Price action reveals market trends by analyzing past price movements and patterns, providing insights into potential future behavior. Volume analysis complements this by measuring the number of shares or contracts traded, indicating the strength or weakness behind price changes. Combining price action with volume data offers a more comprehensive view of market dynamics, enhancing trading decisions and risk management.

Table of Comparison

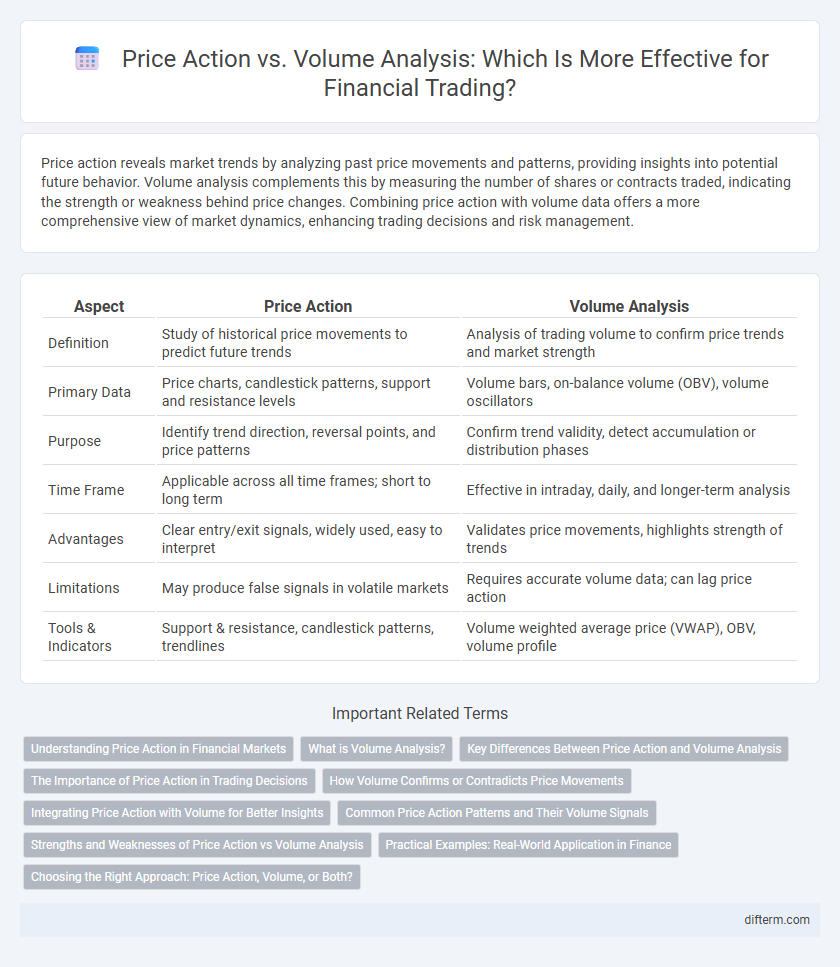

| Aspect | Price Action | Volume Analysis |

|---|---|---|

| Definition | Study of historical price movements to predict future trends | Analysis of trading volume to confirm price trends and market strength |

| Primary Data | Price charts, candlestick patterns, support and resistance levels | Volume bars, on-balance volume (OBV), volume oscillators |

| Purpose | Identify trend direction, reversal points, and price patterns | Confirm trend validity, detect accumulation or distribution phases |

| Time Frame | Applicable across all time frames; short to long term | Effective in intraday, daily, and longer-term analysis |

| Advantages | Clear entry/exit signals, widely used, easy to interpret | Validates price movements, highlights strength of trends |

| Limitations | May produce false signals in volatile markets | Requires accurate volume data; can lag price action |

| Tools & Indicators | Support & resistance, candlestick patterns, trendlines | Volume weighted average price (VWAP), OBV, volume profile |

Understanding Price Action in Financial Markets

Price action in financial markets refers to analyzing historical price movements to forecast future trends, relying on patterns such as support and resistance, candlestick formations, and trend lines. This method provides real-time insight into market sentiment without dependence on lagging indicators, allowing traders to make timely decisions. Understanding price action helps identify entry and exit points based on actual supply and demand dynamics influencing market behavior.

What is Volume Analysis?

Volume analysis examines the number of shares or contracts traded in a security or market during a specific period, providing insights into the strength or weakness of price movements. By analyzing volume patterns, traders can confirm trends, identify potential reversals, and assess the validity of price actions. High volume typically indicates strong investor interest and can validate price breakouts or breakdowns.

Key Differences Between Price Action and Volume Analysis

Price action analysis focuses on the movement of asset prices over time, using patterns and candlestick formations to predict future market direction. Volume analysis examines the number of shares or contracts traded to confirm trends and identify the strength behind price movements. The key difference lies in price action analyzing price behavior alone, while volume analysis integrates trading activity to validate or challenge price patterns.

The Importance of Price Action in Trading Decisions

Price action reflects the raw movement of an asset's price, providing traders with real-time insights into market sentiment and momentum without relying on lagging indicators. Understanding price action helps identify key support and resistance levels, trend reversals, and continuation patterns, which are crucial for making precise entry and exit decisions. While volume analysis offers context on the strength behind price moves, price action remains the foundational tool for assessing supply and demand dynamics in any trading strategy.

How Volume Confirms or Contradicts Price Movements

Volume analysis provides critical insight into the strength or weakness of price movements by confirming or contradicting trends in financial markets. Increasing volume during an upward price move typically signals strong buying interest, validating the price trend, while declining volume suggests a potential reversal or weakening momentum. Conversely, price movements on low volume often lack conviction, indicating possible false breakouts or unsustainable trends.

Integrating Price Action with Volume for Better Insights

Integrating price action with volume analysis enhances the reliability of market signals by confirming trends and potential reversals, as rising volume during price advances indicates strong buyer interest. Volume spikes at key price levels often signal institutional participation, providing deeper insight beyond price movements alone. Combining these tools improves decision-making accuracy in trading strategies by identifying genuine market momentum and filtering out false breakouts.

Common Price Action Patterns and Their Volume Signals

Common price action patterns such as pin bars, engulfing candles, and inside bars gain significant confirmation when accompanied by volume signals like volume spikes or divergences. High volume during a breakout of a key price pattern often indicates strong market conviction, validating the trend direction. Conversely, low volume on a price pattern breakout may suggest a false signal or potential reversal, emphasizing the importance of integrating volume analysis with price action for more accurate trade decisions.

Strengths and Weaknesses of Price Action vs Volume Analysis

Price action analysis excels in providing clear insights into market sentiment by observing raw price movements, enabling traders to identify support and resistance levels without reliance on external indicators. However, it may lack the depth offered by volume analysis, which reveals the intensity behind price moves by showing the actual trading activity, thus confirming the strength or weakness of trends. Volume analysis can sometimes be misleading during low liquidity periods, whereas price action remains effective across different market conditions but requires experience to interpret accurately.

Practical Examples: Real-World Application in Finance

Price action trading relies on analyzing candlestick patterns and trendlines to identify potential reversals and breakouts, often used by day traders in volatile markets like forex. Volume analysis complements this by confirming the strength of price movements; for instance, a breakout accompanied by high volume signals strong market conviction, as seen in equity markets during earnings announcements. Combining both techniques enhances decision-making, such as using volume spikes to validate price action signals in commodities trading, improving entry and exit timing for portfolio managers.

Choosing the Right Approach: Price Action, Volume, or Both?

Price action reveals market sentiment through price movements, highlighting trends and reversals without reliance on volume data. Volume analysis provides insight into the strength and validity of price moves by measuring the number of shares or contracts traded. Combining price action with volume analysis offers a comprehensive approach, allowing traders to confirm breakouts, validate trends, and enhance decision-making accuracy.

Price Action vs Volume Analysis Infographic

difterm.com

difterm.com