The bid price represents the highest price a buyer is willing to pay for a security, while the ask price is the lowest price a seller is willing to accept. The difference between these prices, known as the spread, indicates market liquidity and transaction costs. Narrow spreads typically suggest high liquidity and lower trading costs, benefiting investors and traders.

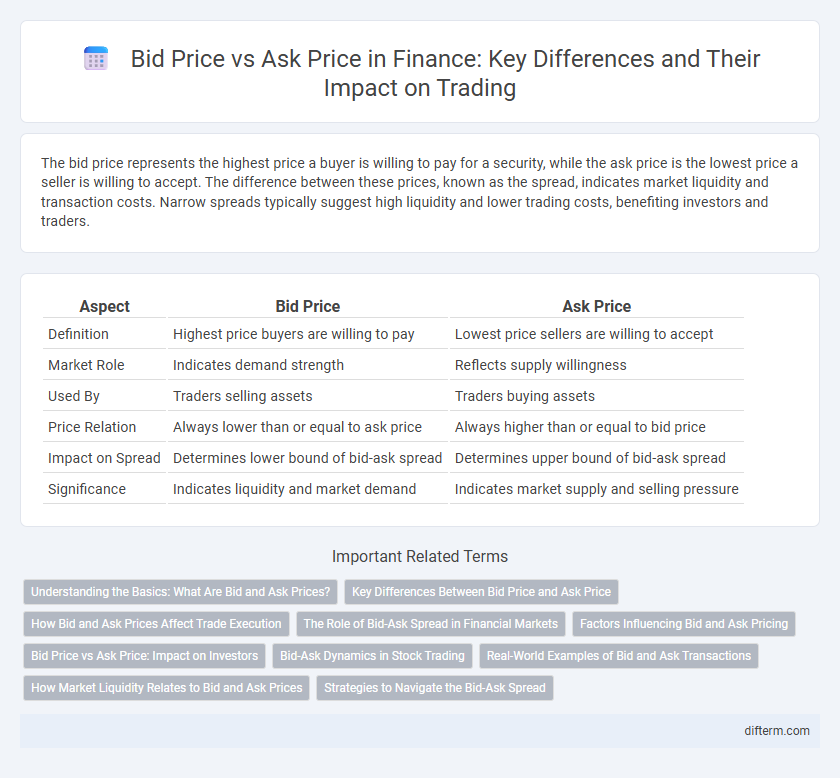

Table of Comparison

| Aspect | Bid Price | Ask Price |

|---|---|---|

| Definition | Highest price buyers are willing to pay | Lowest price sellers are willing to accept |

| Market Role | Indicates demand strength | Reflects supply willingness |

| Used By | Traders selling assets | Traders buying assets |

| Price Relation | Always lower than or equal to ask price | Always higher than or equal to bid price |

| Impact on Spread | Determines lower bound of bid-ask spread | Determines upper bound of bid-ask spread |

| Significance | Indicates liquidity and market demand | Indicates market supply and selling pressure |

Understanding the Basics: What Are Bid and Ask Prices?

The bid price represents the highest amount a buyer is willing to pay for a security, while the ask price is the lowest amount a seller is willing to accept. This bid-ask spread reflects market liquidity and trading costs, with narrower spreads indicating higher liquidity and lower transaction costs. Understanding these prices is essential for investors to gauge market sentiment and make informed trading decisions.

Key Differences Between Bid Price and Ask Price

The bid price represents the highest price a buyer is willing to pay for a security, while the ask price is the lowest price a seller agrees to accept. The difference between these prices, known as the bid-ask spread, reflects the liquidity and transaction cost of the asset. Market makers and traders use this spread to gauge market efficiency and potential profit margins.

How Bid and Ask Prices Affect Trade Execution

Bid price represents the highest price a buyer is willing to pay for a security, while the ask price is the lowest price a seller will accept. The difference between the bid and ask prices, known as the spread, directly impacts trade execution by influencing transaction costs and liquidity. Narrow spreads typically result in faster and more efficient trades, whereas wider spreads can lead to higher costs and delayed execution.

The Role of Bid-Ask Spread in Financial Markets

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid price) and the lowest price a seller is willing to accept (ask price), serving as a crucial indicator of market liquidity. Narrow spreads typically signify high liquidity and efficient markets, while wider spreads often indicate lower liquidity and higher transaction costs. Market makers utilize the bid-ask spread to manage risks and generate profits, influencing price discovery and overall market stability.

Factors Influencing Bid and Ask Pricing

Bid and ask prices are influenced by market liquidity, investor demand, and the level of market volatility. Higher liquidity generally narrows the bid-ask spread, while increased volatility widens it due to the uncertainty in asset valuation. Other factors include trading volume, order size, and the presence of market makers who adjust prices based on supply and demand dynamics.

Bid Price vs Ask Price: Impact on Investors

The bid price represents the highest price a buyer is willing to pay for a security, while the ask price reflects the lowest price a seller is willing to accept. The difference between these prices, known as the bid-ask spread, directly affects transaction costs and liquidity for investors. Narrow spreads typically indicate higher market efficiency and better pricing, enhancing the investor's ability to execute trades at favorable rates.

Bid-Ask Dynamics in Stock Trading

The bid price represents the highest price a buyer is willing to pay for a stock, while the ask price is the lowest price a seller is willing to accept, creating the bid-ask spread that reflects market liquidity and trading costs. Tight bid-ask spreads indicate high liquidity and efficient price discovery, whereas wider spreads suggest lower liquidity and higher transaction costs. Understanding bid-ask dynamics is crucial for traders to optimize order execution and minimize slippage in fast-moving markets.

Real-World Examples of Bid and Ask Transactions

Bid price represents the highest price a buyer is willing to pay for a stock, while ask price is the lowest price a seller is willing to accept, creating the bid-ask spread. In real-world finance, a trader placing a market buy order for Apple shares at the ask price of $150.25 immediately transacts with a seller quoting that price, whereas another trader placing a market sell order sells at the bid price of $150.00, reflecting the highest existing buy offer. This bid-ask spread influences transaction costs and liquidity, crucial in high-frequency trading environments and equity markets such as the NYSE or NASDAQ.

How Market Liquidity Relates to Bid and Ask Prices

Market liquidity directly impacts the bid and ask prices by narrowing or widening the spread between them, reflecting how easily assets can be bought or sold without significant price changes. High liquidity markets exhibit tight bid-ask spreads, which reduce transaction costs and increase market efficiency. Conversely, low liquidity results in wider spreads, leading to higher trading costs and potential price volatility.

Strategies to Navigate the Bid-Ask Spread

Effective strategies to navigate the bid-ask spread include placing limit orders to control execution prices and reduce slippage, especially in volatile or low-liquidity markets. Traders can also analyze historical spread patterns to time trades during periods of narrower spreads, optimizing transaction costs. Utilizing market depth data and algorithmic trading tools helps identify optimal entry and exit points within the bid-ask range.

Bid price vs Ask price Infographic

difterm.com

difterm.com