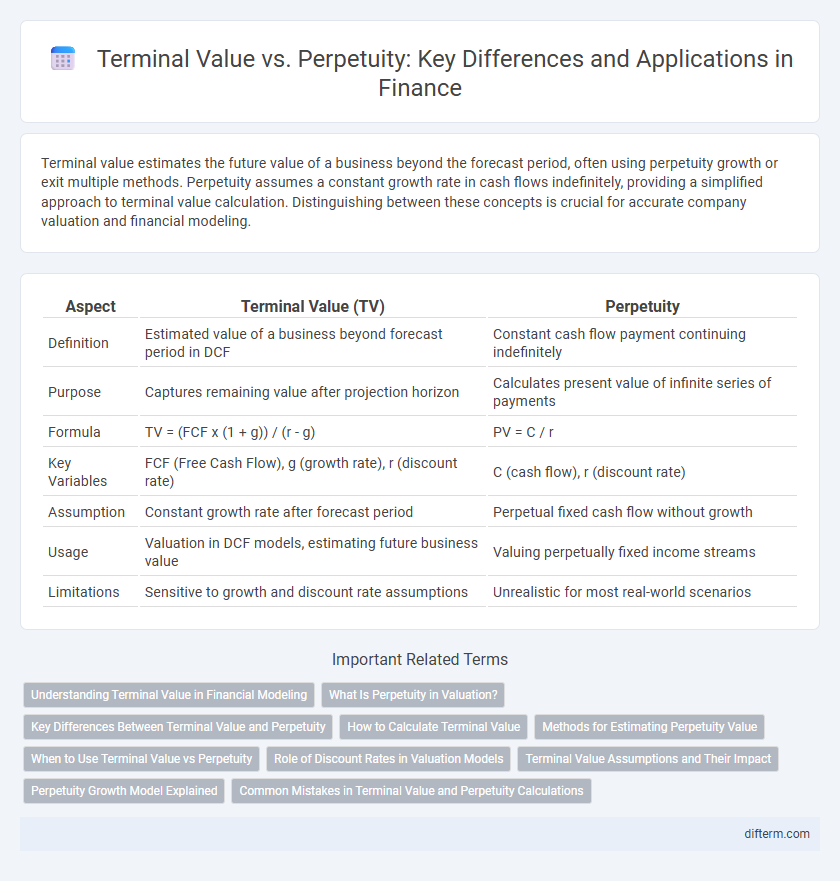

Terminal value estimates the future value of a business beyond the forecast period, often using perpetuity growth or exit multiple methods. Perpetuity assumes a constant growth rate in cash flows indefinitely, providing a simplified approach to terminal value calculation. Distinguishing between these concepts is crucial for accurate company valuation and financial modeling.

Table of Comparison

| Aspect | Terminal Value (TV) | Perpetuity |

|---|---|---|

| Definition | Estimated value of a business beyond forecast period in DCF | Constant cash flow payment continuing indefinitely |

| Purpose | Captures remaining value after projection horizon | Calculates present value of infinite series of payments |

| Formula | TV = (FCF x (1 + g)) / (r - g) | PV = C / r |

| Key Variables | FCF (Free Cash Flow), g (growth rate), r (discount rate) | C (cash flow), r (discount rate) |

| Assumption | Constant growth rate after forecast period | Perpetual fixed cash flow without growth |

| Usage | Valuation in DCF models, estimating future business value | Valuing perpetually fixed income streams |

| Limitations | Sensitive to growth and discount rate assumptions | Unrealistic for most real-world scenarios |

Understanding Terminal Value in Financial Modeling

Terminal Value represents the present value of all future cash flows beyond a forecast period, critical for estimating a company's long-term worth in financial modeling. It often accounts for a significant portion of a business's total valuation and is calculated using methods like the perpetuity growth model or exit multiple approach. Mastery of Terminal Value helps analysts accurately capture growth potential and sustain value beyond explicit projections, ensuring robust investment decisions.

What Is Perpetuity in Valuation?

Perpetuity in valuation refers to a constant stream of identical cash flows expected to continue indefinitely, frequently used in discounted cash flow (DCF) models to estimate the terminal value of an asset. The perpetuity formula divides the expected annual cash flow by the discount rate minus the growth rate, capturing endless value beyond explicit forecast periods. This approach simplifies valuation by assuming stable, ongoing performance, often applied to mature companies with predictable cash flows.

Key Differences Between Terminal Value and Perpetuity

Terminal Value represents the present value of all future cash flows beyond a forecast period, incorporating projected growth rates and discount rates specific to the business context. Perpetuity assumes a constant cash flow indefinitely without growth, typically calculated using a fixed discount rate and constant payment formula. Key differences lie in Terminal Value's flexibility to include growth assumptions and adjustments over time, whereas Perpetuity simplifies valuation with steady, unchanging cash flows.

How to Calculate Terminal Value

Terminal value in finance is calculated by estimating the perpetuity value of future cash flows beyond a forecast period, typically using the Gordon Growth Model. This involves dividing the projected cash flow in the final forecast year by the difference between the discount rate and the perpetual growth rate. Accurate terminal value calculation requires selecting an appropriate discount rate and long-term growth rate to reflect stable cash flow conditions.

Methods for Estimating Perpetuity Value

Estimating perpetuity value often relies on the Gordon Growth Model, which calculates present value by dividing next year's expected cash flow by the difference between the discount rate and the perpetual growth rate. Another method involves the use of exit multiples, where a multiple derived from comparable companies is applied to a financial metric such as EBITDA or free cash flow to approximate terminal value. Selecting the appropriate growth rate and discount rate is critical for accuracy in perpetuity valuation, as small variations significantly impact the terminal value estimation.

When to Use Terminal Value vs Perpetuity

Terminal value is used in discounted cash flow (DCF) analysis to estimate the value of an asset beyond the explicit forecast period, typically when growth rates vary or when projecting finite business horizons. Perpetuity assumes a constant growth rate indefinitely and is appropriate for stable companies with predictable, steady cash flows. Use terminal value when cash flows are expected to change over time and perpetuity when growth and returns are expected to remain stable and perpetual.

Role of Discount Rates in Valuation Models

Discount rates play a critical role in both Terminal Value and Perpetuity valuation models by reflecting the time value of money and risk associated with future cash flows. In Terminal Value calculations, the discount rate impacts the present value of projected cash flows beyond the forecast period, influencing the overall valuation significantly. For Perpetuity models, the discount rate determines the capitalization rate used to value infinite cash flow streams, making it essential for accurate estimation of long-term asset value.

Terminal Value Assumptions and Their Impact

Terminal value calculations in finance rely heavily on assumptions about growth rates, discount rates, and cash flow projections, which directly influence the accuracy of valuation models. Small changes in perpetuity growth rates or discount rates can significantly impact the estimated terminal value, affecting investment decisions and company valuations. Understanding the sensitivity of terminal value assumptions is essential for effective financial modeling and risk assessment.

Perpetuity Growth Model Explained

The Perpetuity Growth Model calculates terminal value by assuming a constant growth rate of cash flows beyond a forecast period, reflecting an infinite continuation of earnings at a stable rate. This method relies on the Gordon Growth formula, where terminal value equals the next year's cash flow divided by the difference between the discount rate and the perpetual growth rate. It is widely used in discounted cash flow (DCF) analysis to estimate a company's value beyond explicit projections, emphasizing sustainable growth assumptions.

Common Mistakes in Terminal Value and Perpetuity Calculations

Common mistakes in terminal value calculations include using an unrealistic perpetual growth rate that exceeds long-term economic growth, leading to overestimated valuations. In perpetuity calculations, overlooking the impact of changing discount rates or failing to adjust cash flows for inflation can distort the present value. Misapplying formulas by confusing terminal value with perpetuity value also results in inaccurate financial models and poor investment decisions.

Terminal Value vs Perpetuity Infographic

difterm.com

difterm.com