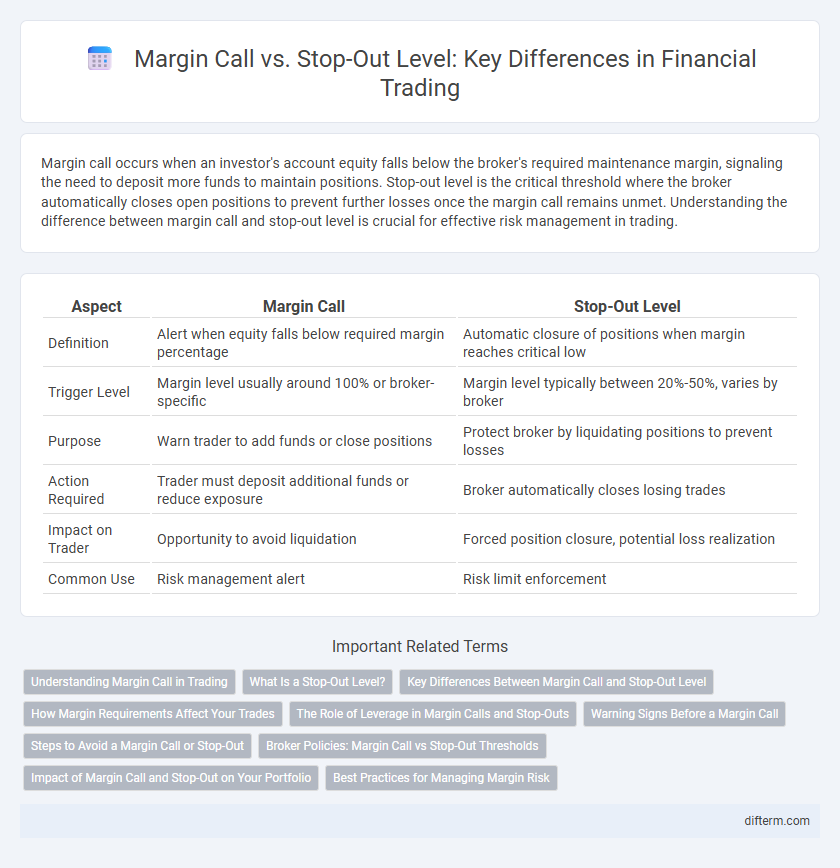

Margin call occurs when an investor's account equity falls below the broker's required maintenance margin, signaling the need to deposit more funds to maintain positions. Stop-out level is the critical threshold where the broker automatically closes open positions to prevent further losses once the margin call remains unmet. Understanding the difference between margin call and stop-out level is crucial for effective risk management in trading.

Table of Comparison

| Aspect | Margin Call | Stop-Out Level |

|---|---|---|

| Definition | Alert when equity falls below required margin percentage | Automatic closure of positions when margin reaches critical low |

| Trigger Level | Margin level usually around 100% or broker-specific | Margin level typically between 20%-50%, varies by broker |

| Purpose | Warn trader to add funds or close positions | Protect broker by liquidating positions to prevent losses |

| Action Required | Trader must deposit additional funds or reduce exposure | Broker automatically closes losing trades |

| Impact on Trader | Opportunity to avoid liquidation | Forced position closure, potential loss realization |

| Common Use | Risk management alert | Risk limit enforcement |

Understanding Margin Call in Trading

Margin Call occurs when a trader's account equity falls below the broker's required margin, signaling the need to deposit additional funds or liquidate positions to maintain open trades. It serves as an early warning to prevent further losses before reaching the Stop-Out Level, where positions are automatically closed. Understanding Margin Call helps traders manage risk by ensuring they maintain sufficient margin to support their trading activities.

What Is a Stop-Out Level?

A stop-out level is the critical threshold in a trading account where the broker automatically closes open positions to prevent further losses when the margin falls below a specified percentage. It is a predefined percentage of the required margin, often set by brokers to protect both the trader and the brokerage from excessive risk. Understanding the stop-out level is essential for managing trading risks and avoiding forced liquidation of positions during market volatility.

Key Differences Between Margin Call and Stop-Out Level

Margin Call occurs when a trader's account equity falls below the required margin, prompting a warning to deposit more funds or close positions to avoid liquidation. Stop-Out Level is reached when equity drops further, triggering automatic position closure by the broker to prevent negative balance and limit risk. The key difference lies in Margin Call serving as a cautionary alert, while Stop-Out Level enforces mandatory position liquidation.

How Margin Requirements Affect Your Trades

Margin requirements directly impact your trading by determining the minimum equity needed to maintain open positions and avoid margin calls. When your account equity falls below the margin call level, brokers issue a warning to add funds or reduce positions, preventing forced liquidation. Reaching the stop-out level triggers automatic closure of losing trades to protect both the trader and broker from further losses, emphasizing the critical role of margin management in risk control.

The Role of Leverage in Margin Calls and Stop-Outs

Leverage amplifies both potential gains and losses, making the margin call and stop-out levels critical thresholds in trading accounts. A margin call occurs when account equity falls below the required maintenance margin, prompting the trader to deposit more funds or close positions to avoid liquidation. The stop-out level is a predefined equity percentage at which brokers automatically close losing positions to prevent further losses and protect the trader's capital.

Warning Signs Before a Margin Call

Warning signs before a margin call include rapid declines in account equity and increased unrealized losses that approach the maintenance margin requirement. Monitoring margin levels closely reveals when margin ratios fall below broker-set thresholds, signaling imminent margin calls. Early detection of these warning indicators allows traders to deposit additional funds or reduce positions to avoid forced liquidation at the stop-out level.

Steps to Avoid a Margin Call or Stop-Out

Maintaining sufficient equity in your trading account by regularly monitoring your margin level is crucial to avoid a margin call or stop-out level. Employing risk management techniques such as setting conservative leverage ratios and using stop-loss orders helps limit potential losses and preserve capital. Diversifying your portfolio further reduces the risk of rapid account depletion triggering margin calls or stop-outs.

Broker Policies: Margin Call vs Stop-Out Thresholds

Broker policies differentiate clearly between margin call and stop-out thresholds to manage trading risks effectively. A margin call occurs when an account's equity falls below the broker's required maintenance margin, prompting the trader to deposit more funds or reduce positions. The stop-out level, set lower than the margin call threshold, triggers automatic position liquidation to prevent further losses and protect both the broker and trader from negative balances.

Impact of Margin Call and Stop-Out on Your Portfolio

Margin Call and Stop-Out levels are critical risk management tools that directly impact your trading portfolio by enforcing margin requirements and preventing further losses. A Margin Call occurs when your equity falls below the required margin, prompting you to deposit additional funds or close positions to avoid liquidation. The Stop-Out Level triggers automatic closing of your open positions when margin falls below a specific threshold, safeguarding your portfolio from negative balances and steep losses.

Best Practices for Managing Margin Risk

Maintaining adequate account equity above the margin call threshold is crucial to avoid forced liquidation at the stop-out level, ensuring sustained trading positions. Employing stop-loss orders and setting conservative leverage limits help mitigate the risk of sudden margin calls during market volatility. Regularly monitoring margin requirements and using automated alerts enhance proactive risk management and prevent unexpected stop-outs.

Margin Call vs Stop-Out Level Infographic

difterm.com

difterm.com