Warrants and options both grant the right to buy or sell an asset at a specified price before expiration, but warrants are typically issued by companies and often have longer durations. Options are standardized contracts traded on exchanges, allowing investors to hedge or speculate, while warrants are less liquid and usually issued as incentives or sweeteners in corporate finance. Understanding the differences in issuance, lifespan, and trading mechanisms is crucial for effective portfolio management and risk assessment.

Table of Comparison

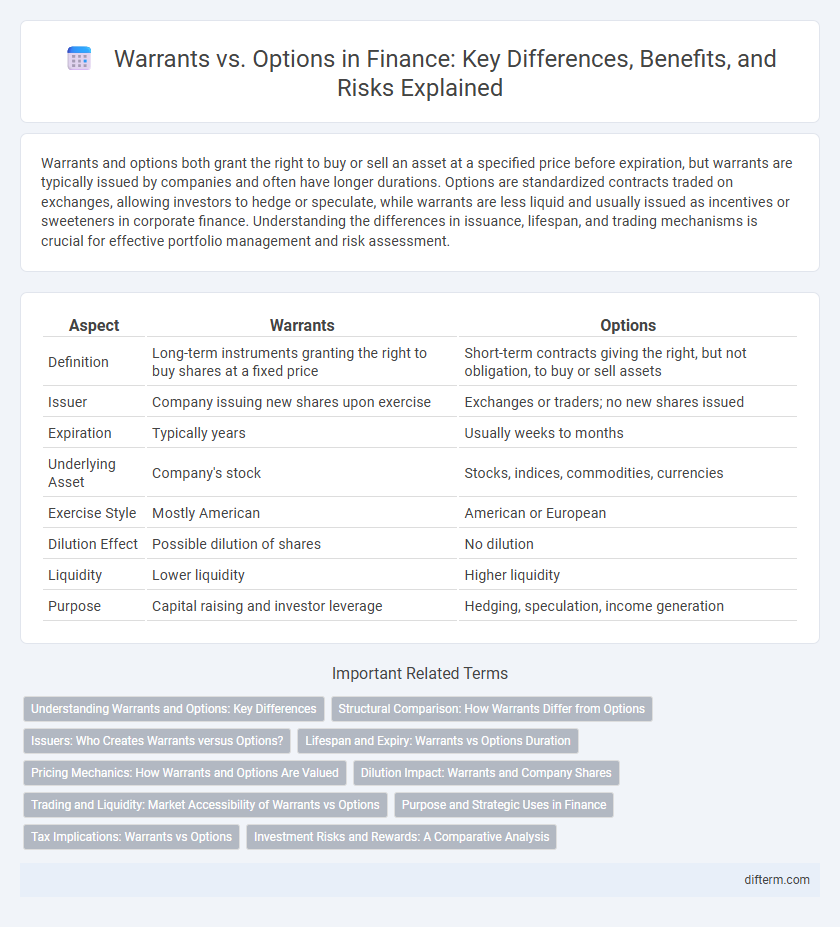

| Aspect | Warrants | Options |

|---|---|---|

| Definition | Long-term instruments granting the right to buy shares at a fixed price | Short-term contracts giving the right, but not obligation, to buy or sell assets |

| Issuer | Company issuing new shares upon exercise | Exchanges or traders; no new shares issued |

| Expiration | Typically years | Usually weeks to months |

| Underlying Asset | Company's stock | Stocks, indices, commodities, currencies |

| Exercise Style | Mostly American | American or European |

| Dilution Effect | Possible dilution of shares | No dilution |

| Liquidity | Lower liquidity | Higher liquidity |

| Purpose | Capital raising and investor leverage | Hedging, speculation, income generation |

Understanding Warrants and Options: Key Differences

Warrants and options both grant the right to buy an underlying asset at a specific price within a set time but differ primarily in issuance and expiration terms; warrants are issued by companies and often have longer durations, sometimes years, while options are standardized contracts traded on exchanges with shorter expirations. Warrants dilute shares upon exercise as they lead to new stock issuance, whereas options typically involve existing shares, resulting in no dilution. Understanding these distinctions is crucial for investors assessing leverage, risk, and potential impact on equity value.

Structural Comparison: How Warrants Differ from Options

Warrants are long-term securities issued by companies that grant the holder the right to purchase shares at a specific price before expiration, often extending several years. Options, typically short-term contracts traded on exchanges, give investors the right to buy or sell underlying assets within a shorter timeframe, generally months. Unlike options, warrants increase the company's outstanding shares upon exercise, leading to potential dilution, whereas options are settled between investors without affecting the company's share count.

Issuers: Who Creates Warrants versus Options?

Warrants are primarily issued by companies themselves as a way to raise capital, often attached to bonds or preferred stock to make the offering more attractive. Options, in contrast, are created and traded on standardized exchanges by market participants and are not issued by the companies underlying the stocks. This fundamental difference means warrants directly impact the issuer's equity structure, while options serve as derivative contracts traded among investors.

Lifespan and Expiry: Warrants vs Options Duration

Warrants typically have a longer lifespan, often lasting several years, compared to options which usually expire within weeks or months. The extended duration of warrants allows investors more time to benefit from potential price movements, whereas options require quicker strategic decisions due to their shorter expiry. This difference in lifespan significantly affects trading strategies and risk management in financial markets.

Pricing Mechanics: How Warrants and Options Are Valued

Warrants are valued based on the underlying stock price, strike price, time to expiration, volatility, risk-free interest rate, and dividends, often using models like Black-Scholes adjusted for dilution effects. Options pricing also relies on the Black-Scholes or binomial models but excludes dilution since options derive from existing shares, resulting in different impacts on stock value. The intrinsic value and time value components are critical in both, with warrants generally carrying longer maturities and a dilution premium reflected in their pricing mechanics.

Dilution Impact: Warrants and Company Shares

Warrants often lead to greater dilution impact on company shares compared to options due to the issuance of new shares upon exercise, increasing the total share count and potentially reducing existing shareholders' ownership percentage. Options typically involve shares held in treasury or repurchased shares, minimizing additional share issuance and dilution risk. Understanding the dilution effects of warrants is crucial for investors evaluating potential changes in equity value and voting power.

Trading and Liquidity: Market Accessibility of Warrants vs Options

Warrants generally offer lower liquidity compared to options due to their issuance by companies and less frequent trading on exchanges, limiting market accessibility for traders. Options, standardized and listed on major exchanges like the CBOE, provide higher liquidity and tighter bid-ask spreads, enhancing ease of entry and exit in trading positions. These liquidity differences impact trading strategies, with options preferred for active traders seeking efficient price discovery and warrants suited for investors targeting longer-term exposure.

Purpose and Strategic Uses in Finance

Warrants are long-term securities issued by companies to raise capital, allowing holders to purchase stock at a specified price, often used for financing and strategic partnerships. Options, typically short-term derivatives traded on exchanges, provide flexibility for hedging, speculation, and income generation without direct company involvement. Both instruments serve distinct strategic purposes: warrants enhance capital structure and investor attraction, while options manage risk and leverage in market positions.

Tax Implications: Warrants vs Options

Warrants often have different tax treatment compared to options, as gains from warrants are typically taxed as capital gains upon exercise or sale, depending on holding periods and local tax laws. Options, especially employee stock options, may incur ordinary income tax upon exercise, with subsequent capital gains tax on the sale of shares, influenced by the type of option--non-qualified or incentive stock options. Understanding the specific tax regulations governing warrants and options is crucial for optimizing after-tax returns and compliance in various jurisdictions.

Investment Risks and Rewards: A Comparative Analysis

Warrants and options both offer leveraged exposure to underlying assets but differ in issuance and expiration terms, affecting investment risks and rewards. Warrants, often issued by companies, can lead to dilution of shares upon exercise, increasing risk for existing shareholders, while options are standardized contracts traded on exchanges with defined expiration dates, providing more liquidity and flexibility. Investors face higher potential rewards with warrants due to longer maturities but must manage the amplified risk from less market liquidity and company-specific factors compared to the more regulated and transparent options market.

Warrants vs Options Infographic

difterm.com

difterm.com