Margin accounts allow investors to borrow funds from a broker to purchase securities, increasing buying power but also amplifying risk through potential interest charges and margin calls. Cash accounts require full payment for securities at the time of purchase, limiting leverage but reducing risk exposure and avoiding interest costs. Choosing between margin and cash accounts depends on an investor's risk tolerance, investment strategy, and capital availability.

Table of Comparison

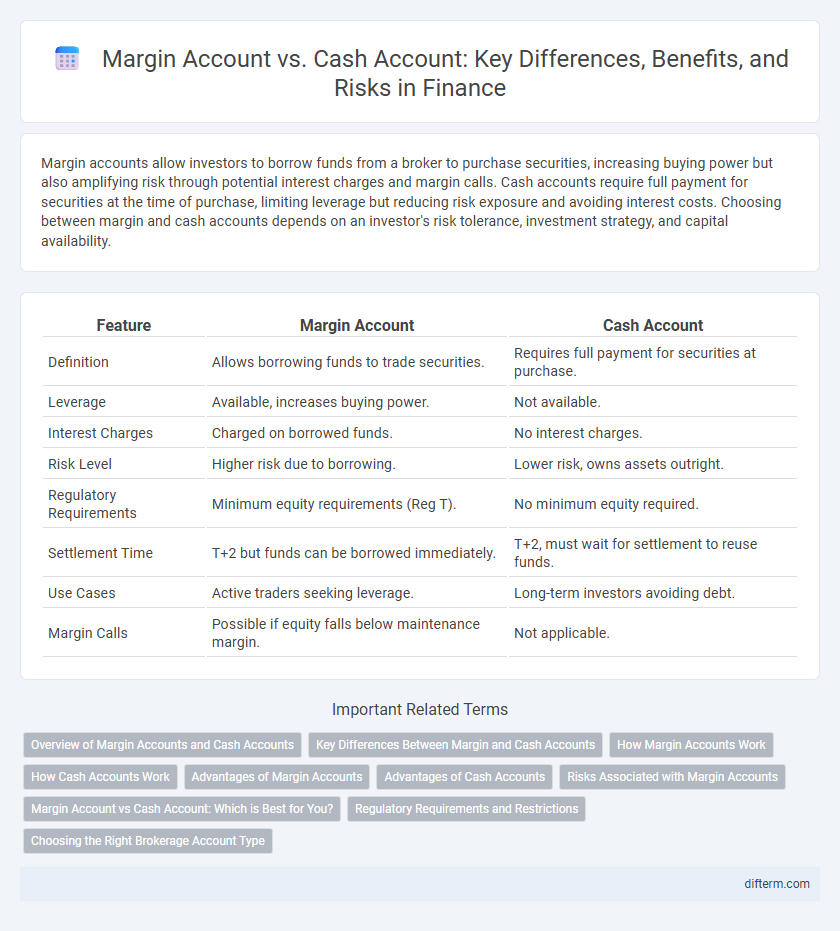

| Feature | Margin Account | Cash Account |

|---|---|---|

| Definition | Allows borrowing funds to trade securities. | Requires full payment for securities at purchase. |

| Leverage | Available, increases buying power. | Not available. |

| Interest Charges | Charged on borrowed funds. | No interest charges. |

| Risk Level | Higher risk due to borrowing. | Lower risk, owns assets outright. |

| Regulatory Requirements | Minimum equity requirements (Reg T). | No minimum equity required. |

| Settlement Time | T+2 but funds can be borrowed immediately. | T+2, must wait for settlement to reuse funds. |

| Use Cases | Active traders seeking leverage. | Long-term investors avoiding debt. |

| Margin Calls | Possible if equity falls below maintenance margin. | Not applicable. |

Overview of Margin Accounts and Cash Accounts

Margin accounts allow investors to borrow funds from brokers to purchase securities, enabling leveraged trading and increased buying power, but they also come with higher risks and interest charges. Cash accounts require investors to pay the full amount for securities upfront, restricting purchases to available funds and eliminating borrowing costs and margin calls. Understanding these key differences is essential for managing investment risk and capital efficiency.

Key Differences Between Margin and Cash Accounts

Margin accounts allow investors to borrow funds from brokers to purchase securities, enabling leveraged trading and potentially higher returns but with increased risk. Cash accounts require investors to pay the full purchase price for securities upfront, limiting transactions to available cash and reducing exposure to debt-related risks. Regulatory rules such as Regulation T affect margin accounts by setting borrowing limits, while cash accounts face fewer restrictions but offer less trading flexibility.

How Margin Accounts Work

Margin accounts allow investors to borrow funds from their brokerage to purchase securities, using the securities themselves as collateral. The borrowed amount, known as the margin loan, must meet the minimum maintenance margin requirement set by regulatory bodies like FINRA. Interest accrues on the borrowed funds, and if the account value falls below the maintenance margin, a margin call requires the investor to deposit additional funds or sell assets to restore the minimum equity level.

How Cash Accounts Work

Cash accounts require investors to pay the full amount for securities purchased, meaning no borrowing is involved and trades are settled using available funds only. These accounts limit the ability to leverage investments, reducing risk but also potential returns compared to margin accounts. Settlement periods typically last two business days (T+2), during which funds must be available to avoid violations or restrictions.

Advantages of Margin Accounts

Margin accounts offer investors the advantage of increased purchasing power by allowing them to borrow funds to buy securities, effectively leveraging their investments. They provide greater flexibility for short selling, enabling traders to profit from declining asset prices. Additionally, margin accounts facilitate faster trade execution and access to a wider range of investment strategies compared to cash accounts.

Advantages of Cash Accounts

Cash accounts offer greater risk management by requiring full payment for securities, eliminating the possibility of margin calls and debt accumulation. Investors benefit from straightforward accounting and fewer regulatory restrictions compared to margin accounts. This conservative approach ensures better control over investment portfolios and limits potential financial liabilities.

Risks Associated with Margin Accounts

Margin accounts in finance introduce significant risks due to the use of borrowed funds to trade securities, amplifying potential losses that can exceed the initial investment. Margin calls demand additional capital when account equity falls below maintenance requirements, potentially forcing the liquidation of assets at unfavorable prices. The volatility of leveraged positions increases exposure to rapid market fluctuations, making margin accounts inherently riskier compared to cash accounts where transactions are limited to available funds.

Margin Account vs Cash Account: Which is Best for You?

A margin account allows investors to borrow funds to purchase securities, offering increased buying power but also heightened risk due to potential margin calls and interest charges. Cash accounts require full payment for securities, limiting buying power but reducing risk and eliminating debt obligations. Choosing between a margin account and a cash account depends on your risk tolerance, investment strategy, and financial goals, with margin accounts suited for experienced investors seeking leverage and cash accounts ideal for conservative investors prioritizing safety.

Regulatory Requirements and Restrictions

Margin accounts allow investors to borrow funds from brokers to purchase securities, subject to regulations such as the Federal Reserve Board's Regulation T, which limits initial margin to 50% of the purchase price and mandates maintenance margin levels to prevent excessive leverage. Cash accounts require full payment for all securities at the time of purchase, prohibiting borrowing and short selling, thereby limiting regulatory concerns related to credit risk and margin calls. Both account types must comply with SEC and FINRA rules, but margin accounts involve stricter oversight to manage credit exposure and investor risk.

Choosing the Right Brokerage Account Type

Selecting the right brokerage account depends on investment goals and risk tolerance; margin accounts allow borrowing funds to leverage investments but increase risk exposure, while cash accounts require full payment for securities, limiting risk but reducing buying power. Margin accounts enable greater flexibility with short selling and faster trade settlements, making them suitable for experienced investors seeking growth opportunities. Understanding margin requirements, interest costs, and regulatory regulations is essential to optimize portfolio strategy and manage potential financial liabilities effectively.

Margin Account vs Cash Account Infographic

difterm.com

difterm.com