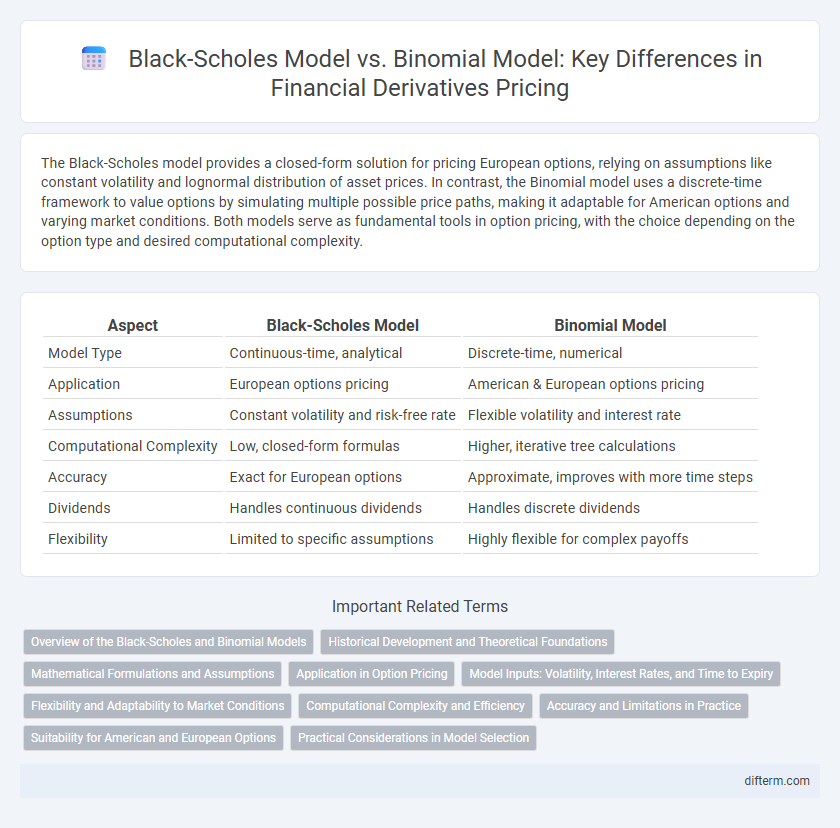

The Black-Scholes model provides a closed-form solution for pricing European options, relying on assumptions like constant volatility and lognormal distribution of asset prices. In contrast, the Binomial model uses a discrete-time framework to value options by simulating multiple possible price paths, making it adaptable for American options and varying market conditions. Both models serve as fundamental tools in option pricing, with the choice depending on the option type and desired computational complexity.

Table of Comparison

| Aspect | Black-Scholes Model | Binomial Model |

|---|---|---|

| Model Type | Continuous-time, analytical | Discrete-time, numerical |

| Application | European options pricing | American & European options pricing |

| Assumptions | Constant volatility and risk-free rate | Flexible volatility and interest rate |

| Computational Complexity | Low, closed-form formulas | Higher, iterative tree calculations |

| Accuracy | Exact for European options | Approximate, improves with more time steps |

| Dividends | Handles continuous dividends | Handles discrete dividends |

| Flexibility | Limited to specific assumptions | Highly flexible for complex payoffs |

Overview of the Black-Scholes and Binomial Models

The Black-Scholes model is a continuous-time framework used to price European options by solving a partial differential equation under the assumption of log-normal asset price distribution. The Binomial model, based on discrete-time steps, constructs a price tree representing possible future asset prices and is flexible enough to handle American options with early exercise features. Both models estimate option prices but differ in approach: Black-Scholes uses a closed-form solution for European options, whereas Binomial employs a lattice method adaptable to various option types.

Historical Development and Theoretical Foundations

The Black-Scholes model, introduced in 1973 by Fischer Black and Myron Scholes, revolutionized option pricing by providing a closed-form solution based on continuous-time stochastic processes and assumptions of constant volatility and risk-free rate. The Binomial model, developed by Cox, Ross, and Rubinstein in 1979, offers a discrete-time lattice approach, allowing for flexible modeling of American options and varying input parameters. Both models stem from the fundamental principles of no-arbitrage and risk-neutral valuation, but while Black-Scholes relies on differential equations and lognormal distribution of prices, the Binomial model uses a recombining price tree to approximate price dynamics and option values.

Mathematical Formulations and Assumptions

The Black-Scholes model relies on continuous-time stochastic calculus, assuming lognormal asset price distribution and constant volatility, and formulates option prices through a partial differential equation solved analytically. In contrast, the Binomial model discretizes time into intervals, modeling price movements via a recombining lattice and allowing varying assumptions on volatility and dividends. The Black-Scholes model's assumption of constant volatility and continuous trading contrasts with the Binomial model's flexibility in accommodating varying parameters and early exercise features.

Application in Option Pricing

The Black-Scholes model provides a closed-form solution for European option pricing under assumptions of constant volatility and log-normal asset price distribution, making it computationally efficient for standard options. In contrast, the Binomial model employs a discrete-time lattice framework, allowing flexible valuation of American options with early exercise features and varying volatility assumptions. Both models are fundamental in option pricing, with Black-Scholes suited for simplicity and speed, while the Binomial model offers greater adaptability to complex option structures.

Model Inputs: Volatility, Interest Rates, and Time to Expiry

The Black-Scholes model requires constant volatility, risk-free interest rates, and precise time to expiry for continuous-time option pricing, making it highly sensitive to these inputs. In contrast, the Binomial model accommodates variable volatility and fluctuating interest rates over discrete time intervals, allowing for a more flexible representation of changing market conditions. Both models depend critically on accurate estimates of volatility, interest rates, and time to expiry, which directly influence option valuation and hedging strategies.

Flexibility and Adaptability to Market Conditions

The Black-Scholes model offers a closed-form solution ideal for European options but assumes constant volatility and interest rates, limiting its adaptability to dynamic market conditions. The Binomial model, with its discrete-time framework, provides greater flexibility by accommodating varying volatility, dividend yields, and American-style option features through iterative calculations. This adaptability makes the Binomial model preferable for scenarios requiring precise modeling of changing market environments and early exercise opportunities.

Computational Complexity and Efficiency

The Black-Scholes model provides a closed-form solution for European option pricing, resulting in low computational complexity and high efficiency for continuous-time financial markets. In contrast, the Binomial model, relying on discrete-time steps and tree structures, involves higher computational overhead as the number of time intervals increases, especially for American options or path-dependent derivatives. Despite greater computational demands, the Binomial model offers flexibility and accuracy in scenarios where the Black-Scholes assumptions do not hold.

Accuracy and Limitations in Practice

The Black-Scholes model offers closed-form solutions for European options, providing quick and relatively accurate pricing under assumptions of constant volatility and log-normal asset returns, but it struggles with American options and path-dependent features. In contrast, the Binomial model's iterative approach accommodates early exercise opportunities and varying volatility, enhancing accuracy for American-style options and more complex derivatives, although it requires increased computational time as the number of steps grows. Both models face limitations in practice due to assumptions like constant volatility and risk-free rates, making them less effective under real market conditions with stochastic volatility and discrete dividends.

Suitability for American and European Options

The Black-Scholes model is primarily suited for European options due to its assumption of continuous trading and no early exercise, which limits its accuracy for American options that allow early exercise. In contrast, the Binomial model effectively accommodates American options by using a discrete-time framework capable of modeling early exercise opportunities at each step. This flexibility makes the Binomial model preferable for pricing American options, while the Black-Scholes model remains efficient for European options with no early exercise feature.

Practical Considerations in Model Selection

The Black-Scholes model offers closed-form solutions ideal for European options with constant volatility and interest rates, making it efficient for quick pricing. The Binomial model provides greater flexibility, handling American options, varying volatility, and early exercise features through iterative lattice construction. Choosing between models depends on option type, computational resources, and the need for accuracy in capturing market conditions.

Black-Scholes model vs Binomial model Infographic

difterm.com

difterm.com