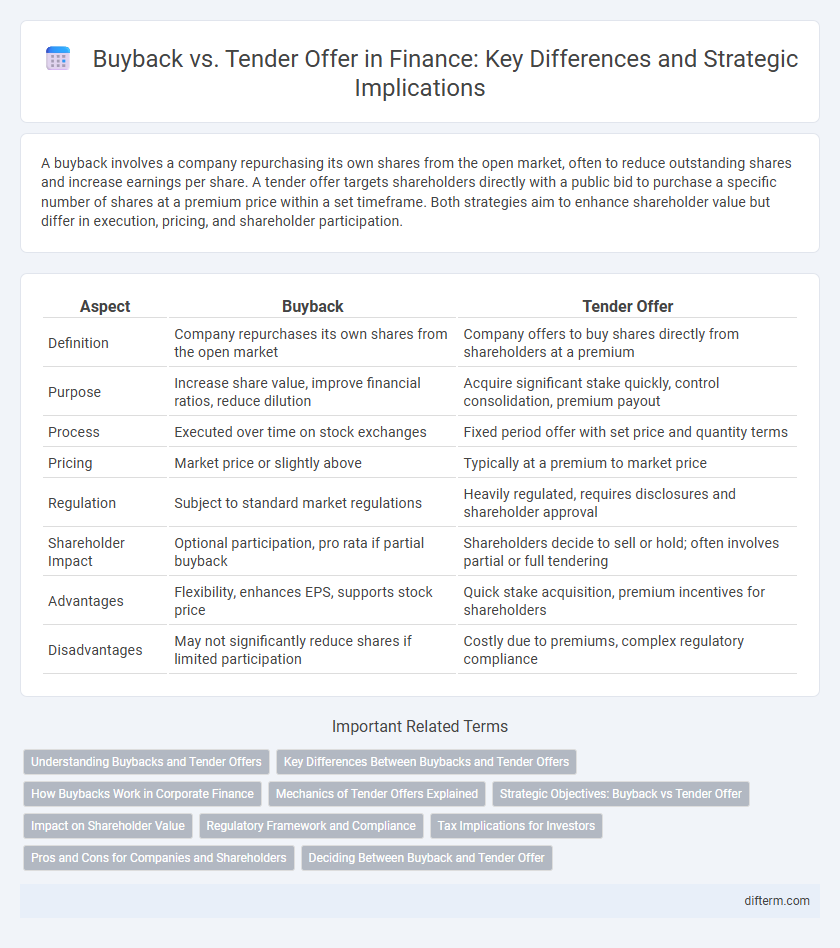

A buyback involves a company repurchasing its own shares from the open market, often to reduce outstanding shares and increase earnings per share. A tender offer targets shareholders directly with a public bid to purchase a specific number of shares at a premium price within a set timeframe. Both strategies aim to enhance shareholder value but differ in execution, pricing, and shareholder participation.

Table of Comparison

| Aspect | Buyback | Tender Offer |

|---|---|---|

| Definition | Company repurchases its own shares from the open market | Company offers to buy shares directly from shareholders at a premium |

| Purpose | Increase share value, improve financial ratios, reduce dilution | Acquire significant stake quickly, control consolidation, premium payout |

| Process | Executed over time on stock exchanges | Fixed period offer with set price and quantity terms |

| Pricing | Market price or slightly above | Typically at a premium to market price |

| Regulation | Subject to standard market regulations | Heavily regulated, requires disclosures and shareholder approval |

| Shareholder Impact | Optional participation, pro rata if partial buyback | Shareholders decide to sell or hold; often involves partial or full tendering |

| Advantages | Flexibility, enhances EPS, supports stock price | Quick stake acquisition, premium incentives for shareholders |

| Disadvantages | May not significantly reduce shares if limited participation | Costly due to premiums, complex regulatory compliance |

Understanding Buybacks and Tender Offers

Buybacks involve a company repurchasing its own shares from the open market to reduce outstanding equity, often boosting earnings per share and stock value. Tender offers are formal proposals to buy a specific number of shares at a premium directly from shareholders, frequently used in corporate takeovers or strategic acquisitions. Understanding the nuances between buybacks and tender offers is essential for investors assessing corporate capital allocation and shareholder value strategies.

Key Differences Between Buybacks and Tender Offers

Buybacks involve a company repurchasing its own shares directly from the open market, often to reduce outstanding shares and boost stock value, while tender offers entail a company making a formal offer to shareholders to purchase a specific number of shares at a premium price within a set timeframe. Key differences include the execution method--buybacks are decentralized and gradual, whereas tender offers are centralized and time-bound--and the price determination, with buybacks relying on market prices and tender offers typically offering a premium to incentivize shareholder participation. Regulatory complexity is higher in tender offers due to disclosure requirements, whereas buybacks generally have more straightforward compliance under securities laws.

How Buybacks Work in Corporate Finance

Buybacks in corporate finance involve a company repurchasing its own shares from the open market or directly from shareholders to reduce the number of outstanding shares. This process increases earnings per share (EPS) and often boosts the stock price by signaling confidence in the company's future prospects. Buybacks provide flexibility compared to tender offers as they can be executed gradually without committing to a fixed volume or price.

Mechanics of Tender Offers Explained

Tender offers involve a company directly proposing to purchase shares from shareholders at a specified price, usually above the market value, for a set period. Shareholders can decide to sell their shares during this timeframe, allowing the company to acquire a significant portion of stock efficiently. This mechanism contrasts with open-market buybacks, providing more control over the number of shares repurchased and timing of the transaction.

Strategic Objectives: Buyback vs Tender Offer

Buybacks strategically enhance shareholder value by reducing the share count, often signaling company confidence and improving earnings per share (EPS). Tender offers aim to acquire a significant portion of shares swiftly to gain control or restructure ownership, often at a premium price. Both methods support strategic goals but differ in execution and impact on shareholder dynamics.

Impact on Shareholder Value

Buybacks often increase shareholder value by reducing the number of outstanding shares, thereby boosting earnings per share and potentially driving up stock price. Tender offers provide shareholders with a premium on the market price, offering immediate liquidity and value realization. The choice between the two strategies depends on market conditions and corporate objectives, with buybacks signaling confidence in future growth while tender offers may appeal during undervaluation periods.

Regulatory Framework and Compliance

Buybacks are governed by Section 10b-18 of the Securities Exchange Act, providing issuers a safe harbor against manipulation claims if specific conditions on timing, price, and volume are met. Tender offers must comply with the Williams Act, requiring disclosure of intent, terms, and financing, ensuring equal treatment of all shareholders. Regulatory frameworks emphasize transparency and fairness to maintain market integrity and protect investor interests during repurchase transactions.

Tax Implications for Investors

Buybacks typically result in capital gains tax for investors when shares are sold back to the company, often at potentially favorable long-term capital gains rates. Tender offers may trigger immediate tax liabilities since accepting the offer is considered a sale of securities, usually leading to capital gains or losses based on the purchase price versus basis. Tax treatment differences between buybacks and tender offers can significantly impact investors' after-tax returns, making it essential to evaluate cost basis, holding period, and local tax regulations.

Pros and Cons for Companies and Shareholders

Buybacks enable companies to repurchase shares directly from the market, often at market price, which can increase share value and EPS but may strain cash resources; shareholders benefit from price appreciation yet lack the option to sell at a premium. Tender offers allow companies to buy shares at a specified premium, providing shareholders a clear exit opportunity and potential immediate gain, but may dilute remaining equity and impose higher costs on the company. Companies must weigh buybacks' flexibility and market impact against tender offers' structured approach and shareholder appeal, balancing financial strategy with shareholder value maximization.

Deciding Between Buyback and Tender Offer

Choosing between a buyback and a tender offer hinges on factors like cost, shareholder participation, and market signaling. Buybacks allow companies to repurchase shares flexibly on the open market, often at prevailing prices, while tender offers propose a fixed price directly to shareholders, potentially at a premium to encourage acceptance. Evaluating liquidity needs, shareholder base composition, and regulatory implications helps determine which method optimizes capital structure and shareholder value.

Buyback vs Tender offer Infographic

difterm.com

difterm.com