A wash sale occurs when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days, disallowing the loss for tax deduction purposes. A short sale involves borrowing shares to sell them with the intention of buying them back at a lower price to profit from a decline in the security's price. Understanding the differences between wash sales and short sales is crucial for effective tax planning and risk management in trading strategies.

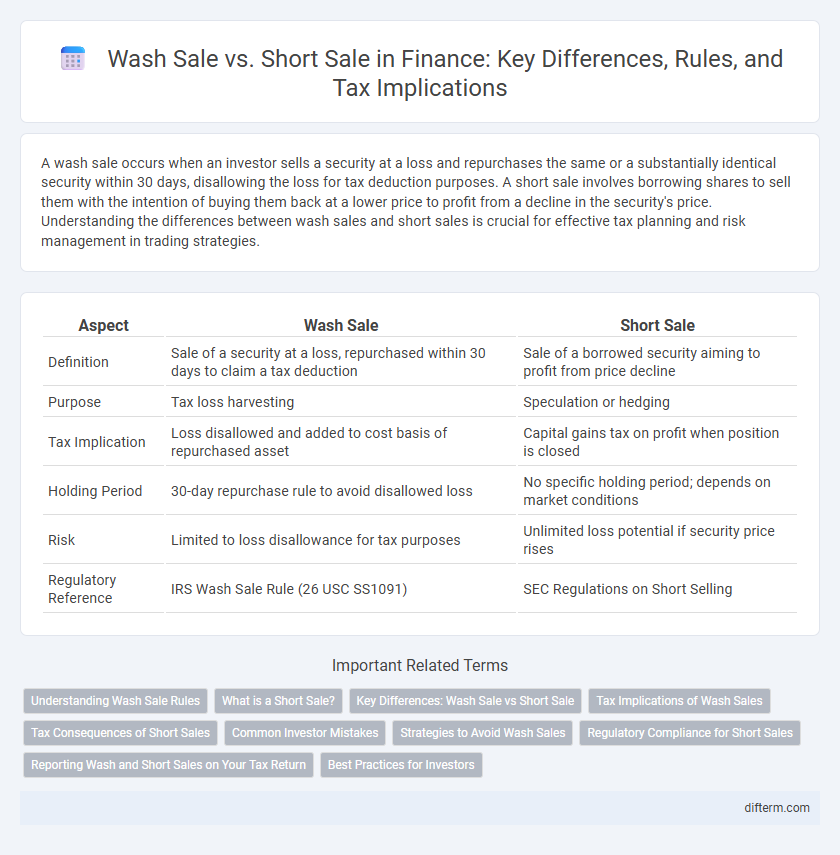

Table of Comparison

| Aspect | Wash Sale | Short Sale |

|---|---|---|

| Definition | Sale of a security at a loss, repurchased within 30 days to claim a tax deduction | Sale of a borrowed security aiming to profit from price decline |

| Purpose | Tax loss harvesting | Speculation or hedging |

| Tax Implication | Loss disallowed and added to cost basis of repurchased asset | Capital gains tax on profit when position is closed |

| Holding Period | 30-day repurchase rule to avoid disallowed loss | No specific holding period; depends on market conditions |

| Risk | Limited to loss disallowance for tax purposes | Unlimited loss potential if security price rises |

| Regulatory Reference | IRS Wash Sale Rule (26 USC SS1091) | SEC Regulations on Short Selling |

Understanding Wash Sale Rules

Wash sale rules prevent investors from claiming a tax loss on a sale of a security if a substantially identical security is purchased within 30 days before or after the sale, ensuring the loss is disallowed for immediate tax benefits. This regulation applies to stocks, options, and mutual funds, impacting tax planning and investment strategies by deferring loss recognition. Short sales, involving the sale of borrowed securities expecting a price decline, are not governed by wash sale rules but have distinct IRS reporting and margin requirements.

What is a Short Sale?

A short sale in finance occurs when an investor borrows shares and sells them on the open market, aiming to repurchase them later at a lower price to profit from the decline. This strategy involves significant risk, as losses can be unlimited if the stock price rises instead of falling. Short sales are regulated to prevent market manipulation and require maintaining margin accounts with brokerage firms.

Key Differences: Wash Sale vs Short Sale

Wash sales occur when a security is sold at a loss and repurchased within 30 days, triggering IRS rules that disallow the loss for tax deduction purposes. Short sales involve borrowing shares to sell at the current price, aiming to repurchase them later at a lower price to profit from declining market value. The primary difference lies in wash sales being a tax-related transaction limitation, while short sales are a speculative trading strategy involving borrowed securities.

Tax Implications of Wash Sales

Wash sales occur when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days, disallowing the loss deduction for tax purposes. The disallowed loss is added to the cost basis of the repurchased security, deferring the tax benefit until the security is eventually sold. In contrast, short sales involve selling borrowed securities with the obligation to repurchase later, and the tax treatment differs as gains or losses are recognized only upon closing the short position.

Tax Consequences of Short Sales

Short sales, involving borrowing and selling a security not currently owned, can result in complex tax consequences, as the IRS treats the proceeds as a loan until the position is closed. When the short position is closed, gains or losses are recognized based on the difference between the sale price and the repurchase price, impacting taxable income. Unlike wash sales, short sales do not trigger the wash sale rule, but taxpayers must track holding periods for accurate capital gains reporting and possible tax deferral strategies.

Common Investor Mistakes

Confusing wash sales with short sales is a common investor mistake that can lead to unexpected tax consequences and compliance issues. Wash sales occur when an investor sells a security at a loss and repurchases it within 30 days, disallowing the loss deduction, whereas short sales involve selling borrowed securities with the intention of buying them back later at a lower price. Failing to understand the distinct tax treatment and timing rules of wash sales versus short sales often results in inaccurate reporting and missed opportunities for tax optimization.

Strategies to Avoid Wash Sales

To avoid wash sales, investors should wait at least 31 days before repurchasing the same or substantially identical securities after a sale at a loss. Utilizing tax-loss harvesting calendars and tracking transaction dates with financial software can also minimize the risk of triggering wash sale rules. Employing short sales as a hedging strategy requires careful timing and portfolio adjustments to prevent overlapping positions that may complicate tax implications.

Regulatory Compliance for Short Sales

Short sales require strict adherence to SEC regulations, including Regulation SHO, which mandates locating and borrowing shares before executing the sale to prevent naked short selling. Brokers must ensure compliance through timely reporting and fail-to-deliver monitoring to avoid penalties and market manipulation allegations. Regulatory oversight aims to maintain market integrity and transparency, distinguishing short sales from wash sales where ownership remains unchanged.

Reporting Wash and Short Sales on Your Tax Return

Reporting wash sales requires identifying transactions where a security is sold at a loss and repurchased within 30 days to adjust the cost basis and defer the loss deduction on your tax return. Short sales involve borrowing securities to sell them with the obligation to repurchase later, and gains or losses must be reported when the short position is closed. Proper tracking of wash and short sales ensures accurate capital gains and losses reporting, preventing misstatements and potential IRS penalties.

Best Practices for Investors

Investors should carefully distinguish between wash sales and short sales to avoid unintended tax consequences and comply with regulatory requirements. Maintaining detailed records of transaction dates and securities involved helps in accurately reporting wash sales, which disallow losses on repurchased securities within 30 days. Employing strategic timing and leveraging brokerage tools can optimize short sale execution while mitigating risks related to margin calls and borrowing costs.

Wash Sale vs Short Sale Infographic

difterm.com

difterm.com