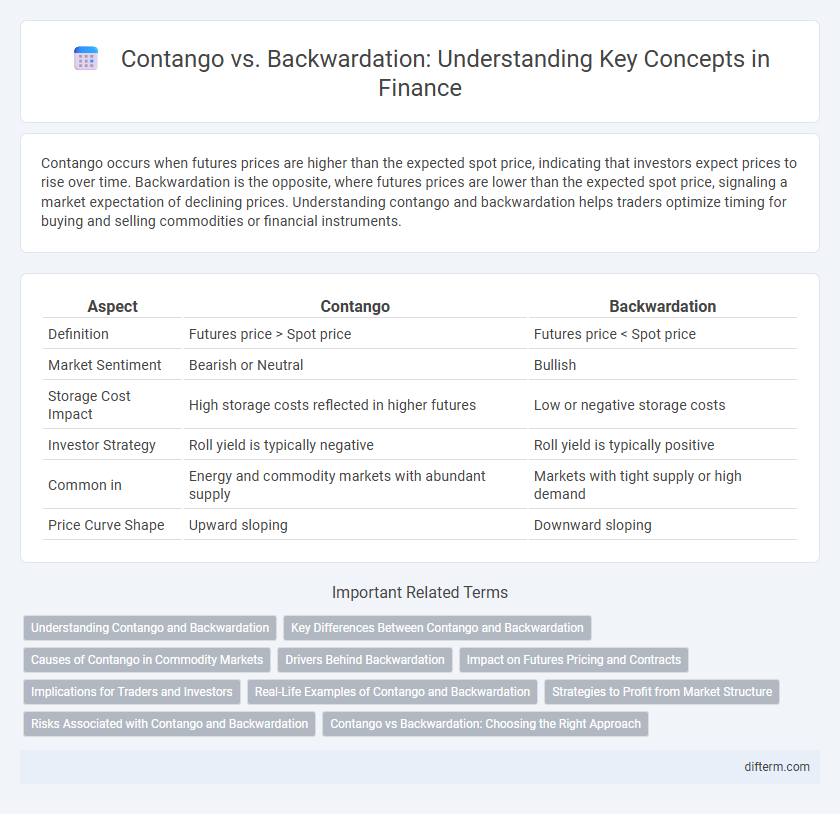

Contango occurs when futures prices are higher than the expected spot price, indicating that investors expect prices to rise over time. Backwardation is the opposite, where futures prices are lower than the expected spot price, signaling a market expectation of declining prices. Understanding contango and backwardation helps traders optimize timing for buying and selling commodities or financial instruments.

Table of Comparison

| Aspect | Contango | Backwardation |

|---|---|---|

| Definition | Futures price > Spot price | Futures price < Spot price |

| Market Sentiment | Bearish or Neutral | Bullish |

| Storage Cost Impact | High storage costs reflected in higher futures | Low or negative storage costs |

| Investor Strategy | Roll yield is typically negative | Roll yield is typically positive |

| Common in | Energy and commodity markets with abundant supply | Markets with tight supply or high demand |

| Price Curve Shape | Upward sloping | Downward sloping |

Understanding Contango and Backwardation

Contango occurs when futures prices are higher than the expected spot price, indicating that the market expects higher prices in the future due to storage costs or carrying charges. Backwardation happens when futures prices are lower than the expected spot price, often signaling supply shortages or high demand for immediate delivery. Understanding these concepts helps traders and investors anticipate market trends and optimize trading strategies in commodities and financial derivatives.

Key Differences Between Contango and Backwardation

Contango describes a market condition where futures prices are higher than the expected spot price at contract maturity, often indicating storage costs or convenience yield factors. Backwardation occurs when futures prices are lower than the expected spot price, signaling scarcity or higher demand for immediate delivery. These opposing states impact trading strategies, risk management, and price forecasting in commodities and financial derivatives markets.

Causes of Contango in Commodity Markets

Contango in commodity markets occurs when future prices exceed spot prices due to factors such as storage costs, insurance, and financing expenses embedded in the futures price. Market expectations of rising supply or stable demand also contribute to this upward price curve. Seasonal production patterns and logistical constraints frequently exacerbate these cost-driven premiums, reinforcing contango conditions.

Drivers Behind Backwardation

Backwardation occurs when futures prices are lower than the spot price, typically driven by high demand for immediate delivery and limited supply in the underlying commodity. Key drivers include seasonal factors, geopolitical tensions, and storage costs that incentivize holding physical assets rather than contracts. Market expectations of falling prices or excess future supply also contribute to the backwardation structure.

Impact on Futures Pricing and Contracts

Contango occurs when futures prices are higher than the expected future spot prices, causing investors to pay a premium for contracts, which can erode returns in rolling futures positions. Backwardation arises when futures prices are lower than expected future spot prices, offering a potential benefit to futures holders by allowing gains as contract prices rise toward spot prices over time. The impact on futures pricing and contracts includes influencing trading strategies, cost of carry, and risk management approaches for commodities and financial instruments.

Implications for Traders and Investors

Contango, where futures prices exceed spot prices, implies higher carrying costs and may lead traders to incur losses rolling contracts forward, affecting long-term investment strategies. Backwardation, characterized by futures prices below spot prices, signals supply tightness and usually benefits traders who hold contracts to expiration, potentially yielding positive roll yields. Understanding these market conditions helps investors optimize timing and risk management in commodity and futures trading.

Real-Life Examples of Contango and Backwardation

In the oil futures market, contango frequently occurs when current spot prices are lower than future contract prices due to storage costs and expectations of rising demand, as seen during periods of ample supply like in 2020. Backwardation is evident in agricultural commodities such as wheat, where immediate demand or supply disruptions cause spot prices to exceed futures prices, exemplified during harvest supply shortages. These market structures impact trading strategies, inventory management, and risk assessments for producers and investors.

Strategies to Profit from Market Structure

Contango and backwardation describe futures market structures where prices are respectively above or below expected future spot prices, influencing trading strategies. In contango, traders often implement a roll yield strategy by selling expiring contracts and buying longer-dated ones to capitalize on time decay, while in backwardation, holding near-term contracts allows capturing positive roll yields as prices converge upwards. Arbitrage opportunities also arise by exploiting price differentials between spot and futures markets, enabling investors to profit from predictable shifts in market structure.

Risks Associated with Contango and Backwardation

Contango poses risks such as persistent roll losses for investors holding long futures positions, leading to diminished returns when the futures price exceeds the expected spot price at contract maturity. Backwardation carries the risk of sudden price spikes in spot markets that can cause significant volatility and margin calls for short hedgers in futures contracts. Both conditions affect liquidity and hedging effectiveness, requiring traders and portfolio managers to closely monitor market signals and adjust strategies to mitigate potential financial exposure.

Contango vs Backwardation: Choosing the Right Approach

Contango occurs when futures prices are higher than the expected spot price, indicating a market expectation of rising prices, while backwardation reflects futures prices below the expected spot price, signaling anticipated price declines. Choosing the right approach depends on factors such as market sentiment, storage costs, and the underlying asset's supply and demand dynamics. Investors must analyze these elements to optimize trading strategies and hedge effectively against price movements in commodity and financial markets.

Contango vs Backwardation Infographic

difterm.com

difterm.com