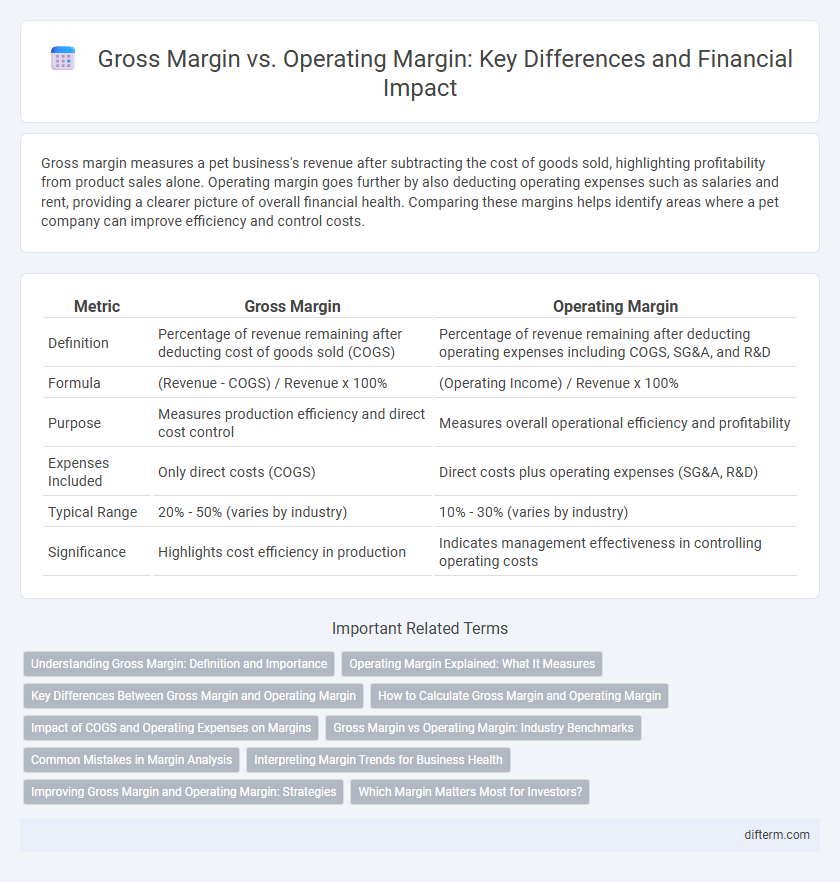

Gross margin measures a pet business's revenue after subtracting the cost of goods sold, highlighting profitability from product sales alone. Operating margin goes further by also deducting operating expenses such as salaries and rent, providing a clearer picture of overall financial health. Comparing these margins helps identify areas where a pet company can improve efficiency and control costs.

Table of Comparison

| Metric | Gross Margin | Operating Margin |

|---|---|---|

| Definition | Percentage of revenue remaining after deducting cost of goods sold (COGS) | Percentage of revenue remaining after deducting operating expenses including COGS, SG&A, and R&D |

| Formula | (Revenue - COGS) / Revenue x 100% | (Operating Income) / Revenue x 100% |

| Purpose | Measures production efficiency and direct cost control | Measures overall operational efficiency and profitability |

| Expenses Included | Only direct costs (COGS) | Direct costs plus operating expenses (SG&A, R&D) |

| Typical Range | 20% - 50% (varies by industry) | 10% - 30% (varies by industry) |

| Significance | Highlights cost efficiency in production | Indicates management effectiveness in controlling operating costs |

Understanding Gross Margin: Definition and Importance

Gross margin represents the percentage of revenue that exceeds the cost of goods sold (COGS), highlighting how efficiently a company produces its products or services. It serves as a crucial indicator of a business's core profitability before accounting for operating expenses such as marketing, salaries, and rent. Understanding gross margin helps investors and managers assess pricing strategies, production costs, and overall financial health.

Operating Margin Explained: What It Measures

Operating margin measures a company's profitability by calculating the percentage of revenue remaining after covering operating expenses, reflecting the efficiency of core business operations. It excludes non-operating income, interest, and taxes, providing a clear view of operational performance. Investors and analysts use operating margin to assess management effectiveness in controlling costs and generating profit from sales.

Key Differences Between Gross Margin and Operating Margin

Gross Margin reflects the percentage of revenue remaining after deducting the cost of goods sold (COGS), highlighting production efficiency and direct costs management. Operating Margin accounts for both COGS and operating expenses such as selling, general, and administrative costs (SG&A), revealing overall operational profitability. The key difference lies in Operating Margin providing a more comprehensive insight into business performance by including overhead and operational expenses beyond just production costs.

How to Calculate Gross Margin and Operating Margin

Gross Margin is calculated by subtracting Cost of Goods Sold (COGS) from Total Revenue, then dividing by Total Revenue, expressed as a percentage. Operating Margin is determined by subtracting Operating Expenses from Gross Profit and dividing the result by Total Revenue, also shown as a percentage. Both metrics are critical for evaluating a company's profitability and operational efficiency in financial analysis.

Impact of COGS and Operating Expenses on Margins

Gross Margin reflects the profitability after deducting Cost of Goods Sold (COGS), highlighting the direct production efficiency and pricing strategy of a business. Operating Margin further accounts for Operating Expenses such as marketing, administration, and research, providing a comprehensive view of operational efficiency. An increase in COGS directly reduces Gross Margin, while higher operating expenses primarily diminish Operating Margin, affecting overall profitability and financial health.

Gross Margin vs Operating Margin: Industry Benchmarks

Gross margin typically ranges from 30% to 60% across industries, reflecting core production efficiency and direct cost control, while operating margin benchmarks vary more widely from 10% to 30%, indicating overall operational profitability including overhead expenses. For sectors like technology and pharmaceuticals, gross margins often exceed 60%, with operating margins above 20% due to high-value products and scalable operations. In contrast, retail and manufacturing industries exhibit lower gross margins around 20% to 40%, with operating margins frequently under 15%, driven by competitive pricing and higher operating costs.

Common Mistakes in Margin Analysis

Confusing gross margin with operating margin often leads to flawed financial analysis, as gross margin measures revenue minus cost of goods sold, while operating margin accounts for all operating expenses. Overlooking non-operating costs like interest and taxes when interpreting margins can distort profitability insights. Analysts frequently err by ignoring margin trends over time, which obscures true operational efficiency and cost management effectiveness.

Interpreting Margin Trends for Business Health

Gross margin measures a company's efficiency in producing goods, reflecting the difference between sales revenue and cost of goods sold, while operating margin accounts for all operating expenses, offering insight into overall operational efficiency. An increasing gross margin paired with a stable or improving operating margin suggests enhanced cost control and profitability, indicating strong business health. Conversely, declining margins may signal rising production costs or inefficient operations, prompting a deeper analysis of expense management and pricing strategies.

Improving Gross Margin and Operating Margin: Strategies

Improving gross margin involves reducing the cost of goods sold through negotiating better supplier contracts, optimizing production processes, and enhancing product quality to justify premium pricing. Strategies to boost operating margin focus on controlling operating expenses by streamlining administrative costs, investing in technology for automation, and implementing efficient workforce management. Companies that simultaneously enhance gross and operating margins achieve stronger profitability and sustainable competitive advantage in the financial markets.

Which Margin Matters Most for Investors?

Gross margin, reflecting the core profitability from sales after direct costs, highlights a company's efficiency in production and pricing strategy. Operating margin, incorporating operating expenses alongside gross profit, provides a clearer view of overall operational efficiency and cost management. Investors prioritize operating margin as it offers a comprehensive measure of profitability and sustainable earnings potential beyond mere production costs.

Gross Margin vs Operating Margin Infographic

difterm.com

difterm.com