Investment grade bonds have higher credit ratings, indicating lower default risk and offering more stable returns for conservative investors. Junk bonds carry lower credit ratings and higher yield potential, reflecting increased risk and volatility. Understanding the risk-reward balance between investment grade and junk bonds is crucial for building a diversified bond portfolio.

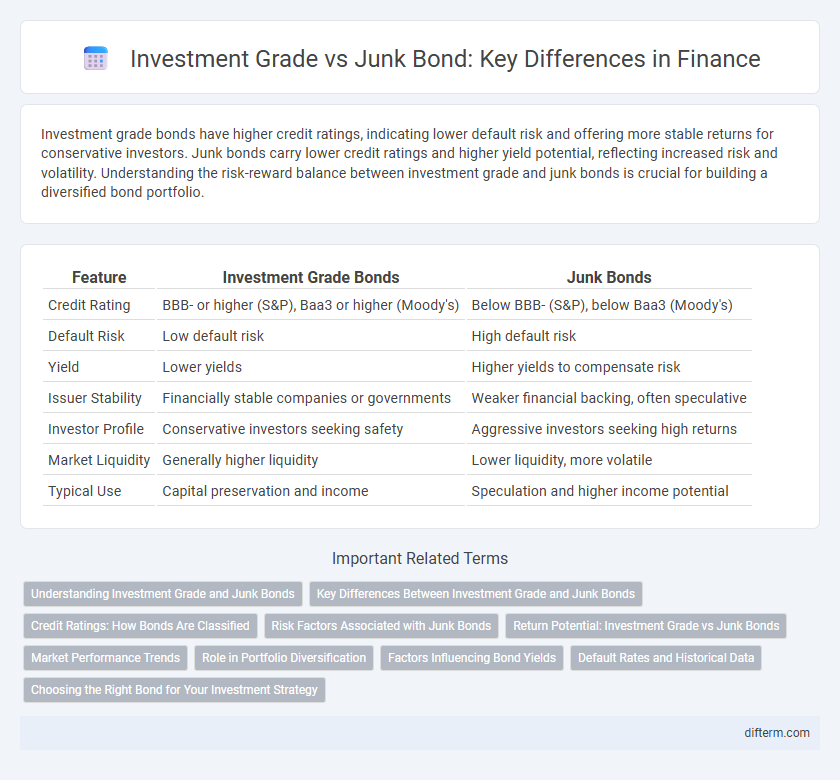

Table of Comparison

| Feature | Investment Grade Bonds | Junk Bonds |

|---|---|---|

| Credit Rating | BBB- or higher (S&P), Baa3 or higher (Moody's) | Below BBB- (S&P), below Baa3 (Moody's) |

| Default Risk | Low default risk | High default risk |

| Yield | Lower yields | Higher yields to compensate risk |

| Issuer Stability | Financially stable companies or governments | Weaker financial backing, often speculative |

| Investor Profile | Conservative investors seeking safety | Aggressive investors seeking high returns |

| Market Liquidity | Generally higher liquidity | Lower liquidity, more volatile |

| Typical Use | Capital preservation and income | Speculation and higher income potential |

Understanding Investment Grade and Junk Bonds

Investment grade bonds are debt securities rated BBB- or higher by credit rating agencies such as S&P, Moody's, and Fitch, indicating low default risk and high credit quality. Junk bonds, also known as high-yield bonds, have ratings below BBB- and offer higher yields to compensate for increased default risk and credit uncertainty. Investors evaluate the trade-off between safety and return by analyzing credit ratings, yield spreads, and issuer financial health to determine suitability within fixed income portfolios.

Key Differences Between Investment Grade and Junk Bonds

Investment grade bonds have higher credit ratings, typically BBB- or above from rating agencies like S&P or Moody's, indicating lower default risk and more stable returns. Junk bonds, rated below BBB-, carry significantly higher risk due to weaker financial health of issuers but offer higher yields as compensation. The liquidity, risk profile, and investor base also differ, with investment grade bonds attracting conservative investors and junk bonds appealing to those seeking higher income despite potential credit losses.

Credit Ratings: How Bonds Are Classified

Investment grade bonds are rated BBB- or higher by Standard & Poor's and Baa3 or higher by Moody's, reflecting lower default risk and higher credit quality. Junk bonds, also known as high-yield bonds, carry ratings below BBB- or Baa3, indicating higher risk and the potential for higher returns. Credit rating agencies evaluate issuer financial strength, debt levels, and economic conditions to classify bonds, guiding investors on risk exposure and investment strategies.

Risk Factors Associated with Junk Bonds

Junk bonds, also known as high-yield bonds, carry a significantly higher risk of default compared to investment-grade bonds due to the issuers' weaker credit ratings. These bonds often face greater volatility in interest rates and economic downturns, increasing the likelihood of delayed or missed interest payments. Investors in junk bonds must carefully assess credit risk, liquidity risk, and market sentiment, as these factors can lead to substantial fluctuations in bond prices and potential losses.

Return Potential: Investment Grade vs Junk Bonds

Investment grade bonds typically offer lower return potential due to their higher credit quality and lower default risk. Junk bonds, classified as below investment grade, provide higher yield opportunities to compensate for increased default risk and volatility. Investors seeking greater income often weigh the trade-off between the higher returns of junk bonds and the relative safety of investment grade bonds.

Market Performance Trends

Investment grade bonds typically demonstrate lower yields and reduced default risk, attracting conservative investors seeking stable returns, while junk bonds offer higher yields but with increased volatility and credit risk. Market performance trends reveal investment grade bonds outperform during economic downturns due to their safety, whereas junk bonds tend to surge in strong economic cycles driven by higher risk appetite. Credit rating agencies such as Moody's and S&P highlight these distinctions, with investment grade bonds rated BBB- or higher and junk bonds rated below this threshold, directly impacting market demand and price stability.

Role in Portfolio Diversification

Investment grade bonds, rated BBB- or higher by agencies like S&P, offer stability and lower default risk, serving as a core component for risk-averse portfolio diversification. Junk bonds, rated below BBB-, provide higher yields that can enhance returns and increase income diversification but come with elevated credit risk and volatility. Combining both bond types enables investors to balance risk and reward, optimizing overall portfolio performance and reducing correlation with equities.

Factors Influencing Bond Yields

Investment grade bonds typically offer lower yields due to their higher credit ratings and lower default risk, attracting conservative investors seeking capital preservation. Junk bonds, rated below investment grade, carry higher yields to compensate for increased credit risk and potential default, appealing to risk-tolerant investors aiming for higher returns. Market interest rates, issuer creditworthiness, inflation expectations, and economic conditions significantly influence both investment grade and junk bond yields.

Default Rates and Historical Data

Investment grade bonds typically exhibit lower default rates, averaging around 0.1% annually based on Moody's historical data, reflecting their higher credit quality and lower risk profile. Junk bonds, classified as below BBB- by S&P, have historically shown average default rates near 4-5%, indicating greater credit risk and potential for loss of principal. Historical trends reveal that during economic downturns, junk bond default rates spike notably, while investment grade bond defaults remain comparatively stable.

Choosing the Right Bond for Your Investment Strategy

Investment grade bonds offer lower risk and stable returns, making them suitable for conservative portfolios seeking capital preservation and steady income. Junk bonds provide higher yields but carry increased default risk, appealing to investors with a higher risk tolerance aiming for greater returns. Assessing credit ratings, interest rate environment, and portfolio goals is essential in choosing between investment grade and junk bonds to align with your investment strategy.

Investment Grade vs Junk Bond Infographic

difterm.com

difterm.com