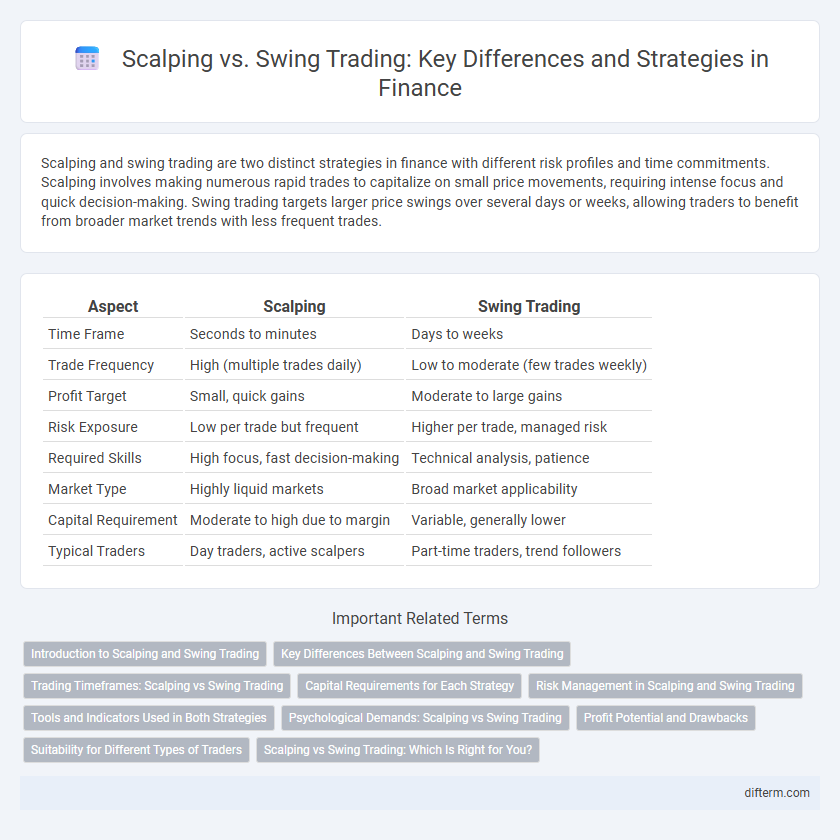

Scalping and swing trading are two distinct strategies in finance with different risk profiles and time commitments. Scalping involves making numerous rapid trades to capitalize on small price movements, requiring intense focus and quick decision-making. Swing trading targets larger price swings over several days or weeks, allowing traders to benefit from broader market trends with less frequent trades.

Table of Comparison

| Aspect | Scalping | Swing Trading |

|---|---|---|

| Time Frame | Seconds to minutes | Days to weeks |

| Trade Frequency | High (multiple trades daily) | Low to moderate (few trades weekly) |

| Profit Target | Small, quick gains | Moderate to large gains |

| Risk Exposure | Low per trade but frequent | Higher per trade, managed risk |

| Required Skills | High focus, fast decision-making | Technical analysis, patience |

| Market Type | Highly liquid markets | Broad market applicability |

| Capital Requirement | Moderate to high due to margin | Variable, generally lower |

| Typical Traders | Day traders, active scalpers | Part-time traders, trend followers |

Introduction to Scalping and Swing Trading

Scalping involves executing numerous trades within seconds or minutes to capture small price movements and requires high market liquidity and fast decision-making. Swing trading focuses on holding positions from several days to weeks, aiming to profit from expected market swings by analyzing technical indicators and market trends. Both strategies demand distinct risk management techniques and suit different trader profiles based on time commitment and market volatility tolerance.

Key Differences Between Scalping and Swing Trading

Scalping involves executing numerous trades within seconds to minutes, targeting small price movements to capture quick profits, while swing trading holds positions from several days to weeks to capitalize on larger price swings. Scalpers rely heavily on technical analysis and high liquidity to enter and exit positions rapidly, whereas swing traders combine technical indicators with fundamental analysis for more sustained trends. Risk management in scalping requires fast decision-making and tight stop-loss orders, contrasting with swing trading's broader stop-loss ranges due to longer holding periods.

Trading Timeframes: Scalping vs Swing Trading

Scalping targets ultra-short timeframes, often executing trades within seconds to minutes to capitalize on small price fluctuations, while swing trading spans several days to weeks, aiming to profit from medium-term market trends. Scalpers rely on high-frequency trading with rapid decision-making and tight stop-loss orders, whereas swing traders use technical and fundamental analysis to identify momentum over longer periods. Choosing between scalping and swing trading depends on risk tolerance, market volatility, and the trader's preferred intensity and time commitment.

Capital Requirements for Each Strategy

Scalping requires a higher capital base due to frequent trades and the need to cover transaction costs while maintaining leverage. Swing trading demands relatively lower capital, allowing traders to hold positions longer and absorb market fluctuations without rapid margin calls. Understanding these capital requirements is crucial for aligning one's investment portfolio with the chosen trading strategy's risk tolerance and liquidity needs.

Risk Management in Scalping and Swing Trading

Scalping involves executing numerous quick trades to capitalize on small price movements, requiring strict risk management through tight stop-loss orders and precise position sizing to minimize exposure. Swing trading holds positions over days or weeks, demanding broader risk management strategies like diversified portfolios and trailing stops to protect against larger market swings. Effective management in both approaches hinges on balancing reward-to-risk ratios tailored to the trading timeframe and volatility levels.

Tools and Indicators Used in Both Strategies

Scalping relies heavily on fast-paced tools such as Level II quotes, tick charts, and the Relative Strength Index (RSI) to capture small price movements within seconds or minutes. Swing trading utilizes longer-term indicators like moving averages, Bollinger Bands, and the MACD to identify trend reversals and price momentum over days or weeks. Both strategies benefit from using volume analysis and support/resistance levels, but the time frames and sensitivity of the indicators differ significantly.

Psychological Demands: Scalping vs Swing Trading

Scalping requires intense focus and quick decision-making under pressure, demanding traders maintain high mental agility and resilience to handle rapid market fluctuations. Swing trading allows more time for analysis and emotional regulation, reducing stress but requiring patience and discipline to hold positions through volatile periods. Both strategies challenge psychological stamina differently, with scalping favoring short-term stress tolerance and swing trading emphasizing long-term emotional control.

Profit Potential and Drawbacks

Scalping offers rapid profit potential through frequent trades capitalizing on small price movements but involves high transaction costs and increased stress due to constant market monitoring. Swing trading aims for larger gains by holding positions over several days or weeks, reducing trading frequency and costs but exposing traders to overnight market risks and potential larger drawdowns. Both strategies require distinct risk management approaches and suit different trader profiles based on time commitment and market volatility tolerance.

Suitability for Different Types of Traders

Scalping suits traders seeking rapid, high-frequency trades with minimal market exposure, ideal for those with quick decision-making skills and access to real-time data feeds. Swing trading fits investors preferring to hold positions for several days or weeks, leveraging technical analysis and market trends to capture larger price movements. Risk tolerance, time availability, and trading capital are key factors determining a trader's suitability for scalping or swing trading strategies.

Scalping vs Swing Trading: Which Is Right for You?

Scalping and swing trading offer distinct approaches to capitalizing on market movements, with scalping focusing on rapid, small profits from frequent trades and swing trading targeting larger gains over days or weeks by capturing market swings. Scalping requires intense focus, quick decision-making, and high liquidity assets, while swing trading demands patience, technical analysis skills, and tolerance for overnight risk. Choosing between scalping and swing trading depends on your trading style, risk tolerance, time commitment, and market knowledge to align with your financial goals.

Scalping vs Swing Trading Infographic

difterm.com

difterm.com