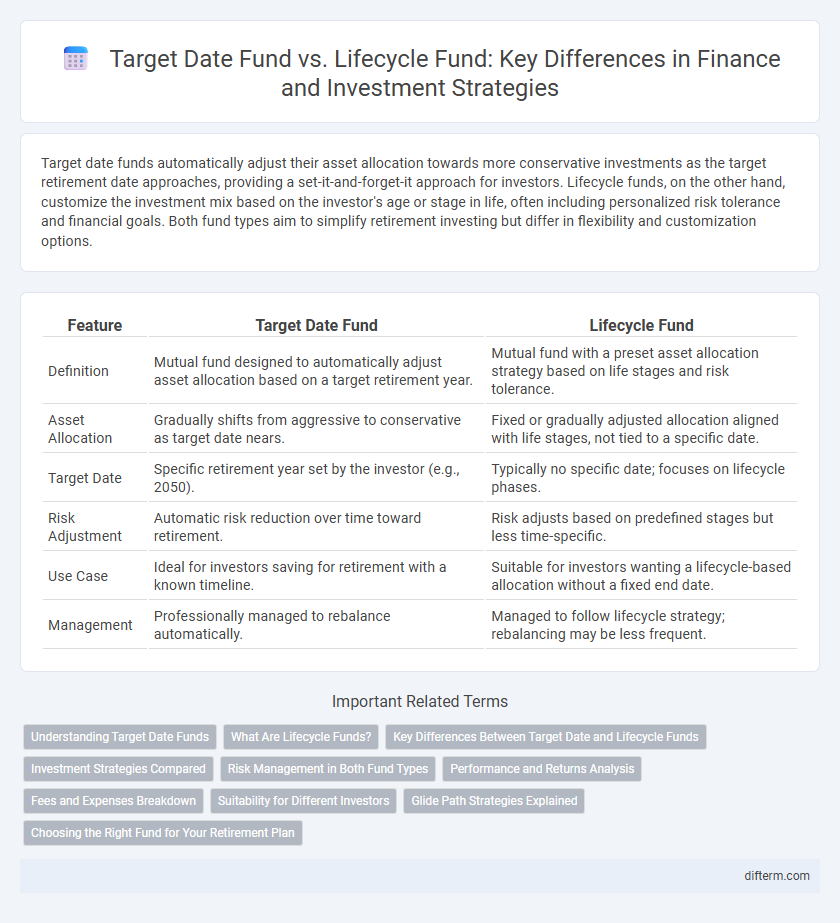

Target date funds automatically adjust their asset allocation towards more conservative investments as the target retirement date approaches, providing a set-it-and-forget-it approach for investors. Lifecycle funds, on the other hand, customize the investment mix based on the investor's age or stage in life, often including personalized risk tolerance and financial goals. Both fund types aim to simplify retirement investing but differ in flexibility and customization options.

Table of Comparison

| Feature | Target Date Fund | Lifecycle Fund |

|---|---|---|

| Definition | Mutual fund designed to automatically adjust asset allocation based on a target retirement year. | Mutual fund with a preset asset allocation strategy based on life stages and risk tolerance. |

| Asset Allocation | Gradually shifts from aggressive to conservative as target date nears. | Fixed or gradually adjusted allocation aligned with life stages, not tied to a specific date. |

| Target Date | Specific retirement year set by the investor (e.g., 2050). | Typically no specific date; focuses on lifecycle phases. |

| Risk Adjustment | Automatic risk reduction over time toward retirement. | Risk adjusts based on predefined stages but less time-specific. |

| Use Case | Ideal for investors saving for retirement with a known timeline. | Suitable for investors wanting a lifecycle-based allocation without a fixed end date. |

| Management | Professionally managed to rebalance automatically. | Managed to follow lifecycle strategy; rebalancing may be less frequent. |

Understanding Target Date Funds

Target date funds are designed to provide a diversified investment portfolio that automatically adjusts its asset allocation based on a specified retirement year, offering a simplified investment strategy for long-term goals. These funds typically start with a more aggressive mix of stocks and gradually shift toward more conservative investments, such as bonds, as the target date approaches. Understanding target date funds involves recognizing their glide path methodology and the importance of aligning the fund's target year with the investor's expected retirement timeline for optimal risk management.

What Are Lifecycle Funds?

Lifecycle funds, also known as target retirement funds, automatically adjust their asset allocation based on the investor's expected retirement date, gradually shifting from higher-risk investments like stocks to lower-risk assets such as bonds. These funds simplify retirement investing by reducing risk exposure as the target date approaches, aligning with the investor's changing financial needs over time. Lifecycle funds provide a diversified portfolio that evolves, minimizing the need for active management while aiming to optimize returns throughout the investment horizon.

Key Differences Between Target Date and Lifecycle Funds

Target date funds automatically adjust asset allocation to become more conservative as the specified retirement date approaches, focusing on a single predetermined time horizon. Lifecycle funds also shift asset allocation over time but provide customizable strategies based on investor-specific goals and risk tolerance beyond a fixed retirement date. Key differences include target date funds' fixed glide path versus lifecycle funds' flexible, personalized investment approach.

Investment Strategies Compared

Target date funds and lifecycle funds both employ age-based investment strategies but differ in customization and glide path flexibility. Target date funds automatically adjust asset allocation toward more conservative investments as the target retirement date approaches, emphasizing a predefined, time-driven glide path. Lifecycle funds offer tailored investment strategies based on individual investor profiles, allowing more personalized risk tolerance and financial goals alignment throughout the accumulation and decumulation phases.

Risk Management in Both Fund Types

Target date funds utilize a predetermined asset allocation that gradually shifts from higher-risk equities to lower-risk fixed income as the target retirement date approaches, effectively managing risk by reducing exposure over time. Lifecycle funds also adjust asset allocation based on an individual's age or stage in life but may incorporate broader risk considerations, such as changes in income or financial priorities, offering a more personalized risk management approach. Both fund types prioritize risk reduction as retirement nears, though lifecycle funds provide greater customization to address unique investor circumstances.

Performance and Returns Analysis

Target date funds adjust asset allocation based on a fixed retirement year, generally shifting from higher-risk equities to lower-risk bonds, which can impact returns depending on market conditions and time horizon. Lifecycle funds offer similar risk reduction but may use a more personalized glide path, potentially enhancing performance by better aligning with individual investor risk tolerance and retirement goals. Performance and returns analysis shows target date funds often provide a standardized risk-return profile, while lifecycle funds may deliver more tailored outcomes with varying returns based on their customized asset allocation strategies.

Fees and Expenses Breakdown

Target date funds typically charge slightly higher management fees and expense ratios compared to lifecycle funds due to their structured glide path and ongoing asset allocation adjustments. Lifecycle funds often have lower administrative costs by maintaining a more static or simplified portfolio strategy. Investors should carefully examine the breakdown of expense ratios, including management fees, underlying fund expenses, and potential trading costs, to determine the total cost impact on long-term returns.

Suitability for Different Investors

Target date funds suit investors seeking a simplified, hands-off approach aligned with a specific retirement year, automatically adjusting asset allocation to reduce risk over time. Lifecycle funds offer greater customization, appealing to investors who want tailored strategies based on varying investment horizons and risk tolerance within different life stages. Both funds provide diversified portfolios, but the choice depends on individual preferences for automation versus personalized control in retirement planning.

Glide Path Strategies Explained

Target date funds use a predetermined glide path that automatically shifts asset allocation from higher-risk equities to lower-risk bonds as the target retirement date approaches. Lifecycle funds offer a more personalized glide path, adjusting investments based on an individual's unique retirement timeline and risk tolerance. Glide path strategies in both fund types balance growth and risk by systematically reducing exposure to volatile assets to preserve capital near retirement.

Choosing the Right Fund for Your Retirement Plan

Target date funds automatically adjust asset allocation based on a specified retirement year, offering a simplified investment approach tailored to your retirement timeline. Lifecycle funds provide a more customized strategy by continuously rebalancing investments according to changing risk profiles and market conditions throughout an investor's life stages. Selecting the right fund depends on your desired level of management, risk tolerance, and the specific retirement goals you aim to achieve.

Target date fund vs Lifecycle fund Infographic

difterm.com

difterm.com