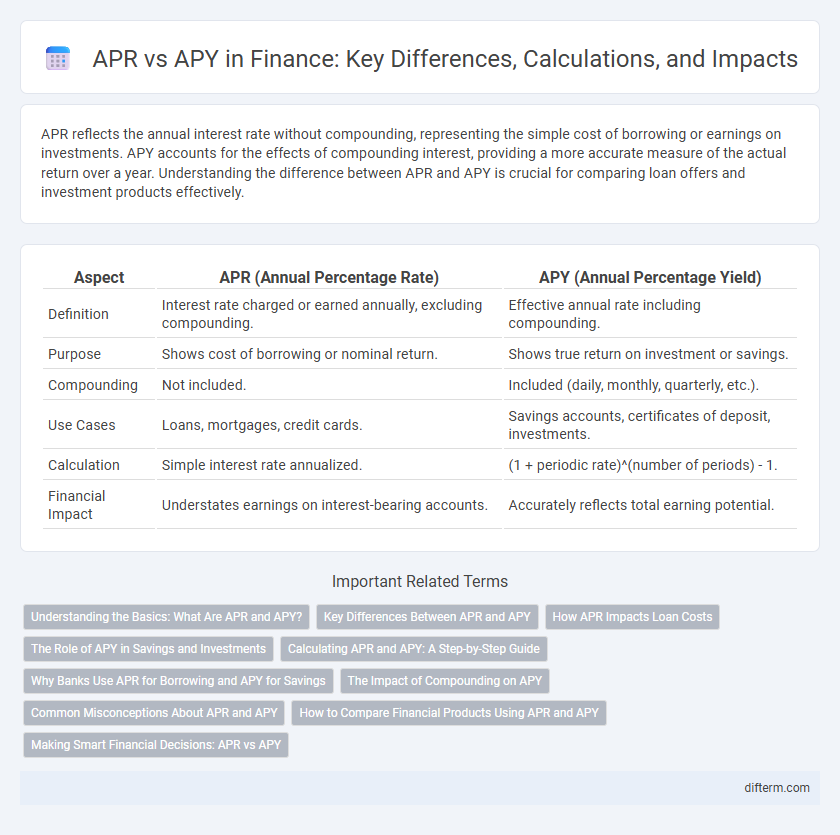

APR reflects the annual interest rate without compounding, representing the simple cost of borrowing or earnings on investments. APY accounts for the effects of compounding interest, providing a more accurate measure of the actual return over a year. Understanding the difference between APR and APY is crucial for comparing loan offers and investment products effectively.

Table of Comparison

| Aspect | APR (Annual Percentage Rate) | APY (Annual Percentage Yield) |

|---|---|---|

| Definition | Interest rate charged or earned annually, excluding compounding. | Effective annual rate including compounding. |

| Purpose | Shows cost of borrowing or nominal return. | Shows true return on investment or savings. |

| Compounding | Not included. | Included (daily, monthly, quarterly, etc.). |

| Use Cases | Loans, mortgages, credit cards. | Savings accounts, certificates of deposit, investments. |

| Calculation | Simple interest rate annualized. | (1 + periodic rate)^(number of periods) - 1. |

| Financial Impact | Understates earnings on interest-bearing accounts. | Accurately reflects total earning potential. |

Understanding the Basics: What Are APR and APY?

APR (Annual Percentage Rate) represents the yearly cost of borrowing, including interest and fees, expressed as a percentage. APY (Annual Percentage Yield) reflects the actual yearly return on an investment, accounting for compound interest. Understanding the difference helps consumers evaluate loan costs versus investment growth accurately.

Key Differences Between APR and APY

APR (Annual Percentage Rate) represents the yearly interest rate charged on loans or earned on investments without compounding, highlighting the simple interest cost or yield. APY (Annual Percentage Yield) includes the effects of compounding interest over the year, providing a more accurate measure of the actual return or cost. Understanding the key differences between APR and APY is crucial for comparing financial products, as APR shows the nominal rate while APY reflects the effective annual rate accounting for compounding frequency.

How APR Impacts Loan Costs

APR (Annual Percentage Rate) directly influences loan costs by representing the true yearly interest expense, including fees and other charges, which helps borrowers compare loan offers accurately. A higher APR increases the total repayment amount over the loan term, affecting monthly payments and overall affordability. Understanding APR is crucial for evaluating the cost-effectiveness of loans and managing long-term financial commitments.

The Role of APY in Savings and Investments

APY (Annual Percentage Yield) reflects the total interest earned on savings or investments over one year, including compound interest, making it a more accurate measure of investment growth compared to APR (Annual Percentage Rate). APY helps investors compare the real returns of different financial products, such as savings accounts, certificates of deposit, and money market accounts, by accounting for the frequency of compounding periods. Understanding APY is crucial for maximizing savings growth and making informed decisions in financial planning and investment strategies.

Calculating APR and APY: A Step-by-Step Guide

Calculating APR involves dividing the total interest paid over a year by the principal loan amount, excluding compounding effects. APY calculation accounts for interest compounding by using the formula (1 + periodic rate)^(number of periods) - 1, reflecting the actual annual return. Understanding both calculations enables accurate comparison of loan costs and investment returns in finance.

Why Banks Use APR for Borrowing and APY for Savings

Banks use APR for borrowing because it clearly represents the annual cost of loans, including interest and fees, helping borrowers understand their total repayment obligation. APY is preferred for savings accounts as it incorporates compound interest, providing an accurate measure of actual earnings over time. This distinction ensures transparent communication of costs and returns aligned with the different financial products' purposes.

The Impact of Compounding on APY

The Annual Percentage Yield (APY) incorporates the effect of compounding interest, representing the real rate of return on an investment over a year. Unlike the Annual Percentage Rate (APR), which excludes compounding, APY provides a more accurate measure of financial growth by calculating interest on both the principal and accumulated interest. This compounding impact significantly increases earnings, especially with frequent compounding periods, making APY a critical metric for comparing investment and loan products.

Common Misconceptions About APR and APY

Many investors confuse APR (Annual Percentage Rate) with APY (Annual Percentage Yield), not realizing that APR represents the interest rate without compounding, while APY includes the effects of compounding over a year. This misconception can lead to underestimating the true cost of a loan or the actual return on an investment. Understanding the distinction between APR and APY is crucial for accurate financial comparison and decision-making.

How to Compare Financial Products Using APR and APY

APR (Annual Percentage Rate) represents the yearly interest charged on a loan or earned through an investment without compounding, while APY (Annual Percentage Yield) accounts for compound interest over a year, showing the true annual return. When comparing financial products, prioritize APY for savings accounts and investments to understand real earning potential, and focus on APR for loans and credit products to gauge true borrowing costs. Evaluating both metrics side by side ensures accurate comparison of interest rates, fees, and compounding effects for informed financial decisions.

Making Smart Financial Decisions: APR vs APY

APR represents the annual percentage rate, showing the cost of borrowing without accounting for compounding, while APY, or annual percentage yield, includes compounding effects, revealing the true return on investments or savings. Understanding the difference between APR and APY is critical for making smart financial decisions, as APR helps compare loan costs and APY more accurately reflects potential earnings. Choosing loans or investments based on these metrics ensures better evaluation of interest costs and growth, maximizing financial benefits.

APR vs APY Infographic

difterm.com

difterm.com