A sinking fund is a strategic savings account designed to gradually pay off debt or replace a major asset, ensuring financial obligations are met without strain. In contrast, a reserve fund serves as a financial safety net set aside to cover unexpected expenses or emergencies, maintaining operational stability. Both funds are essential for prudent financial management but cater to distinctly different purposes in asset and risk management.

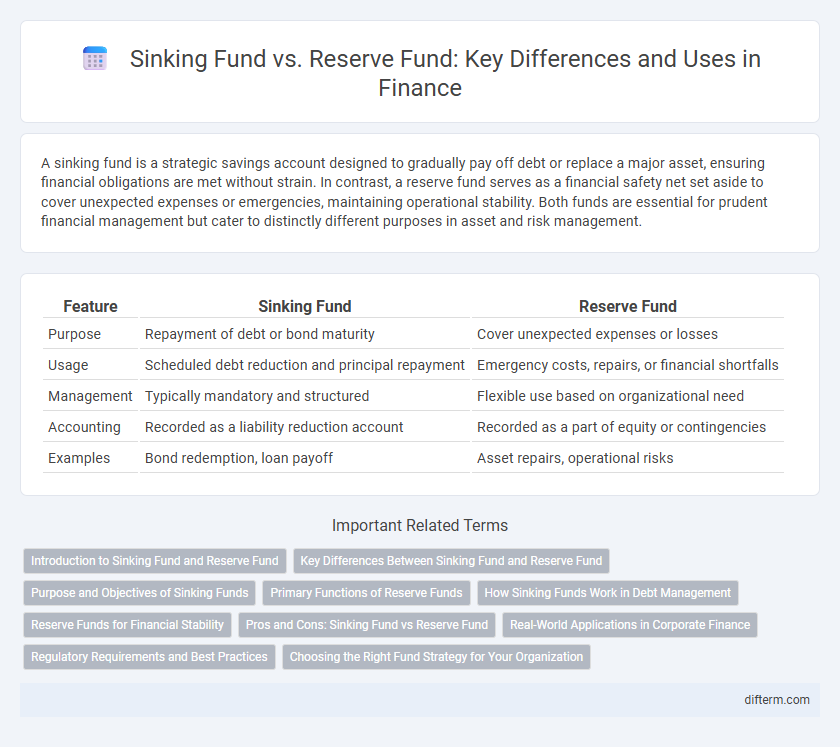

Table of Comparison

| Feature | Sinking Fund | Reserve Fund |

|---|---|---|

| Purpose | Repayment of debt or bond maturity | Cover unexpected expenses or losses |

| Usage | Scheduled debt reduction and principal repayment | Emergency costs, repairs, or financial shortfalls |

| Management | Typically mandatory and structured | Flexible use based on organizational need |

| Accounting | Recorded as a liability reduction account | Recorded as a part of equity or contingencies |

| Examples | Bond redemption, loan payoff | Asset repairs, operational risks |

Introduction to Sinking Fund and Reserve Fund

A sinking fund is a strategic financial reserve created by setting aside money regularly to repay debt or replace a depreciating asset over time, ensuring timely fulfillment of financial obligations. In contrast, a reserve fund serves as an emergency cash buffer reserved for unexpected expenses or financial shortfalls, enhancing overall fiscal stability. Both funds play critical roles in prudent financial management but differ in purpose and utilization.

Key Differences Between Sinking Fund and Reserve Fund

A sinking fund is established to repay debt or replace a specific asset, with contributions made regularly to ensure availability of funds at maturity, while a reserve fund serves as a financial safety net for unexpected expenses or operational shortfalls. Sinking funds are typically earmarked and legally restricted for predetermined obligations, whereas reserve funds offer more flexibility in usage, supporting general financial stability. The key difference lies in their purpose: sinking funds target debt repayment or asset replacement, and reserve funds safeguard against financial uncertainties within an organization or investment.

Purpose and Objectives of Sinking Funds

Sinking funds are specifically established to systematically accumulate capital over time for the repayment of debt or replacement of large assets, ensuring financial stability and meeting future obligations without impacting cash flow. Their primary objective is to reduce credit risk by guaranteeing funds are available for bond redemption or scheduled liabilities. Reserve funds, in contrast, serve as contingency pools to cover unexpected expenses or operational shortfalls rather than predetermined financial commitments.

Primary Functions of Reserve Funds

Reserve funds primarily serve as financial safety nets for organizations, ensuring liquidity and stability during unexpected expenses or revenue shortfalls. They are essential for covering operating costs, maintaining creditworthiness, and funding capital expenditures without incurring debt. Unlike sinking funds, which target specific debt repayment, reserve funds provide broader financial security and operational continuity.

How Sinking Funds Work in Debt Management

Sinking funds in debt management function by setting aside regular, pre-planned amounts of money specifically to repay a debt or bond at maturity, reducing default risk and improving creditworthiness. This systematic accumulation of funds ensures that the principal amount can be paid off without straining the organization's cash flow. Unlike reserve funds that cover unforeseen expenses, sinking funds provide a structured repayment strategy enhancing long-term financial stability.

Reserve Funds for Financial Stability

Reserve funds provide critical financial stability by serving as a buffer against unexpected expenses or economic downturns, ensuring organizations can meet obligations without disrupting operations. Unlike sinking funds, which are earmarked for specific debt repayment, reserve funds remain flexible and accessible for various unforeseen financial needs. Maintaining adequate reserve funds is essential for risk management and long-term fiscal health in both corporate and governmental finance.

Pros and Cons: Sinking Fund vs Reserve Fund

Sinking funds provide a systematic way to repay debt or replace large assets, reducing financial risk but requiring disciplined, regular contributions that may limit cash flow flexibility. Reserve funds offer a financial cushion for unexpected expenses or emergencies, enhancing liquidity and operational stability while potentially encouraging less rigorous budgeting habits. Choosing between sinking funds and reserve funds depends on prioritizing debt repayment versus maintaining immediate liquidity for unforeseen costs.

Real-World Applications in Corporate Finance

Sinking funds are systematically accumulated reserves used by corporations to repay debt or replace fixed assets, ensuring structured debt management and capital expenditure. Reserve funds serve as financial buffers to absorb unexpected losses or fluctuations in operating cash flow, enhancing corporate liquidity and risk management. Companies frequently deploy sinking funds to retire bonds at maturity while leveraging reserve funds to maintain solvency during economic downturns or operational disruptions.

Regulatory Requirements and Best Practices

Sinking funds are often mandated by regulatory bodies to ensure systematic repayment of debt over time, minimizing default risk for bond issuers. Reserve funds, while sometimes required for compliance in sectors like banking and insurance, are primarily maintained as a financial safety net to cover unexpected expenses or losses. Best practices dictate clear documentation and segregation of sinking and reserve funds to meet legal standards and optimize organizational liquidity management.

Choosing the Right Fund Strategy for Your Organization

A sinking fund is a dedicated pool of money set aside to repay debt or replace assets at specific intervals, ensuring long-term financial stability by reducing large future expenditures. A reserve fund serves as a financial safety net to cover unexpected expenses or operational shortfalls, enhancing organizational resilience against economic fluctuations. Selecting the right fund strategy requires analyzing your organization's cash flow patterns, risk tolerance, and future liabilities to maintain liquidity while supporting strategic growth objectives.

Sinking Fund vs Reserve Fund Infographic

difterm.com

difterm.com