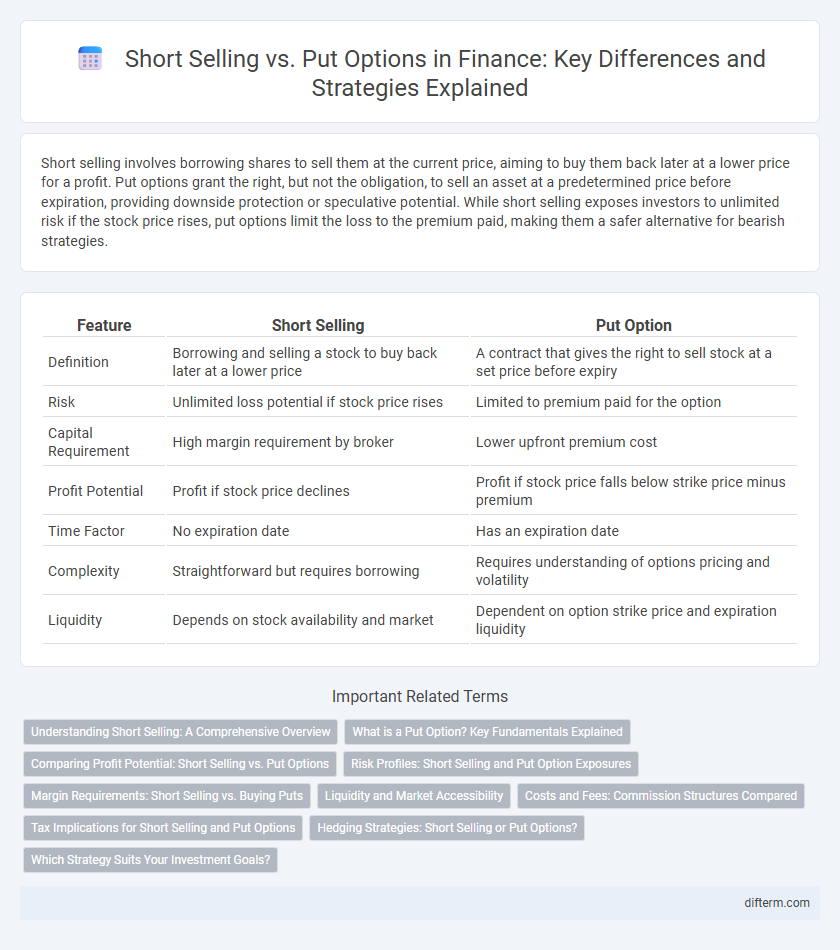

Short selling involves borrowing shares to sell them at the current price, aiming to buy them back later at a lower price for a profit. Put options grant the right, but not the obligation, to sell an asset at a predetermined price before expiration, providing downside protection or speculative potential. While short selling exposes investors to unlimited risk if the stock price rises, put options limit the loss to the premium paid, making them a safer alternative for bearish strategies.

Table of Comparison

| Feature | Short Selling | Put Option |

|---|---|---|

| Definition | Borrowing and selling a stock to buy back later at a lower price | A contract that gives the right to sell stock at a set price before expiry |

| Risk | Unlimited loss potential if stock price rises | Limited to premium paid for the option |

| Capital Requirement | High margin requirement by broker | Lower upfront premium cost |

| Profit Potential | Profit if stock price declines | Profit if stock price falls below strike price minus premium |

| Time Factor | No expiration date | Has an expiration date |

| Complexity | Straightforward but requires borrowing | Requires understanding of options pricing and volatility |

| Liquidity | Depends on stock availability and market | Dependent on option strike price and expiration liquidity |

Understanding Short Selling: A Comprehensive Overview

Short selling involves borrowing shares to sell them at the current price, aiming to buy them back later at a lower price to profit from a decline in the stock's value. This strategy carries unlimited risk since the stock price can rise indefinitely, forcing the short seller to cover at higher costs. Investors must be mindful of margin requirements and potential short squeezes when engaging in short selling.

What is a Put Option? Key Fundamentals Explained

A put option is a financial contract that gives the holder the right, but not the obligation, to sell an underlying asset at a predetermined price within a specified time frame. It serves as a tool for investors to hedge against potential declines in the asset's price or to speculate on downward market movements. Key fundamentals include the strike price, expiration date, and premium paid, which collectively define the option's value and risk profile.

Comparing Profit Potential: Short Selling vs. Put Options

Short selling offers unlimited profit potential as the stock price can theoretically drop to zero, while put options provide significant, but limited gains capped by the strike price minus the premium paid. Put options limit risk to the premium cost, unlike short selling, which carries unlimited loss exposure if the stock price rises. Investors seeking leverage and controlled risk often prefer put options, whereas those aiming for direct short-term bets on declines may choose short selling.

Risk Profiles: Short Selling and Put Option Exposures

Short selling exposes investors to unlimited risk as the stock price can rise indefinitely, resulting in potentially catastrophic losses, while put options limit risk to the premium paid, offering defined downside protection. Short sellers must maintain margin requirements and face margin calls if the stock price increases, whereas put option holders carry no margin risk and can only lose the option premium. The asymmetric risk profile of puts makes them favorable for hedging or speculative bearish positions, contrasting the high-risk, unlimited-loss potential inherent in short selling.

Margin Requirements: Short Selling vs. Buying Puts

Short selling typically demands higher margin requirements set by brokers, often requiring 150% of the shorted stock's value to cover potential losses and borrowing costs. In contrast, buying put options requires only the premium upfront, offering defined risk limited to this premium without the need for margin calls. This makes puts more accessible for risk-averse investors seeking downside protection without tying up significant capital compared to traditional short selling.

Liquidity and Market Accessibility

Short selling offers higher liquidity by allowing investors to directly borrow and sell shares on the open market, enabling immediate execution in liquid markets. Put options provide market accessibility with defined risk and lower capital requirements, making them attractive for investors with limited margin capacity. Both strategies depend on market conditions, but options markets may exhibit less liquidity compared to underlying stocks, impacting execution speed and bid-ask spreads.

Costs and Fees: Commission Structures Compared

Short selling typically involves borrowing shares and paying interest on the loan, resulting in variable costs tied to the borrow rate and potential margin requirements. Put options require paying an upfront premium, which represents the maximum loss, with no ongoing borrowing costs but possible commissions on option trades. Broker commissions for short selling often include higher fees due to borrowing complexities, while options commissions depend on contract volume and can be lower in flat-rate models.

Tax Implications for Short Selling and Put Options

Short selling triggers taxable events when shares are repurchased, with gains treated as short-term capital gains taxed at ordinary income rates, while losses can offset other gains. Put options generate taxable income when exercised or sold, typically classified as capital gains or losses depending on the holding period, often benefiting from favorable long-term capital gains tax rates if held over a year. Understanding these distinct tax implications helps investors optimize portfolio strategies by anticipating tax liabilities from short selling versus put option trading.

Hedging Strategies: Short Selling or Put Options?

Short selling and put options both serve as effective hedging strategies to protect against potential declines in asset value. Short selling involves borrowing and selling the asset to repurchase at a lower price, providing direct exposure to downward price movements but carrying unlimited risk. Put options grant the right to sell the asset at a predetermined price, limiting loss to the premium paid while offering leveraged downside protection and defined risk.

Which Strategy Suits Your Investment Goals?

Short selling involves borrowing shares to sell at the current price, aiming to buy them back later at a lower price for profit, exposing investors to unlimited downside risk. Put options grant the right to sell a stock at a predetermined price, offering limited risk to the premium paid while benefiting from downside movements. Investors seeking leveraged exposure with defined risk may favor put options, while those confident in significant declines and willing to accept higher risk might opt for short selling.

Short selling vs put option Infographic

difterm.com

difterm.com