Fixed income investments provide regular interest payments and prioritize capital preservation, making them suitable for risk-averse investors seeking steady income. Equity investments offer ownership in companies, with potential for higher returns through dividends and capital appreciation, but entail greater market volatility. Balancing fixed income and equity in a portfolio helps optimize risk and return based on individual financial goals.

Table of Comparison

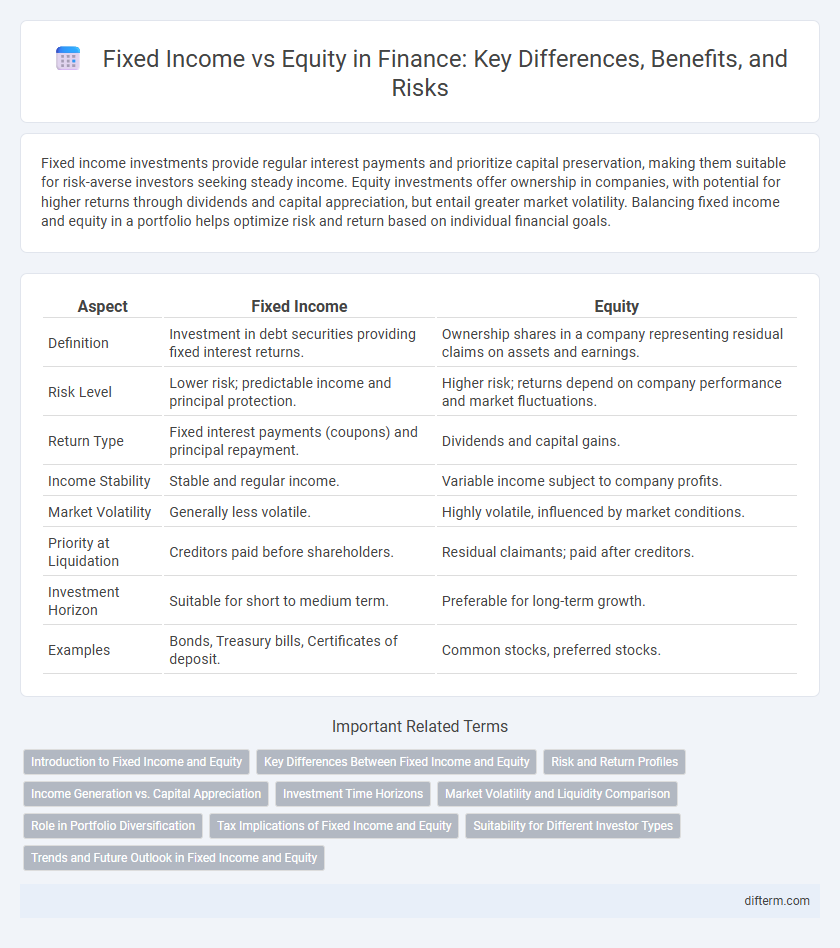

| Aspect | Fixed Income | Equity |

|---|---|---|

| Definition | Investment in debt securities providing fixed interest returns. | Ownership shares in a company representing residual claims on assets and earnings. |

| Risk Level | Lower risk; predictable income and principal protection. | Higher risk; returns depend on company performance and market fluctuations. |

| Return Type | Fixed interest payments (coupons) and principal repayment. | Dividends and capital gains. |

| Income Stability | Stable and regular income. | Variable income subject to company profits. |

| Market Volatility | Generally less volatile. | Highly volatile, influenced by market conditions. |

| Priority at Liquidation | Creditors paid before shareholders. | Residual claimants; paid after creditors. |

| Investment Horizon | Suitable for short to medium term. | Preferable for long-term growth. |

| Examples | Bonds, Treasury bills, Certificates of deposit. | Common stocks, preferred stocks. |

Introduction to Fixed Income and Equity

Fixed income investments, such as bonds and treasury bills, provide predictable cash flows and lower risk compared to equities, which represent ownership in a company with variable returns. While fixed income prioritizes capital preservation and steady income, equities offer higher growth potential through dividends and capital gains but come with increased volatility. Understanding the risk-return profile and income stability of fixed income versus the growth opportunities in equity is essential for balanced portfolio construction.

Key Differences Between Fixed Income and Equity

Fixed income investments provide regular interest payments and principal repayment at maturity, offering lower risk and predictable cash flow, whereas equity investments represent ownership in a company with potential for capital appreciation and dividends but involve higher volatility. Fixed income assets, such as bonds and treasury securities, prioritize capital preservation and income stability, while equities, including common and preferred stocks, focus on growth through market value increases. Key differences include risk level, income consistency, and claim priority during company liquidation, with fixed income holders having higher priority than equity shareholders.

Risk and Return Profiles

Fixed income investments typically offer lower risk and more predictable returns compared to equities, making them suitable for conservative investors seeking steady income through interest payments. Equities generally provide higher potential returns but come with increased volatility and risk due to market fluctuations and company performance variability. Understanding the risk-return tradeoff is crucial for portfolio diversification and aligning investment strategies with financial goals.

Income Generation vs. Capital Appreciation

Fixed income investments primarily provide consistent income generation through regular interest payments, making them ideal for risk-averse investors seeking stability. Equity investments focus on capital appreciation, offering potential for higher long-term growth as company values increase. Balancing fixed income and equity allocations can optimize portfolio returns while managing risk tolerance.

Investment Time Horizons

Fixed income investments typically suit shorter to medium investment time horizons due to their predictable interest payments and lower volatility, providing steady income and capital preservation. Equity investments align better with longer time horizons, benefiting from potential capital appreciation and dividend growth despite higher short-term market fluctuations. Understanding time horizon is crucial for balancing risk tolerance and return objectives in portfolio construction.

Market Volatility and Liquidity Comparison

Fixed income securities typically exhibit lower market volatility compared to equities, making them more stable during economic downturns. Liquidity in bond markets varies widely, with government bonds offering high liquidity while corporate bonds may have limited trading volumes, contrasting with the generally higher liquidity and price fluctuations observed in equity markets. Investors prioritize fixed income assets for steady cash flow and risk mitigation, whereas equities appeal for growth potential despite their susceptibility to market swings.

Role in Portfolio Diversification

Fixed income securities, such as bonds, offer stable and predictable cash flows that reduce overall portfolio volatility and provide a counterbalance to the higher risk and potential returns of equities. Equities contribute growth potential through capital appreciation and dividends, enhancing long-term portfolio value but introduce greater sensitivity to market fluctuations. Combining fixed income and equity investments diversifies risk exposure, improving risk-adjusted returns and stabilizing income streams in various economic environments.

Tax Implications of Fixed Income and Equity

Fixed income investments, such as bonds, often generate interest income that is typically taxed at ordinary income tax rates, which can be higher than the capital gains tax rates applied to equity investments. Equity investments usually result in dividends and capital gains, where qualified dividends and long-term capital gains benefit from preferential tax rates, potentially reducing overall tax liability. Understanding these tax implications is crucial for investors aiming to optimize their after-tax returns in different market conditions.

Suitability for Different Investor Types

Fixed income investments suit conservative investors seeking stable returns and lower risk, providing consistent interest payments and capital preservation. Equity investments attract growth-oriented investors willing to accept higher volatility for potential capital appreciation and dividend income. Portfolio diversification often involves balancing fixed income and equity based on individual risk tolerance, investment horizon, and financial goals.

Trends and Future Outlook in Fixed Income and Equity

Fixed income markets are experiencing rising demand driven by increased interest rate volatility and investor preference for stable cash flows, with government and corporate bonds gaining traction. Equity markets, fueled by technological innovation and economic recovery, show robust growth potential but face valuation pressures amid inflation concerns and geopolitical risks. Future outlook indicates fixed income will play a crucial role in diversified portfolios, balancing equity market uncertainties through steady income generation and risk mitigation strategies.

fixed income vs equity Infographic

difterm.com

difterm.com