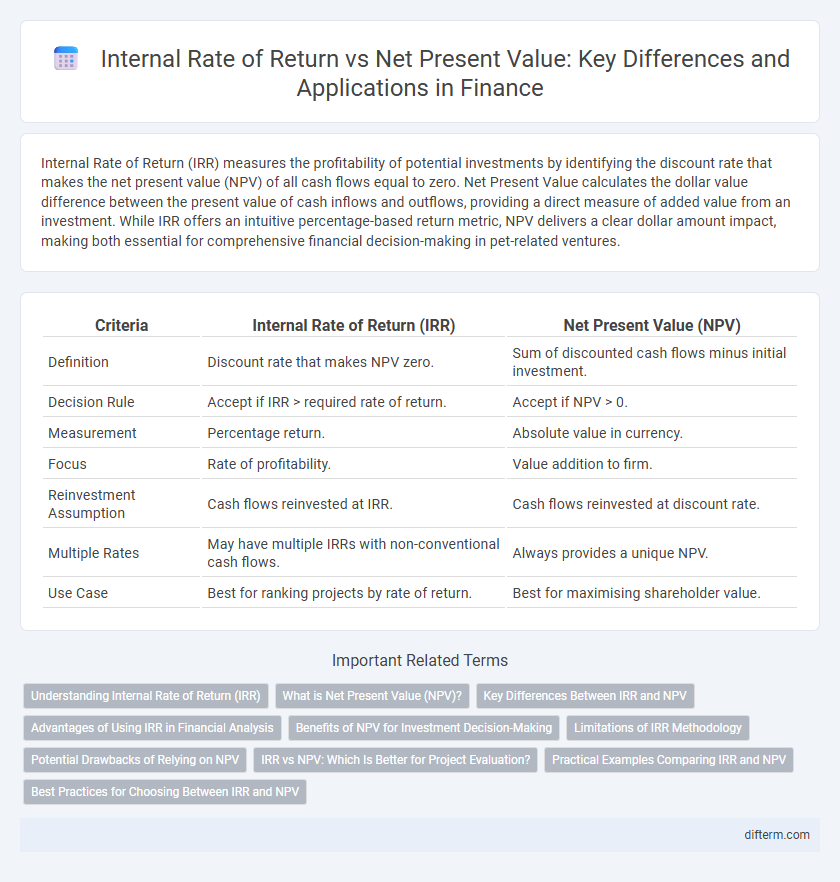

Internal Rate of Return (IRR) measures the profitability of potential investments by identifying the discount rate that makes the net present value (NPV) of all cash flows equal to zero. Net Present Value calculates the dollar value difference between the present value of cash inflows and outflows, providing a direct measure of added value from an investment. While IRR offers an intuitive percentage-based return metric, NPV delivers a clear dollar amount impact, making both essential for comprehensive financial decision-making in pet-related ventures.

Table of Comparison

| Criteria | Internal Rate of Return (IRR) | Net Present Value (NPV) |

|---|---|---|

| Definition | Discount rate that makes NPV zero. | Sum of discounted cash flows minus initial investment. |

| Decision Rule | Accept if IRR > required rate of return. | Accept if NPV > 0. |

| Measurement | Percentage return. | Absolute value in currency. |

| Focus | Rate of profitability. | Value addition to firm. |

| Reinvestment Assumption | Cash flows reinvested at IRR. | Cash flows reinvested at discount rate. |

| Multiple Rates | May have multiple IRRs with non-conventional cash flows. | Always provides a unique NPV. |

| Use Case | Best for ranking projects by rate of return. | Best for maximising shareholder value. |

Understanding Internal Rate of Return (IRR)

Internal Rate of Return (IRR) represents the discount rate at which the net present value (NPV) of a project's cash flows equals zero, indicating the project's expected rate of profitability. IRR helps investors assess the efficiency of investments by comparing it to the required rate of return or cost of capital. Understanding IRR is crucial for evaluating project feasibility and making informed financial decisions, especially when ranking multiple investment opportunities.

What is Net Present Value (NPV)?

Net Present Value (NPV) measures the profitability of an investment by calculating the difference between the present value of cash inflows and outflows using a specific discount rate. It accounts for the time value of money, allowing investors to assess the expected return relative to the project's risk. A positive NPV indicates that the projected earnings exceed the initial investment, making the project financially viable.

Key Differences Between IRR and NPV

Internal Rate of Return (IRR) calculates the discount rate that makes the net present value (NPV) of all cash flows from a project equal to zero, serving as a percentage measure of investment profitability. Net Present Value quantifies the dollar value difference between the present value of cash inflows and outflows, emphasizing actual value added to the firm. Key differences include IRR's expression as a percentage rate versus NPV's currency value, IRR's potential multiple solutions in non-conventional cash flow projects compared to NPV's consistent uniqueness, and NPV's superiority in ranking mutually exclusive projects based on value maximization.

Advantages of Using IRR in Financial Analysis

Internal Rate of Return (IRR) offers a clear percentage-based metric that facilitates straightforward comparison of investment projects regardless of their scale. IRR accounts for the time value of money, enabling investors to assess the profitability and efficiency of cash flows over the project's lifespan. This metric aids in decision-making by providing an intuitive threshold for acceptance relative to a company's required rate of return or cost of capital.

Benefits of NPV for Investment Decision-Making

Net Present Value (NPV) provides a clear measure of an investment's profitability by discounting future cash flows to their present value, allowing for precise comparison of different projects. NPV accounts for the time value of money, ensuring that cash inflows and outflows occurring at different times are accurately evaluated. This method reduces risk by incorporating a firm's required rate of return, helping investors prioritize projects that maximize shareholder value.

Limitations of IRR Methodology

Internal Rate of Return (IRR) can be misleading when evaluating projects with non-conventional cash flows or multiple sign changes, resulting in multiple IRRs that complicate decision-making. IRR assumes reinvestment of intermediate cash flows at the same rate, which often overstates profitability compared to Net Present Value (NPV) that discounts cash flows at a firm's cost of capital. Unlike NPV, IRR does not account for scale of investment, causing potential misranking of mutually exclusive projects and ignoring the absolute value created for shareholders.

Potential Drawbacks of Relying on NPV

Net Present Value (NPV) can sometimes overlook the timing of cash flows, leading to misleading investment decisions when projects have non-conventional cash flows or varying risk profiles. Over-reliance on NPV may ignore the scale of investment, causing smaller projects with higher relative returns to be undervalued compared to larger projects yielding higher absolute NPVs. In contrast, Internal Rate of Return (IRR) provides a rate-based metric that can better capture profitability relative to investment size, though it has its own limitations with multiple IRRs or mutually exclusive projects.

IRR vs NPV: Which Is Better for Project Evaluation?

Internal Rate of Return (IRR) and Net Present Value (NPV) are critical metrics for project evaluation, each offering unique insights; IRR provides the discount rate that equates the project's cash inflows and outflows, making it useful for comparing profitability relative to cost of capital. NPV calculates the absolute value of net benefits by discounting future cash flows to their present value, offering a direct measure of value creation. NPV is generally preferred when evaluating mutually exclusive projects due to its ability to measure absolute profitability, whereas IRR can be misleading for projects with non-conventional cash flows or multiple IRRs.

Practical Examples Comparing IRR and NPV

Net Present Value (NPV) measures the absolute value created by an investment, showing profit in today's dollars, while Internal Rate of Return (IRR) indicates the annualized percentage return expected from the project. For example, a project with an NPV of $100,000 and an IRR of 12% is generally more desirable than one with an NPV of $80,000 but a higher IRR of 14%, because NPV reflects overall value creation. In practical financial decisions, relying solely on IRR can mislead when comparing mutually exclusive projects or those with non-conventional cash flows, making NPV a more reliable metric for maximizing shareholder wealth.

Best Practices for Choosing Between IRR and NPV

Best practices for choosing between Internal Rate of Return (IRR) and Net Present Value (NPV) emphasize selecting NPV for projects with non-conventional cash flows or multiple discount rates, as it provides a direct estimate of added value. IRR is useful for quick comparisons and understanding the break-even rate of return but may be misleading in projects with mutually exclusive investments or varying capital costs. Financial analysts prioritize NPV for decision-making because it aligns with wealth maximization and accounts for the cost of capital more accurately.

internal rate of return vs net present value Infographic

difterm.com

difterm.com