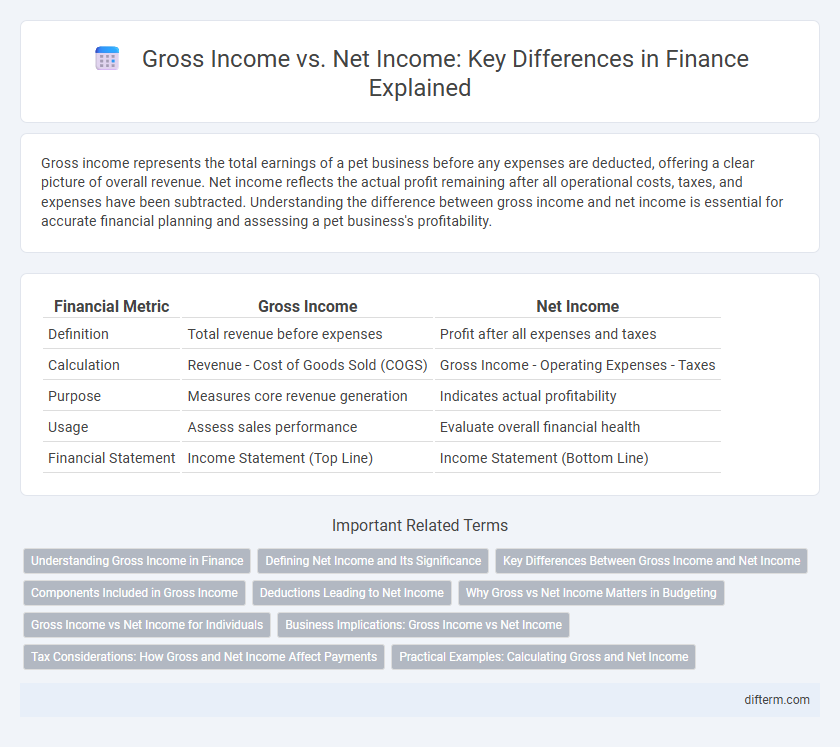

Gross income represents the total earnings of a pet business before any expenses are deducted, offering a clear picture of overall revenue. Net income reflects the actual profit remaining after all operational costs, taxes, and expenses have been subtracted. Understanding the difference between gross income and net income is essential for accurate financial planning and assessing a pet business's profitability.

Table of Comparison

| Financial Metric | Gross Income | Net Income |

|---|---|---|

| Definition | Total revenue before expenses | Profit after all expenses and taxes |

| Calculation | Revenue - Cost of Goods Sold (COGS) | Gross Income - Operating Expenses - Taxes |

| Purpose | Measures core revenue generation | Indicates actual profitability |

| Usage | Assess sales performance | Evaluate overall financial health |

| Financial Statement | Income Statement (Top Line) | Income Statement (Bottom Line) |

Understanding Gross Income in Finance

Gross income in finance represents the total earnings a company or individual generates before any deductions such as taxes, expenses, or allowances are applied. It includes revenue from all sources, providing a clear indicator of overall financial performance prior to operational costs. Analyzing gross income helps stakeholders assess profitability potential and make informed budgeting or investment decisions.

Defining Net Income and Its Significance

Net income represents the total earnings of a company after deducting all expenses, taxes, and costs from gross income, providing a clear measure of profitability. It is a critical indicator for investors and stakeholders to assess the company's financial health and operational efficiency. Understanding net income aids in making informed decisions regarding investments, dividend distributions, and strategic planning.

Key Differences Between Gross Income and Net Income

Gross income represents the total earnings before any deductions, including taxes, operating expenses, and interest. Net income reflects the actual profit after all expenses have been subtracted from gross income, providing a clearer picture of a company's financial health. Key differences include gross income showcasing revenue generation capacity, while net income indicates profitability and efficiency in managing costs.

Components Included in Gross Income

Gross income encompasses all earnings before deductions and taxes, including wages, salaries, bonuses, rental income, dividends, interest, and business revenue. It represents the total income generated from all sources, providing a comprehensive view of financial inflow. Understanding the components included in gross income is essential for accurate tax reporting and financial analysis.

Deductions Leading to Net Income

Gross income represents total earnings before any deductions, while net income reflects the actual profit after subtracting taxes, operating expenses, interest, and depreciation. Key deductions such as federal and state taxes, Social Security, Medicare, retirement contributions, and business expenses significantly reduce gross income to arrive at net income. Understanding these deductions is crucial for accurate financial analysis, tax planning, and budgeting in both personal finance and corporate accounting.

Why Gross vs Net Income Matters in Budgeting

Gross income provides the total earnings before any deductions, serving as a base for estimating taxes and savings potential. Net income reflects the actual amount available for spending and budgeting after taxes, debts, and expenses are deducted. Understanding the difference between gross and net income is crucial for creating accurate personal or business budgets, ensuring realistic financial planning and cash flow management.

Gross Income vs Net Income for Individuals

Gross income for individuals represents the total earnings before any deductions, including salaries, wages, bonuses, and other income sources. Net income is the amount remaining after subtracting taxes, retirement contributions, and other withholdings from gross income. Understanding the difference between gross income and net income is essential for effective personal budgeting and financial planning.

Business Implications: Gross Income vs Net Income

Gross income reflects the total revenue generated by a business before deducting expenses, serving as a key indicator of sales performance and market demand. Net income represents the actual profitability after accounting for operating costs, taxes, and interest, guiding strategic decisions on cost management and investment. Understanding the distinction between gross income and net income enables businesses to evaluate operational efficiency and financial health accurately.

Tax Considerations: How Gross and Net Income Affect Payments

Gross income represents the total earnings before any deductions, including taxes, while net income is the amount remaining after tax liabilities and other withholdings are subtracted. Tax considerations directly influence net income, as progressive tax rates and deductions reduce the gross income to arrive at the taxable income, impacting take-home pay and financial planning. Understanding the distinctions between gross and net income is essential for accurate budgeting, tax liability estimation, and optimizing allowable deductions to maximize disposable income.

Practical Examples: Calculating Gross and Net Income

Gross income includes total earnings before deductions such as taxes, social security, and retirement contributions, exemplified by a salary of $60,000 annually. Net income reflects the actual take-home pay after all deductions, which might reduce that $60,000 to approximately $45,000. Understanding the distinction is crucial for accurate budgeting and financial planning.

Gross Income vs Net Income Infographic

difterm.com

difterm.com