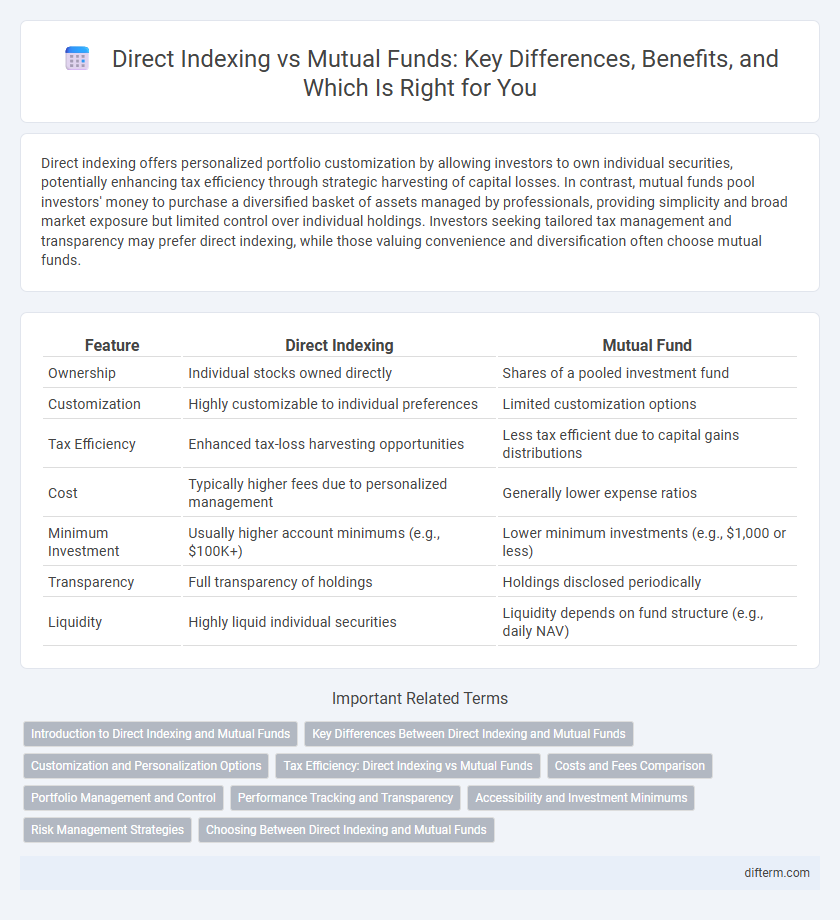

Direct indexing offers personalized portfolio customization by allowing investors to own individual securities, potentially enhancing tax efficiency through strategic harvesting of capital losses. In contrast, mutual funds pool investors' money to purchase a diversified basket of assets managed by professionals, providing simplicity and broad market exposure but limited control over individual holdings. Investors seeking tailored tax management and transparency may prefer direct indexing, while those valuing convenience and diversification often choose mutual funds.

Table of Comparison

| Feature | Direct Indexing | Mutual Fund |

|---|---|---|

| Ownership | Individual stocks owned directly | Shares of a pooled investment fund |

| Customization | Highly customizable to individual preferences | Limited customization options |

| Tax Efficiency | Enhanced tax-loss harvesting opportunities | Less tax efficient due to capital gains distributions |

| Cost | Typically higher fees due to personalized management | Generally lower expense ratios |

| Minimum Investment | Usually higher account minimums (e.g., $100K+) | Lower minimum investments (e.g., $1,000 or less) |

| Transparency | Full transparency of holdings | Holdings disclosed periodically |

| Liquidity | Highly liquid individual securities | Liquidity depends on fund structure (e.g., daily NAV) |

Introduction to Direct Indexing and Mutual Funds

Direct indexing allows investors to buy the underlying individual securities of an index, providing greater customization and tax-loss harvesting opportunities compared to traditional mutual funds. Mutual funds pool money from many investors to purchase a diversified portfolio managed by professionals, offering simplicity and diversification without direct control over individual holdings. Direct indexing often appeals to investors seeking personalized portfolios and tax efficiency, while mutual funds suit those preferring hands-off investing and broad market exposure.

Key Differences Between Direct Indexing and Mutual Funds

Direct indexing offers investors personalized portfolios by purchasing individual securities that mirror an index, enabling tax-loss harvesting and customization based on specific preferences. Mutual funds pool investor money to buy a diversified portfolio managed by professionals, providing simplicity and liquidity but less control over individual holdings. Key differences include ownership transparency, tax efficiency, management style, and fee structures, with direct indexing often resulting in lower taxes and greater customization compared to mutual funds.

Customization and Personalization Options

Direct indexing offers extensive customization by allowing investors to select individual securities based on personal values, tax preferences, or investment goals, unlike mutual funds that provide a fixed portfolio managed by professionals. Investors can exclude specific stocks or sectors, enhancing personalization and aligning the portfolio with ethical considerations or risk tolerance. Mutual funds lack this granular control, making direct indexing a more flexible solution for tailored investment strategies.

Tax Efficiency: Direct Indexing vs Mutual Funds

Direct indexing offers superior tax efficiency compared to mutual funds by allowing investors to harvest tax losses at the individual stock level, reducing overall capital gains taxes. Mutual funds often generate capital gains distributions that investors cannot control, leading to unexpected tax liabilities. This granular control in direct indexing enables more precise tax-loss harvesting strategies, optimizing after-tax returns.

Costs and Fees Comparison

Direct indexing typically offers lower ongoing management fees compared to mutual funds, as investors avoid the average 0.5% to 1.5% annual expense ratios charged by funds. While direct indexing may involve upfront costs such as trading commissions and platform fees, these expenses often decrease with scale and result in better tax efficiency. Mutual funds incur higher administrative and operational costs, which can reduce net returns over time relative to the more cost-effective, customizable approach of direct indexing.

Portfolio Management and Control

Direct indexing allows investors to customize their portfolios by directly owning individual securities, providing enhanced control over tax management and stock selection. Mutual funds offer professional portfolio management but limit investors' ability to tailor holdings or implement personalized tax strategies. This increased control in direct indexing can lead to improved tax efficiency and alignment with specific investment goals.

Performance Tracking and Transparency

Direct indexing offers precise performance tracking by allowing investors to monitor each individual stock within the portfolio, enhancing transparency compared to mutual funds that report aggregated results. Mutual funds consolidate numerous assets, making it challenging for investors to gain detailed insights into underlying holdings and real-time performance. Enhanced transparency in direct indexing supports more informed investment decisions and individualized tax management strategies.

Accessibility and Investment Minimums

Direct indexing offers greater accessibility by enabling investors to customize portfolios with lower minimum investments compared to mutual funds, which often require higher entry thresholds. Many mutual funds demand minimum investments ranging from $1,000 to $3,000, whereas direct indexing platforms can start with amounts as low as $5,000 or even less through fractional shares. This accessibility allows investors to tailor tax strategies and diversification more effectively while managing initial capital outlay.

Risk Management Strategies

Direct indexing enhances risk management by allowing investors to customize portfolios and exclude specific securities, thereby reducing exposure to unwanted risks such as sector or company-specific volatility. Mutual funds offer professional risk diversification through pooled investments but lack the personalized control to tailor risk parameters to individual preferences or tax situations. Employing direct indexing enables more precise risk monitoring and tax-loss harvesting opportunities, directly impacting overall portfolio volatility and downside protection.

Choosing Between Direct Indexing and Mutual Funds

Direct indexing offers personalized portfolio customization and potential tax advantages by allowing investors to select individual securities, whereas mutual funds provide professional management and diversification with lower minimum investments. Investors prioritizing control and tax efficiency may prefer direct indexing, while those seeking simplicity and lower fees might lean toward mutual funds. Assessing investment goals, risk tolerance, and cost considerations is crucial when choosing between direct indexing and mutual funds.

Direct indexing vs mutual fund Infographic

difterm.com

difterm.com