Working Capital represents the difference between a company's current assets and current liabilities, indicating the liquidity available for day-to-day operations. Net Working Capital refines this by considering only operational current assets and liabilities, excluding short-term investments or debts unrelated to core activities. Understanding the distinction helps businesses accurately assess financial health and manage cash flow effectively.

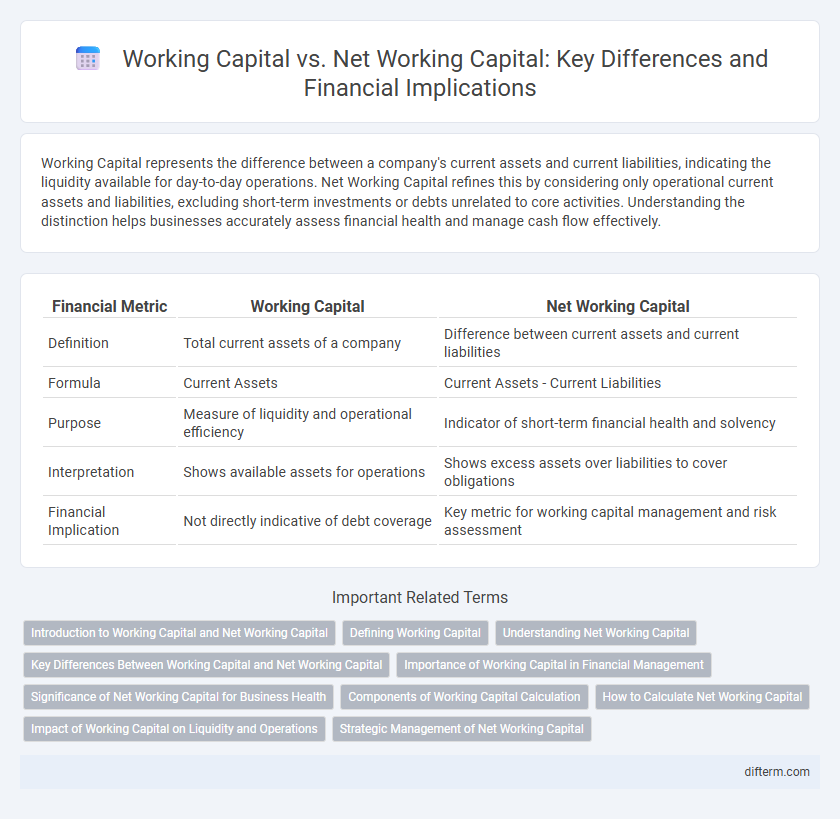

Table of Comparison

| Financial Metric | Working Capital | Net Working Capital |

|---|---|---|

| Definition | Total current assets of a company | Difference between current assets and current liabilities |

| Formula | Current Assets | Current Assets - Current Liabilities |

| Purpose | Measure of liquidity and operational efficiency | Indicator of short-term financial health and solvency |

| Interpretation | Shows available assets for operations | Shows excess assets over liabilities to cover obligations |

| Financial Implication | Not directly indicative of debt coverage | Key metric for working capital management and risk assessment |

Introduction to Working Capital and Net Working Capital

Working capital represents the difference between a company's current assets and current liabilities, reflecting the liquidity available for day-to-day operations. Net working capital specifically measures the excess of current assets over current liabilities, indicating the firm's short-term financial health and operational efficiency. Analyzing working capital and net working capital provides critical insights into a company's ability to meet short-term obligations and manage operational cash flow effectively.

Defining Working Capital

Working capital represents the difference between a company's current assets and current liabilities, indicating its short-term liquidity and operational efficiency. It is a crucial financial metric used to assess whether a business can cover its short-term obligations with its short-term assets. Proper management of working capital ensures smooth day-to-day operations and minimizes the risk of financial distress.

Understanding Net Working Capital

Net Working Capital (NWC) represents the difference between a company's current assets and current liabilities, providing a clear snapshot of liquidity and operational efficiency. Unlike Working Capital, which can sometimes refer to just current assets, NWC focuses on the net amount available to fund day-to-day operations. Understanding NWC is essential for assessing short-term financial health and the ability to meet immediate obligations without relying on external financing.

Key Differences Between Working Capital and Net Working Capital

Working capital represents the total current assets available to a business, while net working capital is calculated by subtracting current liabilities from current assets, providing a clearer measure of liquidity. Working capital indicates the short-term financial health, whereas net working capital offers insight into the company's operational efficiency and ability to cover short-term debts. Understanding these key differences helps stakeholders assess cash flow management and financial stability within an organization.

Importance of Working Capital in Financial Management

Working capital represents the total current assets available to a business for daily operations, reflecting liquidity and operational efficiency. Net working capital, calculated as current assets minus current liabilities, provides a clearer picture of short-term financial health and the firm's ability to meet obligations. Effective working capital management ensures smooth business operations, maintains solvency, and supports growth by optimizing asset utilization and minimizing financing costs.

Significance of Net Working Capital for Business Health

Net Working Capital (NWC) represents the difference between current assets and current liabilities, serving as a critical indicator of a company's short-term financial health and operational efficiency. Positive NWC ensures that a business can meet its short-term obligations, fund daily operations, and invest in growth opportunities without liquidity constraints. Monitoring NWC helps management optimize cash flow, manage risks, and sustain business continuity in fluctuating market conditions.

Components of Working Capital Calculation

Working capital consists of current assets such as cash, accounts receivable, and inventory needed to fund day-to-day operations. Net working capital is calculated by subtracting current liabilities like accounts payable, short-term debt, and accrued expenses from current assets. Understanding these components is essential to assess a company's liquidity and operational efficiency.

How to Calculate Net Working Capital

Net Working Capital (NWC) is calculated by subtracting current liabilities from current assets, reflecting a company's short-term liquidity and operational efficiency. Key components include cash, accounts receivable, inventory for current assets, and accounts payable, short-term debt for current liabilities. Monitoring NWC ensures sufficient resources to cover short-term obligations and maintain smooth business operations.

Impact of Working Capital on Liquidity and Operations

Working capital, calculated as current assets minus current liabilities, directly influences a company's liquidity and operational efficiency by ensuring sufficient short-term assets to cover immediate liabilities. Net working capital reflects the net amount available to fund day-to-day operations, impacting a firm's ability to maintain smooth production cycles and meet financial obligations on time. Effective management of working capital optimizes cash flow, reduces the risk of insolvency, and supports sustained operational performance.

Strategic Management of Net Working Capital

Strategic management of Net Working Capital (NWC) involves optimizing current assets and liabilities to enhance liquidity and operational efficiency, directly impacting a company's short-term financial health. Unlike Working Capital, which simply measures the difference between current assets and current liabilities, NWC focuses on managing components such as inventory, receivables, and payables to support growth and reduce financing costs. Effective NWC management ensures sufficient cash flow for daily operations while minimizing idle resources and strengthening overall financial stability.

Working Capital vs Net Working Capital Infographic

difterm.com

difterm.com