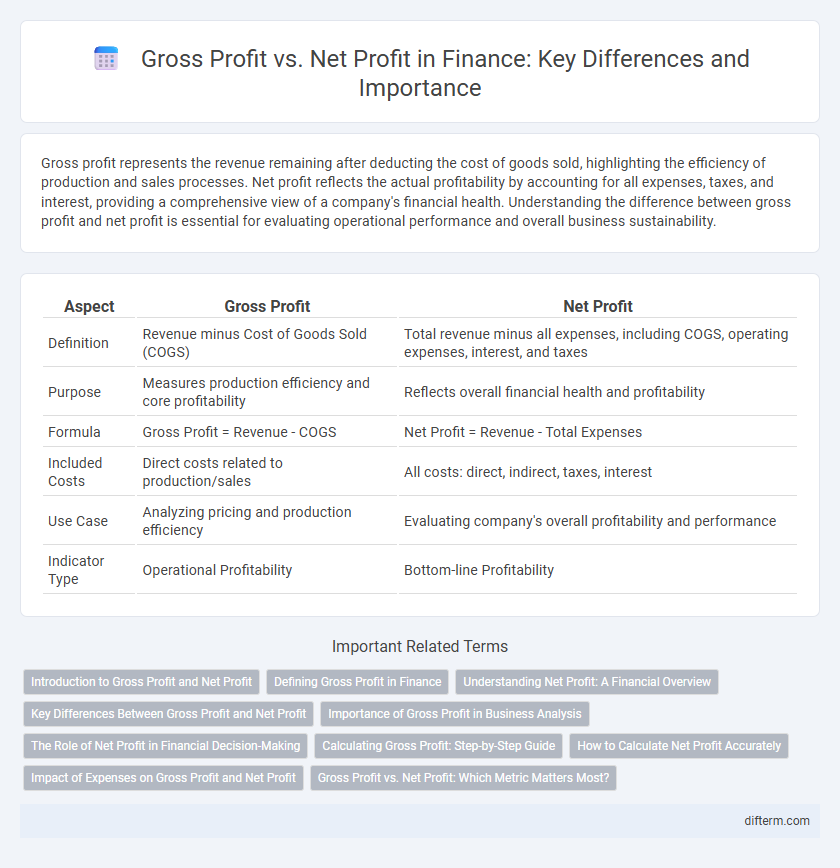

Gross profit represents the revenue remaining after deducting the cost of goods sold, highlighting the efficiency of production and sales processes. Net profit reflects the actual profitability by accounting for all expenses, taxes, and interest, providing a comprehensive view of a company's financial health. Understanding the difference between gross profit and net profit is essential for evaluating operational performance and overall business sustainability.

Table of Comparison

| Aspect | Gross Profit | Net Profit |

|---|---|---|

| Definition | Revenue minus Cost of Goods Sold (COGS) | Total revenue minus all expenses, including COGS, operating expenses, interest, and taxes |

| Purpose | Measures production efficiency and core profitability | Reflects overall financial health and profitability |

| Formula | Gross Profit = Revenue - COGS | Net Profit = Revenue - Total Expenses |

| Included Costs | Direct costs related to production/sales | All costs: direct, indirect, taxes, interest |

| Use Case | Analyzing pricing and production efficiency | Evaluating company's overall profitability and performance |

| Indicator Type | Operational Profitability | Bottom-line Profitability |

Introduction to Gross Profit and Net Profit

Gross profit represents the revenue remaining after deducting the cost of goods sold (COGS), highlighting the efficiency of production and sales processes. Net profit, also known as the bottom line, is the amount left after all operating expenses, interest, taxes, and other costs are subtracted from total revenue, reflecting the overall profitability of a business. Understanding the distinction between gross profit and net profit is crucial for accurate financial analysis and decision-making in finance.

Defining Gross Profit in Finance

Gross profit in finance refers to the amount remaining after deducting the cost of goods sold (COGS) from total revenue, serving as a key indicator of a company's production efficiency. It excludes operating expenses, taxes, and interest, providing a clear view of profitability from core business activities. Understanding gross profit is essential for analyzing pricing strategies, cost management, and overall business viability before accounting for additional financial obligations.

Understanding Net Profit: A Financial Overview

Net profit represents the actual earnings of a business after deducting all expenses, including operating costs, taxes, and interest, from total revenue. Unlike gross profit, which only subtracts the cost of goods sold, net profit reflects the company's overall financial health and efficiency. Investors and analysts closely monitor net profit to assess profitability, operational performance, and a company's ability to generate sustainable returns.

Key Differences Between Gross Profit and Net Profit

Gross profit measures a company's revenue minus the cost of goods sold (COGS), highlighting the efficiency of production and core business operations. Net profit accounts for all expenses, including operating costs, taxes, interest, and other non-operational costs, offering a comprehensive view of overall profitability. Understanding the distinction between gross profit and net profit is crucial for assessing financial health, operational performance, and effective cost management.

Importance of Gross Profit in Business Analysis

Gross profit serves as a fundamental metric in business analysis, reflecting the core profitability of a company by subtracting the cost of goods sold from total revenue. It provides crucial insights into operational efficiency and pricing strategies, enabling stakeholders to evaluate how effectively a business manages its production costs. Understanding gross profit is essential for identifying profit margins and making informed decisions that drive sustainable financial performance.

The Role of Net Profit in Financial Decision-Making

Net profit represents the actual profitability of a business after all expenses, taxes, and costs have been deducted from gross profit, providing a clear picture of financial health. It plays a crucial role in financial decision-making by indicating the company's efficiency in managing operational costs and its ability to generate sustainable earnings. Investors and management rely on net profit to assess profitability trends, guide budgeting, and make informed strategic decisions such as reinvestment, cost-cutting, or dividend distribution.

Calculating Gross Profit: Step-by-Step Guide

Calculating gross profit involves subtracting the cost of goods sold (COGS) from total revenue to determine the core profitability of a company's production or sales activities. Accurately identifying all direct costs such as raw materials, labor, and manufacturing expenses ensures a precise gross profit figure. This calculation is essential for assessing operational efficiency before accounting for operating expenses and taxes that affect net profit.

How to Calculate Net Profit Accurately

Net profit is calculated by subtracting total expenses, including operating costs, interest, taxes, and depreciation, from gross profit. Accurate net profit calculation requires meticulous recording of all financial transactions and ensuring all indirect costs are factored in. Leveraging accounting software and regularly reconciling accounts enhances precision in determining the true net profit figure.

Impact of Expenses on Gross Profit and Net Profit

Gross profit highlights revenues remaining after deducting the cost of goods sold (COGS), directly reflecting production efficiency and pricing strategy. Net profit incorporates all operating expenses, interest, taxes, and non-operating costs, showcasing true profitability and financial health. Significant operating expenses reduce net profit while leaving gross profit unchanged, emphasizing the need for cost control beyond COGS to enhance overall profitability.

Gross Profit vs. Net Profit: Which Metric Matters Most?

Gross profit represents the revenue remaining after deducting the cost of goods sold, highlighting a company's core production efficiency. Net profit accounts for all expenses, including operating costs, taxes, and interest, providing a comprehensive view of a company's overall profitability. Investors often prioritize net profit for assessing financial health, while gross profit is crucial for evaluating pricing strategies and cost control.

Gross profit vs net profit Infographic

difterm.com

difterm.com