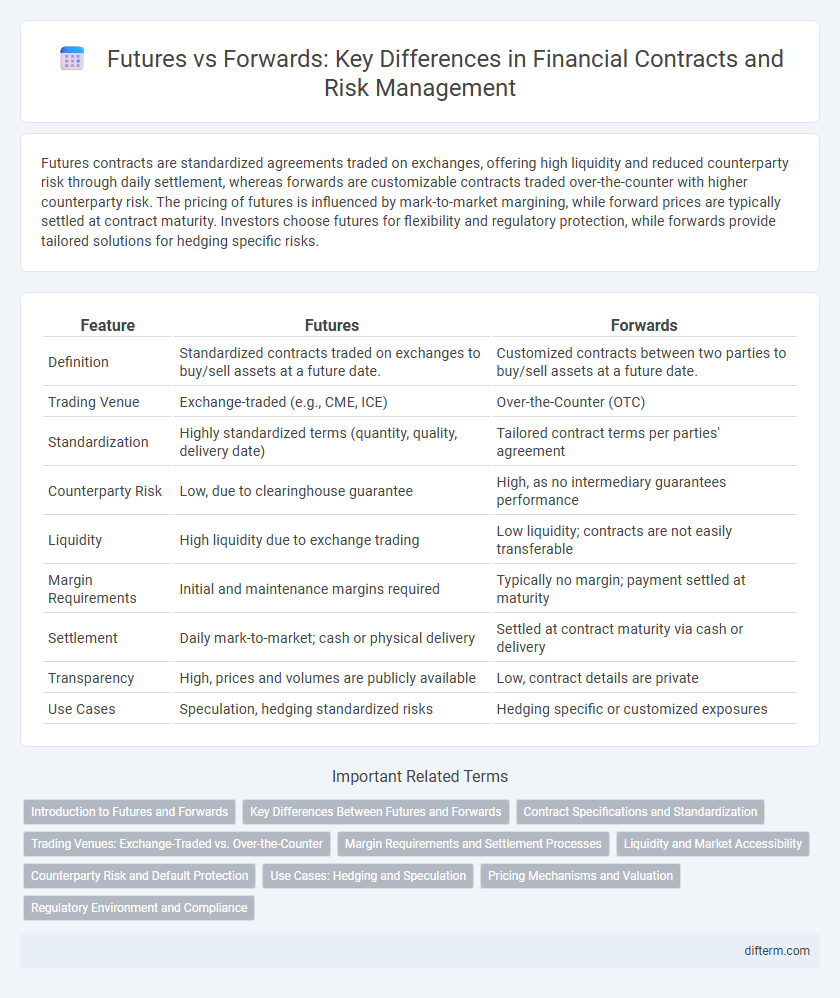

Futures contracts are standardized agreements traded on exchanges, offering high liquidity and reduced counterparty risk through daily settlement, whereas forwards are customizable contracts traded over-the-counter with higher counterparty risk. The pricing of futures is influenced by mark-to-market margining, while forward prices are typically settled at contract maturity. Investors choose futures for flexibility and regulatory protection, while forwards provide tailored solutions for hedging specific risks.

Table of Comparison

| Feature | Futures | Forwards |

|---|---|---|

| Definition | Standardized contracts traded on exchanges to buy/sell assets at a future date. | Customized contracts between two parties to buy/sell assets at a future date. |

| Trading Venue | Exchange-traded (e.g., CME, ICE) | Over-the-Counter (OTC) |

| Standardization | Highly standardized terms (quantity, quality, delivery date) | Tailored contract terms per parties' agreement |

| Counterparty Risk | Low, due to clearinghouse guarantee | High, as no intermediary guarantees performance |

| Liquidity | High liquidity due to exchange trading | Low liquidity; contracts are not easily transferable |

| Margin Requirements | Initial and maintenance margins required | Typically no margin; payment settled at maturity |

| Settlement | Daily mark-to-market; cash or physical delivery | Settled at contract maturity via cash or delivery |

| Transparency | High, prices and volumes are publicly available | Low, contract details are private |

| Use Cases | Speculation, hedging standardized risks | Hedging specific or customized exposures |

Introduction to Futures and Forwards

Futures and forwards are both derivative contracts enabling parties to buy or sell assets at predetermined prices on future dates, commonly used to hedge risk or speculate in financial markets. Futures contracts are standardized and traded on exchanges, providing high liquidity and reduced counterparty risk through daily settlement, while forwards are customized agreements traded over-the-counter with higher counterparty risk. Key differences include contract standardization, settlement procedures, and regulatory oversight, impacting their suitability for various hedging and speculative strategies.

Key Differences Between Futures and Forwards

Futures contracts are standardized agreements traded on regulated exchanges, ensuring high liquidity and daily settlement through margin requirements, while forwards are customized private agreements traded over-the-counter with settlement at contract maturity. Futures possess lower counterparty risk due to clearinghouse guarantees, whereas forwards expose parties to higher default risk because of the lack of a centralized intermediary. Pricing mechanisms differ as futures prices adjust daily with marked-to-market processes, unlike forwards which settle at a pre-agreed price on the settlement date.

Contract Specifications and Standardization

Futures contracts are standardized agreements traded on regulated exchanges, specifying fixed contract sizes, delivery dates, and quality standards, which enhance liquidity and reduce counterparty risk. Forwards are customized private contracts negotiated between parties, allowing flexible terms tailored to specific needs but carrying higher counterparty risk due to lack of standardization. The standardization of futures facilitates price transparency and margin requirements, whereas forwards offer bespoke solutions without centralized clearing.

Trading Venues: Exchange-Traded vs. Over-the-Counter

Futures contracts are standardized agreements traded on regulated exchanges, providing centralized clearing, transparency, and reduced counterparty risk, making them ideal for liquidity and price discovery. Forwards are customizable contracts traded over-the-counter (OTC), allowing parties to tailor terms but exposing them to higher counterparty risk due to lack of centralized clearing. Exchange-traded futures facilitate standardized settlement processes, whereas OTC forwards rely on bilateral agreements, impacting accessibility and regulatory oversight.

Margin Requirements and Settlement Processes

Futures contracts require daily margin adjustments through a clearinghouse, ensuring that gains and losses are settled promptly via mark-to-market mechanisms, which mitigates counterparty risk. In contrast, forwards involve private agreements with no initial margin requirements and settle only at contract maturity, increasing credit risk due to the lack of interim cash flows. The standardized nature of futures facilitates liquidity and transparency, whereas forwards offer customization but entail higher settlement risk.

Liquidity and Market Accessibility

Futures contracts offer high liquidity due to standardized terms and centralized exchange trading, enabling easy entry and exit for a wide range of market participants. Forwards are customized agreements traded over-the-counter (OTC), resulting in lower liquidity and limited market accessibility primarily to institutional investors. The transparency and regulatory oversight of futures markets further enhance accessibility compared to the privately negotiated and less regulated forward contracts.

Counterparty Risk and Default Protection

Futures contracts are standardized and traded on regulated exchanges, significantly reducing counterparty risk through clearinghouses that guarantee contract performance. In contrast, forwards are private agreements between two parties, exposing participants to higher counterparty risk due to the absence of a central clearing entity. Default protection in futures is enhanced by daily mark-to-market settlements and margin requirements, whereas forwards rely on the creditworthiness of counterparties and collateral arrangements to mitigate default risk.

Use Cases: Hedging and Speculation

Futures contracts are widely used for hedging in highly liquid markets such as commodities, currencies, and stock indices, allowing businesses and investors to lock in prices and mitigate risk exposure. Forwards are preferred for customized hedging needs, tailored to specific contract terms not available in standardized futures markets, often used by corporations managing currency or interest rate risks. Both instruments serve speculative purposes, with futures appealing to traders seeking liquidity and leverage in standardized contracts, while forwards attract speculators requiring bespoke agreements with counterparty risk considerations.

Pricing Mechanisms and Valuation

Futures contracts have standardized pricing mechanisms with daily mark-to-market valuations, enabling real-time profit and loss adjustments based on market fluctuations. Forwards are privately negotiated agreements with valuation determined at contract maturity, reflecting the difference between the agreed price and the spot price at settlement. Pricing of futures typically involves the cost of carry model, incorporating interest rates, dividends, and storage costs, whereas forwards pricing directly reflects the underlying asset's expected future spot price without daily cash flow adjustments.

Regulatory Environment and Compliance

Futures contracts are standardized and traded on regulated exchanges, subject to stringent oversight by bodies such as the Commodity Futures Trading Commission (CFTC), ensuring transparency and reduced counterparty risk. Forwards are private, over-the-counter agreements with flexible terms, typically lacking standardized regulation, which increases exposure to credit risk and requires rigorous bilateral compliance management. Regulatory frameworks prioritize futures for systemic stability while imposing collateral requirements and reporting standards to mitigate market manipulation and ensure compliance.

Futures vs Forwards Infographic

difterm.com

difterm.com