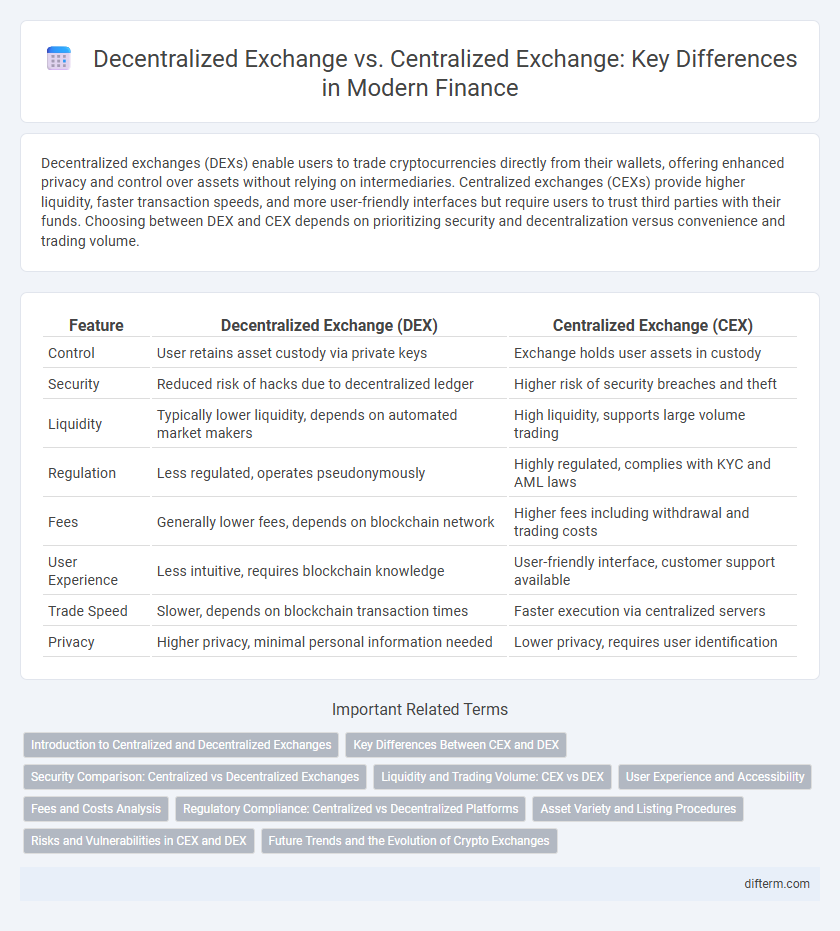

Decentralized exchanges (DEXs) enable users to trade cryptocurrencies directly from their wallets, offering enhanced privacy and control over assets without relying on intermediaries. Centralized exchanges (CEXs) provide higher liquidity, faster transaction speeds, and more user-friendly interfaces but require users to trust third parties with their funds. Choosing between DEX and CEX depends on prioritizing security and decentralization versus convenience and trading volume.

Table of Comparison

| Feature | Decentralized Exchange (DEX) | Centralized Exchange (CEX) |

|---|---|---|

| Control | User retains asset custody via private keys | Exchange holds user assets in custody |

| Security | Reduced risk of hacks due to decentralized ledger | Higher risk of security breaches and theft |

| Liquidity | Typically lower liquidity, depends on automated market makers | High liquidity, supports large volume trading |

| Regulation | Less regulated, operates pseudonymously | Highly regulated, complies with KYC and AML laws |

| Fees | Generally lower fees, depends on blockchain network | Higher fees including withdrawal and trading costs |

| User Experience | Less intuitive, requires blockchain knowledge | User-friendly interface, customer support available |

| Trade Speed | Slower, depends on blockchain transaction times | Faster execution via centralized servers |

| Privacy | Higher privacy, minimal personal information needed | Lower privacy, requires user identification |

Introduction to Centralized and Decentralized Exchanges

Centralized exchanges (CEXs) operate as intermediaries managing user funds and order books, providing high liquidity and user-friendly interfaces but requiring trust in the platform's security and compliance measures. Decentralized exchanges (DEXs) facilitate peer-to-peer trading directly on blockchain networks without intermediaries, enhancing privacy and control over assets while often facing challenges with scalability and user experience. Understanding the distinct operational frameworks and risk profiles of CEXs and DEXs is crucial for investors navigating the cryptocurrency market.

Key Differences Between CEX and DEX

Centralized Exchanges (CEX) operate as intermediaries, managing user funds and offering features like high liquidity, faster transaction speeds, and customer support, whereas Decentralized Exchanges (DEX) enable peer-to-peer trading without intermediaries, promoting enhanced security, privacy, and control over assets. CEX typically requires Know Your Customer (KYC) verification, introducing regulatory oversight, while DEX allows anonymous trading through smart contracts on blockchain networks. The key technical difference lies in custody: CEX holds users' private keys, increasing custodial risk, whereas DEX users retain control of their private keys, reducing vulnerability to hacks and centralized failures.

Security Comparison: Centralized vs Decentralized Exchanges

Centralized exchanges store user funds in custodial wallets, increasing vulnerability to hacks and regulatory risks, whereas decentralized exchanges enable users to retain control of their private keys, significantly reducing exposure to theft. Security breaches in centralized platforms often result in substantial losses due to single points of failure, while decentralized exchanges leverage blockchain technology and smart contracts to enhance transaction transparency and minimize third-party risks. Despite potential smart contract vulnerabilities on decentralized exchanges, their non-custodial nature offers stronger resistance against systemic security threats compared to centralized counterparts.

Liquidity and Trading Volume: CEX vs DEX

Centralized exchanges (CEX) generally offer higher liquidity and trading volume due to their pooled order books and large user bases, enabling faster order execution and narrower spreads. Decentralized exchanges (DEX) often face lower liquidity and trading volume because of fragmented liquidity across multiple platforms and reliance on automated market makers (AMMs), which can result in higher slippage. However, emerging solutions like liquidity aggregation on DEXs are narrowing the gap by combining liquidity pools to enhance trading efficiency and reduce price impact.

User Experience and Accessibility

Centralized exchanges offer a user-friendly interface with streamlined account verification and customer support, enhancing overall accessibility for beginners. Decentralized exchanges prioritize privacy and control, but their complex interfaces and slower transaction speeds can hinder user experience. Accessibility on decentralized platforms is improving with innovations like wallet integrations and layer-2 solutions, yet centralized exchanges maintain an advantage in ease of use and liquidity.

Fees and Costs Analysis

Decentralized exchanges (DEXs) typically charge lower fees than centralized exchanges (CEXs) due to the elimination of intermediaries, with transaction costs often limited to blockchain gas fees. Centralized exchanges impose trading fees, withdrawal fees, and sometimes deposit fees, which can accumulate significantly depending on the platform and user activity. Cost efficiency on a DEX depends heavily on network congestion and gas prices, whereas CEXs offer predictable fee structures but higher overall expenses due to operational overhead.

Regulatory Compliance: Centralized vs Decentralized Platforms

Centralized exchanges typically adhere to stringent regulatory compliance, implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to satisfy legal requirements and protect investors. Decentralized exchanges operate on blockchain technology that allows peer-to-peer trading without intermediaries, often resulting in limited regulatory oversight and jurisdictional challenges. Regulatory bodies increasingly evaluate how decentralized platforms comply with financial laws, posing potential risks and opportunities in the evolving crypto market landscape.

Asset Variety and Listing Procedures

Decentralized exchanges (DEXs) offer a broader variety of assets, including numerous tokens directly listed by users without the need for approval, enhancing accessibility and diversity. Centralized exchanges (CEXs) implement rigorous listing procedures involving thorough compliance checks and vetting processes, resulting in a more curated selection of assets with higher regulatory assurance. The trade-off between DEXs and CEXs in asset variety and listing protocols impacts liquidity, security, and user trust within the cryptocurrency market.

Risks and Vulnerabilities in CEX and DEX

Centralized exchanges (CEX) pose significant risks including hacking vulnerabilities, custodial asset control, and regulatory compliance challenges, which can lead to potential asset freezes or losses. Decentralized exchanges (DEX) mitigate custodial risks by enabling peer-to-peer trading through smart contracts but remain susceptible to smart contract bugs, front-running attacks, and lower liquidity. Security audits, user verification protocols, and liquidity pool management remain critical for minimizing vulnerabilities in both CEX and DEX platforms.

Future Trends and the Evolution of Crypto Exchanges

Decentralized exchanges (DEXs) are increasingly adopting layer 2 scaling solutions to enhance transaction speed and reduce fees, signaling a shift towards more user-friendly and efficient trading platforms. Centralized exchanges (CEXs) are integrating advanced security protocols and regulatory compliance frameworks to build trust and attract institutional investors. The future landscape of crypto exchanges will likely feature hybrid models combining CEX liquidity with DEX decentralization, driven by blockchain interoperability and the rise of decentralized finance (DeFi) applications.

Decentralized Exchange vs Centralized Exchange Infographic

difterm.com

difterm.com