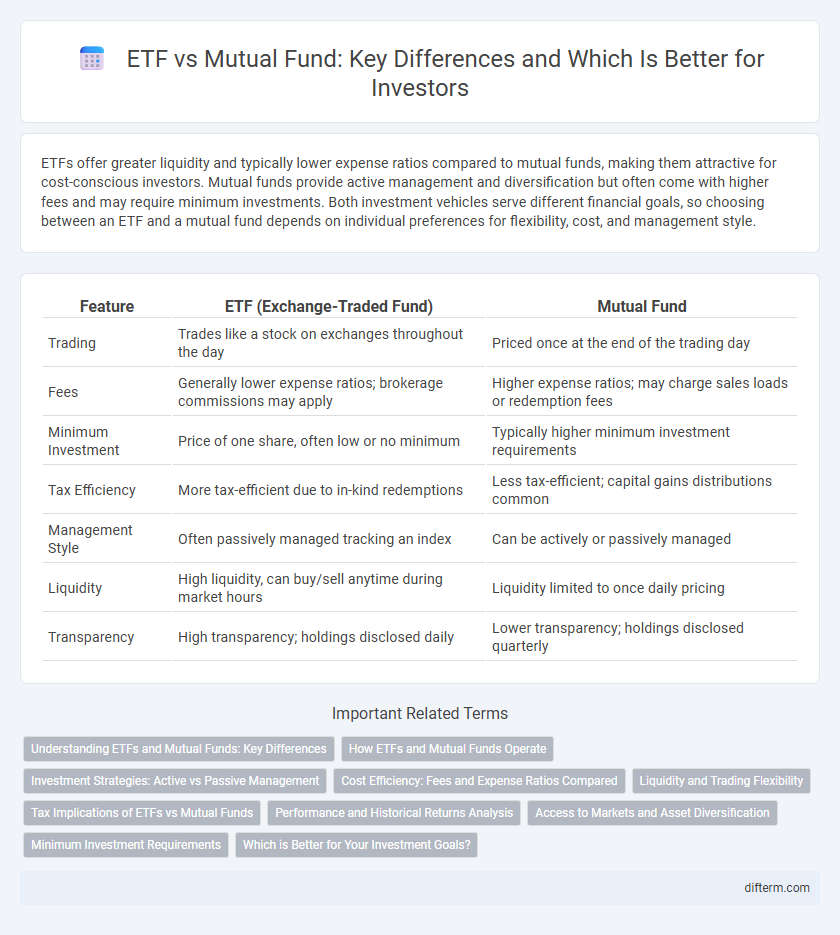

ETFs offer greater liquidity and typically lower expense ratios compared to mutual funds, making them attractive for cost-conscious investors. Mutual funds provide active management and diversification but often come with higher fees and may require minimum investments. Both investment vehicles serve different financial goals, so choosing between an ETF and a mutual fund depends on individual preferences for flexibility, cost, and management style.

Table of Comparison

| Feature | ETF (Exchange-Traded Fund) | Mutual Fund |

|---|---|---|

| Trading | Trades like a stock on exchanges throughout the day | Priced once at the end of the trading day |

| Fees | Generally lower expense ratios; brokerage commissions may apply | Higher expense ratios; may charge sales loads or redemption fees |

| Minimum Investment | Price of one share, often low or no minimum | Typically higher minimum investment requirements |

| Tax Efficiency | More tax-efficient due to in-kind redemptions | Less tax-efficient; capital gains distributions common |

| Management Style | Often passively managed tracking an index | Can be actively or passively managed |

| Liquidity | High liquidity, can buy/sell anytime during market hours | Liquidity limited to once daily pricing |

| Transparency | High transparency; holdings disclosed daily | Lower transparency; holdings disclosed quarterly |

Understanding ETFs and Mutual Funds: Key Differences

ETFs (Exchange-Traded Funds) trade like stocks on exchanges, offering intraday liquidity and generally lower expense ratios compared to mutual funds, which are priced once daily after market close. Mutual funds provide actively managed portfolios with potential for higher fees and minimum investment requirements, while ETFs typically track indexes passively with more tax efficiency. Investors seeking flexibility and cost-effectiveness often prefer ETFs, whereas those looking for professional management and automatic reinvestment might choose mutual funds.

How ETFs and Mutual Funds Operate

ETFs trade on stock exchanges throughout the day, allowing investors to buy and sell shares at market prices, while mutual funds are priced once daily after market close based on their net asset value (NAV). ETFs hold a basket of securities that replicate an index, offering transparency and lower expense ratios, whereas mutual funds are actively or passively managed, often involving higher fees and less frequent pricing updates. The operational structure of ETFs provides intraday liquidity and tax efficiency, contrasting with mutual funds' end-of-day redemption process and potential capital gains distributions.

Investment Strategies: Active vs Passive Management

ETFs primarily follow passive management strategies by tracking specific indices, allowing investors low-cost exposure to broad market segments with minimal portfolio turnover. Mutual funds often employ active management, where fund managers analyze market trends and make selective investment decisions to outperform benchmarks, potentially leading to higher fees and transaction costs. Investors seeking cost efficiency and predictable returns may prefer ETFs, while those aiming for potential alpha and professional oversight might lean toward actively managed mutual funds.

Cost Efficiency: Fees and Expense Ratios Compared

Exchange-Traded Funds (ETFs) generally offer lower expense ratios compared to mutual funds, making them more cost-efficient for long-term investors. Mutual funds often charge higher management fees and may include sales loads, increasing overall investment costs. The lower fees of ETFs enhance net returns by minimizing annual expenses and trading costs, benefiting cost-conscious investors.

Liquidity and Trading Flexibility

ETFs offer superior liquidity due to their ability to be traded on exchanges throughout the trading day at market prices, providing investors with real-time pricing and the flexibility to execute trades instantly. Mutual funds, however, are priced only once daily after market close, limiting trading flexibility and delaying transaction execution until the end of the trading day. This distinction in liquidity and trading mechanisms makes ETFs more attractive for investors seeking timely market access and dynamic portfolio adjustments.

Tax Implications of ETFs vs Mutual Funds

ETFs generally offer greater tax efficiency compared to mutual funds due to their unique in-kind creation and redemption process that minimizes capital gains distributions. Mutual funds tend to distribute capital gains to investors more frequently, potentially increasing tax liabilities. The lower turnover rate in ETFs also contributes to reduced taxable events, making them a preferable choice for tax-conscious investors.

Performance and Historical Returns Analysis

Exchange-traded funds (ETFs) often exhibit lower expense ratios and more tax-efficient structures compared to mutual funds, contributing to better net performance over time. Historical returns analysis reveals that ETFs tend to closely track their underlying indices with minimal tracking error, whereas mutual funds frequently underperform due to higher management fees and trading costs. Studies indicate that over extended periods, ETFs generally outperform actively managed mutual funds, especially in efficiency-focused, passive investment strategies.

Access to Markets and Asset Diversification

ETFs provide investors with direct access to a wide range of global markets through real-time trading on stock exchanges, enabling immediate portfolio adjustments and liquidity. Mutual funds offer diversified asset exposure managed by professional fund managers but lack intraday trading flexibility, often trading at end-of-day NAV prices. Access to multiple asset classes, including equities, bonds, and commodities, is facilitated in both vehicles, though ETFs typically deliver more granular market segmentation and cost-efficiency for diversification strategies.

Minimum Investment Requirements

ETFs typically have lower minimum investment requirements, often allowing investors to purchase as little as one share, making them accessible for smaller portfolios. Mutual funds usually require higher minimum investments, commonly ranging from $1,000 to $3,000, which can be a barrier for some investors. This difference affects liquidity and entry points, influencing investor decisions based on available capital and investment goals.

Which is Better for Your Investment Goals?

ETFs offer lower expense ratios and intraday trading flexibility, making them suitable for cost-conscious investors seeking liquidity and diversification. Mutual funds provide professional management and automatic reinvestment, ideal for those preferring hands-off growth and long-term tax advantages. Choosing between ETFs and mutual funds depends on your investment goals, risk tolerance, and trading preferences.

ETF vs Mutual fund Infographic

difterm.com

difterm.com