit card application, which can slightly lower your credit score. These inquiries remain on your credit report for up to two years and signal to potential lenders that you are actively seeking new credit. Understanding the impact of hard inquiries is crucial for managing credit health and maintaining a strong credit profile.

Key Differences Between Soft and Hard Credit Inquiries

Soft credit inquiries occur when an individual checks their own credit or when a company performs a background check without seeking to extend credit, leaving no impact on the credit score. Hard credit inquiries take place when a lender reviews a credit report to make a lending decision, which can slightly lower the credit score temporarily. The key differences lie in the purpose of the inquiry, its effect on credit scores, and who can see the inquiry on the credit report.

How Soft Inquiries Affect Your Credit Score

Soft credit inquiries occur when a credit check is performed without your permission or for non-lending purposes, such as pre-approved offers or background checks, and they do not impact your credit score. These inquiries are visible only to you on your credit report and are not considered by lenders during credit evaluations. Unlike hard inquiries, which can lower your credit score temporarily, soft inquiries serve as informational checks and have no negative effect on your creditworthiness.

Impact of Hard Inquiries on Your Credit Report

Hard credit inquiries occur when a lender or creditor reviews your credit report as part of a lending decision, leading to a potential decrease in your credit score. These inquiries remain on your credit report for up to two years but typically affect your credit score for only one year. Multiple hard inquiries within a short period can compound the negative impact, signaling increased risk to lenders and potentially lowering your chances of credit approval.

Common Examples of Soft Credit Inquiries

Soft credit inquiries typically occur when individuals check their own credit reports, employers perform background checks, or companies conduct pre-approved credit card or insurance offers. These inquiries do not impact credit scores and are visible only to the individual reviewing their report. Common examples include account reviews by existing creditors, tenant screening by landlords, and promotional inquiries by lenders.

Situations That Trigger Hard Credit Inquiries

Hard credit inquiries are triggered when a consumer applies for new credit, such as a mortgage, auto loan, or credit card, prompting lenders to review the individual's full credit report. These inquiries typically occur during loan approvals, rental applications, or when negotiating financing terms, impacting the credit score temporarily. Soft credit inquiries, by contrast, happen during background checks or pre-approved credit offers and do not affect credit scores.

How to Monitor and Manage Credit Inquiries

Regularly reviewing your credit report from major bureaus like Experian, Equifax, and TransUnion helps identify both soft and hard credit inquiries, enabling effective monitoring of your credit profile. Limiting unnecessary hard inquiries by applying for credit selectively prevents potential negative impacts on your credit score, while tracking soft inquiries ensures you stay aware of pre-approved offers and background checks. Utilizing free credit monitoring tools and setting alerts can streamline managing inquiries, preserving credit health over time.

Best Practices for Minimizing Hard Inquiry Impact

Minimizing the impact of hard credit inquiries involves strategically limiting loan and credit card applications within a short time frame to prevent multiple hard pulls from lowering credit scores. Utilizing soft credit inquiries for prequalification checks allows consumers to assess credit offers without affecting their credit reports or scores. Monitoring credit reports regularly helps identify unauthorized hard inquiries promptly, enabling disputes that protect credit integrity.

Soft Credit Inquiry vs Hard Credit Inquiry Infographic

difterm.com

difterm.com