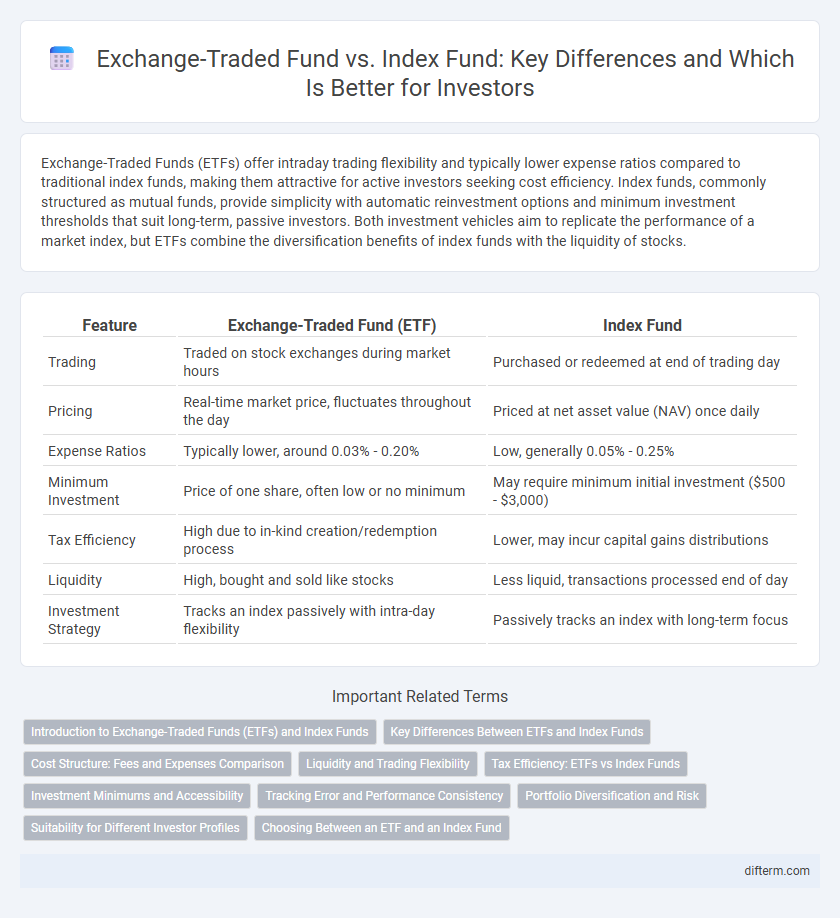

Exchange-Traded Funds (ETFs) offer intraday trading flexibility and typically lower expense ratios compared to traditional index funds, making them attractive for active investors seeking cost efficiency. Index funds, commonly structured as mutual funds, provide simplicity with automatic reinvestment options and minimum investment thresholds that suit long-term, passive investors. Both investment vehicles aim to replicate the performance of a market index, but ETFs combine the diversification benefits of index funds with the liquidity of stocks.

Table of Comparison

| Feature | Exchange-Traded Fund (ETF) | Index Fund |

|---|---|---|

| Trading | Traded on stock exchanges during market hours | Purchased or redeemed at end of trading day |

| Pricing | Real-time market price, fluctuates throughout the day | Priced at net asset value (NAV) once daily |

| Expense Ratios | Typically lower, around 0.03% - 0.20% | Low, generally 0.05% - 0.25% |

| Minimum Investment | Price of one share, often low or no minimum | May require minimum initial investment ($500 - $3,000) |

| Tax Efficiency | High due to in-kind creation/redemption process | Lower, may incur capital gains distributions |

| Liquidity | High, bought and sold like stocks | Less liquid, transactions processed end of day |

| Investment Strategy | Tracks an index passively with intra-day flexibility | Passively tracks an index with long-term focus |

Introduction to Exchange-Traded Funds (ETFs) and Index Funds

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, combining features of mutual funds and individual stocks with intraday liquidity and diversified portfolios. Index funds are mutual funds or ETFs designed to replicate the performance of a specific market index, offering low-cost, passive investment strategies. Both ETFs and index funds provide broad market exposure and cost efficiency, but ETFs offer more flexibility through real-time trading and potential tax advantages.

Key Differences Between ETFs and Index Funds

Exchange-Traded Funds (ETFs) trade like stocks on an exchange, offering intraday liquidity and real-time pricing, whereas Index Funds are mutual funds priced at the end of the trading day. ETFs typically have lower expense ratios and provide greater tax efficiency through in-kind redemptions, while Index Funds may have minimum investment requirements and potentially higher capital gains distributions. Investors seeking flexibility and lower trading costs often prefer ETFs, whereas those favoring automatic investments and a buy-and-hold approach might choose Index Funds.

Cost Structure: Fees and Expenses Comparison

Exchange-Traded Funds (ETFs) typically feature lower expense ratios than traditional Index Funds due to their passive management structure and lower administrative costs. ETFs incur brokerage commissions and bid-ask spreads, which can add to the total cost, while Index Funds often require minimum investments and may charge sales loads or redemption fees. Investors should evaluate both fund expense ratios and trading costs to determine the most cost-effective investment vehicle aligned with their portfolio strategy.

Liquidity and Trading Flexibility

Exchange-Traded Funds (ETFs) offer superior liquidity since they trade on major stock exchanges throughout the trading day, allowing investors to buy and sell shares at real-time market prices. In contrast, Index Funds are priced only once at market close, limiting trading flexibility and potentially resulting in execution delays. ETFs also enable intraday trading strategies such as limit orders and short selling, providing investors with enhanced control over portfolio management.

Tax Efficiency: ETFs vs Index Funds

Exchange-Traded Funds (ETFs) offer superior tax efficiency compared to traditional Index Funds due to their unique creation and redemption mechanism, which minimizes capital gains distributions. ETFs typically allow investors to defer capital gains taxes until shares are sold, while Index Funds often distribute taxable capital gains annually. Studies reveal investors in ETFs may realize significantly lower tax liabilities, enhancing after-tax returns in taxable accounts.

Investment Minimums and Accessibility

Exchange-Traded Funds (ETFs) typically have lower investment minimums, allowing investors to buy as little as one share, enhancing accessibility for individuals with limited capital. Index Funds often require higher minimum investments, sometimes ranging from $1,000 to $3,000, which can be a barrier for beginner investors. The liquidity of ETFs also enables intraday trading on stock exchanges, whereas Index Funds are usually bought or sold at the end of the trading day at net asset value.

Tracking Error and Performance Consistency

Exchange-Traded Funds (ETFs) often exhibit lower tracking error compared to Index Funds due to their intraday trading capabilities and flexibility in portfolio adjustments. Index Funds typically maintain performance consistency by mirroring index components through periodic rebalancing, but may face slight deviations from the benchmark due to management fees and bid-ask spreads. Investors seeking minimal divergence from benchmark returns prioritize ETFs for tighter tracking, while Index Funds appeal for long-term stability in performance adherence.

Portfolio Diversification and Risk

Exchange-Traded Funds (ETFs) offer real-time trading flexibility, enhancing portfolio diversification by allowing investors to precisely time market entries and exits, which can mitigate risk exposure. Index funds provide broad market exposure and typically lower expense ratios, making them a cost-effective option for long-term diversification and risk reduction. Both vehicles track market indices, but ETFs' intraday liquidity caters to active risk management strategies, while index funds suit passive investment approaches focused on steady growth.

Suitability for Different Investor Profiles

Exchange-Traded Funds (ETFs) offer high liquidity and intraday trading flexibility, making them ideal for active investors and those seeking tactical portfolio adjustments. Index Funds typically suit long-term, passive investors due to low expense ratios and buy-and-hold strategies aligned with broad market indices. Conservative investors prioritize Index Funds for stable growth and minimal trading costs, while ETFs attract those valuing diversification with the ability to respond quickly to market movements.

Choosing Between an ETF and an Index Fund

Choosing between an Exchange-Traded Fund (ETF) and an Index Fund depends on trading flexibility, cost structure, and investment goals. ETFs trade like stocks on exchanges, offering intraday liquidity and typically lower expense ratios, while index funds are priced once daily and often require minimum investments. Investors seeking active trading opportunities and lower fees may prefer ETFs, whereas those favoring automatic investing and simplicity might opt for index funds.

Exchange-Traded Fund vs Index Fund Infographic

difterm.com

difterm.com