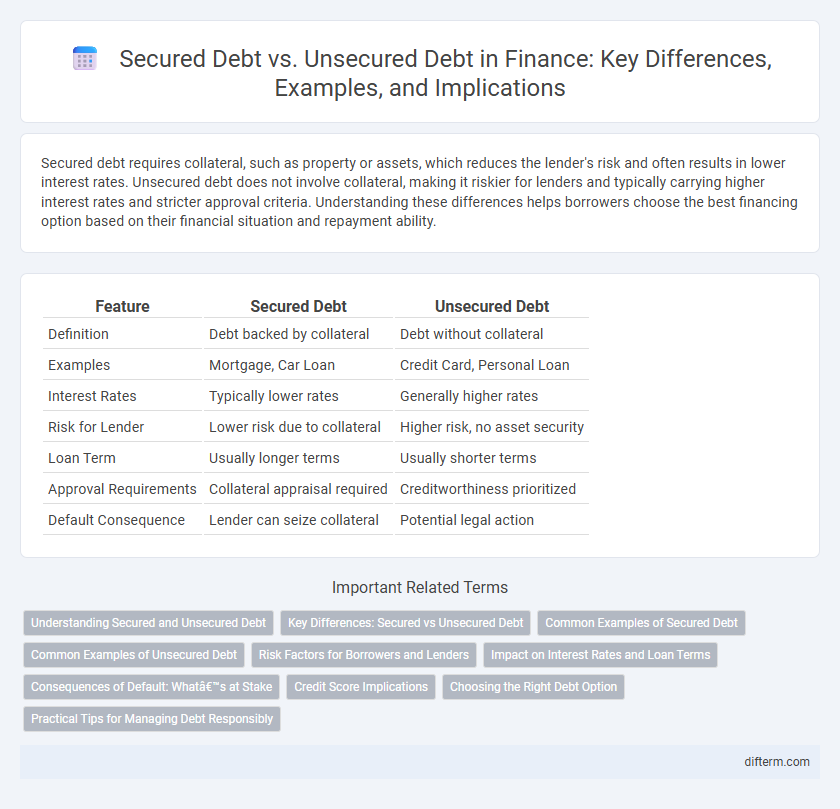

Secured debt requires collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates. Unsecured debt does not involve collateral, making it riskier for lenders and typically carrying higher interest rates and stricter approval criteria. Understanding these differences helps borrowers choose the best financing option based on their financial situation and repayment ability.

Table of Comparison

| Feature | Secured Debt | Unsecured Debt |

|---|---|---|

| Definition | Debt backed by collateral | Debt without collateral |

| Examples | Mortgage, Car Loan | Credit Card, Personal Loan |

| Interest Rates | Typically lower rates | Generally higher rates |

| Risk for Lender | Lower risk due to collateral | Higher risk, no asset security |

| Loan Term | Usually longer terms | Usually shorter terms |

| Approval Requirements | Collateral appraisal required | Creditworthiness prioritized |

| Default Consequence | Lender can seize collateral | Potential legal action |

Understanding Secured and Unsecured Debt

Secured debt involves borrowing backed by collateral, such as a mortgage or car loan, which reduces the lender's risk and often results in lower interest rates. Unsecured debt, including credit cards and personal loans, lacks collateral, leading to higher interest rates due to increased risk for the lender. Understanding the distinction between secured and unsecured debt is crucial for effective financial planning and managing credit risk.

Key Differences: Secured vs Unsecured Debt

Secured debt requires collateral, such as property or assets, which reduces lender risk and often results in lower interest rates. Unsecured debt has no collateral backing, making it riskier for lenders and leading to higher interest rates and stricter credit requirements. The key difference lies in the presence of collateral, impacting lending terms, risk exposure, and potential consequences in case of default.

Common Examples of Secured Debt

Common examples of secured debt include mortgages, auto loans, and home equity lines of credit, where the borrower offers collateral such as real estate or a vehicle to secure the loan. Secured debt typically features lower interest rates than unsecured debt because the lender has a legal claim to the collateral if the borrower defaults. This collateral reduces the lender's risk, making secured debt a preferred option for large purchases or long-term financing.

Common Examples of Unsecured Debt

Common examples of unsecured debt include credit card balances, medical bills, personal loans, and student loans, which are not backed by collateral and rely solely on the borrower's creditworthiness. Unlike secured debt such as mortgages or auto loans, unsecured debt carries higher interest rates due to increased risk for lenders. Understanding these distinctions helps borrowers manage financial obligations and assess risk effectively.

Risk Factors for Borrowers and Lenders

Secured debt carries lower risk for lenders because it is backed by collateral, reducing potential losses in default, but borrowers face the risk of asset repossession. Unsecured debt poses higher risk to lenders due to the lack of collateral, often resulting in higher interest rates to compensate for potential default. For borrowers, unsecured debt may offer more flexibility without risking specific assets but can lead to greater financial strain if repayment is challenging.

Impact on Interest Rates and Loan Terms

Secured debt typically features lower interest rates and more favorable loan terms due to the reduced risk lenders bear by having collateral as security. In contrast, unsecured debt carries higher interest rates and stricter loan conditions to compensate for the increased risk of borrower default. The presence or absence of collateral directly influences the cost of borrowing and repayment flexibility for borrowers.

Consequences of Default: What’s at Stake

Defaulting on secured debt often results in the lender seizing collateral assets like property or vehicles, leading to direct financial losses for the borrower. Unsecured debt default primarily damages credit scores, increases interest rates, and can trigger legal action or wage garnishment without asset repossession. Understanding these consequences influences borrowing decisions, risk assessment, and financial planning strategies.

Credit Score Implications

Secured debt, backed by collateral such as a home or vehicle, typically has a lower risk of default, leading to favorable credit score impacts when payments are made on time. Unsecured debt, including credit cards and personal loans, poses higher risk to lenders, so missed payments can more severely damage credit scores. Maintaining timely payments on both types strengthens credit history, but secured debt can offer more stability for credit score improvement due to its lower risk profile.

Choosing the Right Debt Option

Choosing the right debt option involves evaluating the risk tolerance and asset availability of the borrower, as secured debt is backed by collateral, which typically offers lower interest rates and higher borrowing limits. Unsecured debt lacks collateral, often resulting in higher interest rates but faster access to funds and fewer asset requirements. Comparing annual percentage rates (APRs), repayment terms, and the potential impact on credit scores is essential for making an informed financial decision.

Practical Tips for Managing Debt Responsibly

Prioritize paying off secured debt first since it is backed by collateral, reducing the risk of asset loss. Maintain a detailed budget to track expenses and allocate funds systematically towards high-interest unsecured debt to prevent accumulation. Regularly review credit reports to ensure accuracy and avoid surprises that may impact your debt management strategy.

secured debt vs unsecured debt Infographic

difterm.com

difterm.com