Financial accounting provides standardized reports for external stakeholders, emphasizing historical data and regulatory compliance. Managerial accounting focuses on internal decision-making needs, delivering detailed, forward-looking insights to aid in budgeting and performance evaluation. Both disciplines serve distinct purposes, with financial accounting ensuring transparency and managerial accounting driving strategic planning.

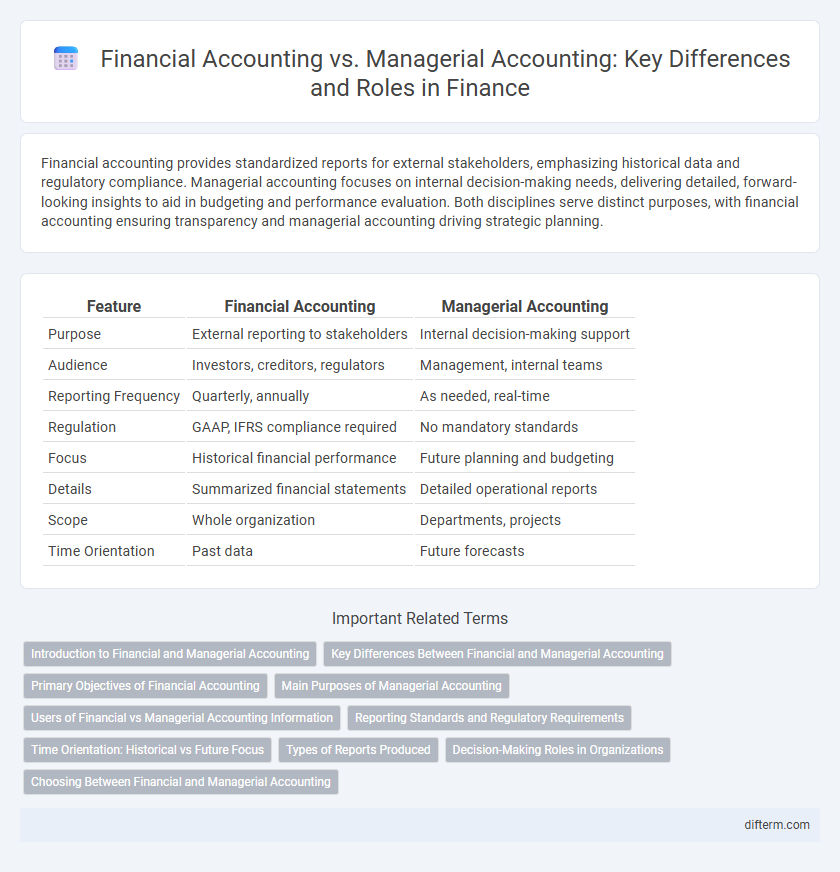

Table of Comparison

| Feature | Financial Accounting | Managerial Accounting |

|---|---|---|

| Purpose | External reporting to stakeholders | Internal decision-making support |

| Audience | Investors, creditors, regulators | Management, internal teams |

| Reporting Frequency | Quarterly, annually | As needed, real-time |

| Regulation | GAAP, IFRS compliance required | No mandatory standards |

| Focus | Historical financial performance | Future planning and budgeting |

| Details | Summarized financial statements | Detailed operational reports |

| Scope | Whole organization | Departments, projects |

| Time Orientation | Past data | Future forecasts |

Introduction to Financial and Managerial Accounting

Financial accounting focuses on the preparation of standardized financial statements such as balance sheets, income statements, and cash flow reports intended for external stakeholders including investors, creditors, and regulatory agencies. Managerial accounting emphasizes internal reporting, providing detailed financial and operational data to assist managers in decision-making, budgeting, and performance evaluation within the organization. Both disciplines utilize core accounting principles but serve distinct purposes--financial accounting ensures compliance and transparency, while managerial accounting supports strategic planning and operational control.

Key Differences Between Financial and Managerial Accounting

Financial accounting emphasizes the preparation of standardized financial statements such as balance sheets and income statements for external stakeholders, adhering strictly to GAAP or IFRS regulations. Managerial accounting focuses on internal reports, including budgets, forecasts, and performance metrics, to assist management in strategic decision-making and operational control. While financial accounting prioritizes historical data and accuracy, managerial accounting is forward-looking, flexible, and tailored to meet the specific needs of business managers.

Primary Objectives of Financial Accounting

Financial accounting primarily aims to provide accurate and standardized financial statements such as balance sheets, income statements, and cash flow statements to external stakeholders including investors, creditors, and regulatory agencies. It ensures compliance with generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) to enhance transparency and comparability. The core objective is to present a true and fair view of the company's financial position and performance over a specific period.

Main Purposes of Managerial Accounting

Managerial accounting primarily aims to provide detailed financial and non-financial information to internal management for effective decision-making, planning, and control. It emphasizes budgeting, performance evaluation, and cost management to enhance operational efficiency and strategic goals. Unlike financial accounting, which targets external stakeholders, managerial accounting focuses on real-time data to support internal business processes.

Users of Financial vs Managerial Accounting Information

Financial accounting primarily serves external users such as investors, creditors, regulators, and tax authorities who require standardized and audited financial statements for decision-making and compliance purposes. Managerial accounting targets internal users including company executives, managers, and department heads who rely on detailed, real-time financial data and performance reports to guide operational planning, budgeting, and strategic decision-making. The distinction lies in financial accounting's emphasis on historical data and external reporting standards, contrasting with managerial accounting's focus on future-oriented, customizable information for internal management.

Reporting Standards and Regulatory Requirements

Financial accounting adheres to standardized reporting guidelines such as GAAP or IFRS, ensuring consistency and comparability of financial statements for external stakeholders. Managerial accounting lacks mandatory regulatory requirements, enabling organizations to customize reports for internal decision-making and strategic planning. The contrasting frameworks highlight financial accounting's emphasis on compliance and transparency versus managerial accounting's flexibility and operational focus.

Time Orientation: Historical vs Future Focus

Financial accounting emphasizes historical data by recording and reporting past financial transactions to external stakeholders such as investors and regulatory bodies. Managerial accounting centers on future-focused insights, providing internal management with forecasts, budgets, and financial planning tools to support strategic decision-making. This distinction underscores financial accounting's retrospective nature versus managerial accounting's prospective orientation for business growth.

Types of Reports Produced

Financial accounting produces standardized reports such as balance sheets, income statements, and cash flow statements that are used by external stakeholders to assess the company's overall financial health. Managerial accounting generates detailed internal reports including budgets, variance analyses, and performance evaluations designed to aid management in decision-making and operational control. These reports differ in purpose, format, and frequency, reflecting the distinct needs of external users and internal managers.

Decision-Making Roles in Organizations

Financial accounting provides external stakeholders with standardized reports that ensure transparency and compliance, aiding in investment and regulatory decisions. Managerial accounting delivers detailed internal data, enabling managers to evaluate operational performance and make strategic decisions aligned with organizational goals. The distinct roles of these accounting types optimize decision-making by addressing the needs of different users within and outside the company.

Choosing Between Financial and Managerial Accounting

Choosing between financial accounting and managerial accounting depends on the intended audience and purpose; financial accounting focuses on creating external reports conforming to GAAP for stakeholders, while managerial accounting provides detailed, real-time data to assist internal management in strategic decision-making. Organizations aiming for regulatory compliance and investor communication prioritize financial accounting, whereas those emphasizing operational efficiency and budget control lean toward managerial accounting. Effective financial management often involves integrating insights from both accounting types to balance external reporting requirements with dynamic internal planning.

Financial Accounting vs Managerial Accounting Infographic

difterm.com

difterm.com