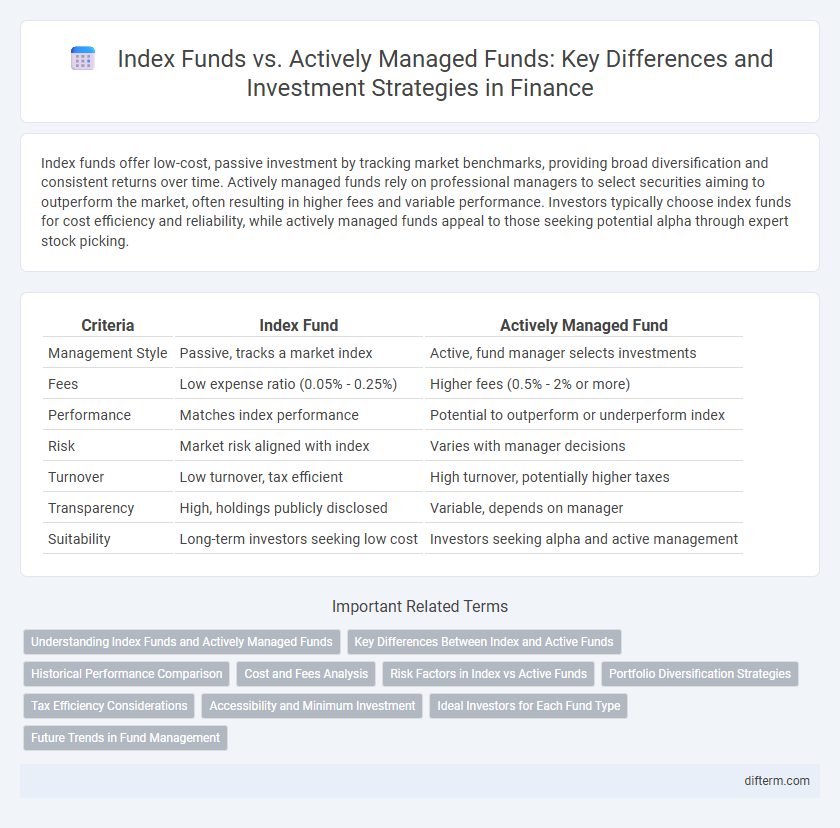

Index funds offer low-cost, passive investment by tracking market benchmarks, providing broad diversification and consistent returns over time. Actively managed funds rely on professional managers to select securities aiming to outperform the market, often resulting in higher fees and variable performance. Investors typically choose index funds for cost efficiency and reliability, while actively managed funds appeal to those seeking potential alpha through expert stock picking.

Table of Comparison

| Criteria | Index Fund | Actively Managed Fund |

|---|---|---|

| Management Style | Passive, tracks a market index | Active, fund manager selects investments |

| Fees | Low expense ratio (0.05% - 0.25%) | Higher fees (0.5% - 2% or more) |

| Performance | Matches index performance | Potential to outperform or underperform index |

| Risk | Market risk aligned with index | Varies with manager decisions |

| Turnover | Low turnover, tax efficient | High turnover, potentially higher taxes |

| Transparency | High, holdings publicly disclosed | Variable, depends on manager |

| Suitability | Long-term investors seeking low cost | Investors seeking alpha and active management |

Understanding Index Funds and Actively Managed Funds

Index funds track a specific market index, offering broad market exposure with lower fees and minimal portfolio turnover, making them ideal for passive investors seeking consistent, long-term growth. Actively managed funds rely on professional portfolio managers who select securities aiming to outperform market benchmarks, often resulting in higher fees and increased trading activity. Understanding these differences helps investors align fund choices with their risk tolerance, investment goals, and cost sensitivity in portfolio management.

Key Differences Between Index and Active Funds

Index funds track a specific market index, offering low management fees and broad market exposure, while actively managed funds rely on portfolio managers to select securities aiming to outperform the market, often resulting in higher fees. Index funds typically provide more predictable returns aligned with market performance, whereas active funds carry the potential for higher returns accompanied by increased risk and variability. The choice between these funds depends on investor goals, risk tolerance, and cost considerations.

Historical Performance Comparison

Index funds have consistently demonstrated lower expense ratios and stable returns by tracking market benchmarks, resulting in long-term performance that often surpasses many actively managed funds. Actively managed funds, despite opportunities for higher gains through strategic stock selection, frequently underperform due to higher fees and market timing risks. Historical data from sources like Morningstar and S&P Dow Jones Indices illustrate that over 80% of actively managed funds fail to outperform their benchmark indices over a 10-year period.

Cost and Fees Analysis

Index funds typically offer lower expense ratios, averaging around 0.10% to 0.25%, due to their passive management approach that tracks a market index. Actively managed funds often charge higher fees, with expense ratios ranging from 0.50% to over 1.00%, reflecting costs associated with research and active portfolio management. Lower costs in index funds often translate to better net returns for investors over the long term when compared to the higher fees of actively managed funds.

Risk Factors in Index vs Active Funds

Index funds typically exhibit lower risk due to broad market diversification and passive management, which minimizes the impact of individual security volatility. Actively managed funds face greater risk from manager decisions, sector concentration, and market timing, potentially leading to higher performance variability. Historical data shows index funds often deliver more consistent returns with reduced downside risk compared to many actively managed portfolios.

Portfolio Diversification Strategies

Index funds employ broad market exposure by tracking specific market indices, offering automatic diversification across numerous sectors and companies, which reduces unsystematic risk. Actively managed funds utilize expert portfolio managers who strategically select assets to exploit market inefficiencies, aiming to outperform benchmarks through targeted diversification and risk management. Portfolio diversification in index funds provides consistent market returns with lower costs, whereas actively managed funds seek enhanced returns at the expense of higher fees and potential concentration risks.

Tax Efficiency Considerations

Index funds typically offer higher tax efficiency due to lower portfolio turnover, resulting in fewer capital gains distributions compared to actively managed funds. Actively managed funds often engage in more frequent trading, which can trigger short-term capital gains taxed at higher rates. Investors seeking tax-advantaged strategies often prefer index funds to minimize taxable events and optimize after-tax returns.

Accessibility and Minimum Investment

Index funds typically offer greater accessibility due to lower minimum investment requirements, making them ideal for beginner investors or those with limited capital. Actively managed funds often have higher minimum investments, restricting access to wealthier individuals or institutional investors. The comparatively low cost and ease of entry for index funds enhance their appeal in broadening investor participation.

Ideal Investors for Each Fund Type

Index funds suit investors seeking low-cost, diversified exposure with minimal trading, ideal for those prioritizing long-term growth and passive strategies. Actively managed funds attract investors willing to pay higher fees for expert stock selection and potential outperformance, fitting those comfortable with higher risk and shorter investment horizons. Understanding risk tolerance, investment goals, and cost sensitivity helps determine the optimal fund choice.

Future Trends in Fund Management

Index funds are expected to dominate the future of fund management due to their low fees, transparency, and alignment with market performance. Advances in artificial intelligence and big data analytics will enhance the precision of both index tracking and stock selection in actively managed funds, but cost efficiency remains a critical advantage for passive investing. Investors increasingly favor ESG-integrated index funds as sustainability criteria become central to portfolio construction and regulatory frameworks evolve globally.

Index fund vs Actively managed fund Infographic

difterm.com

difterm.com