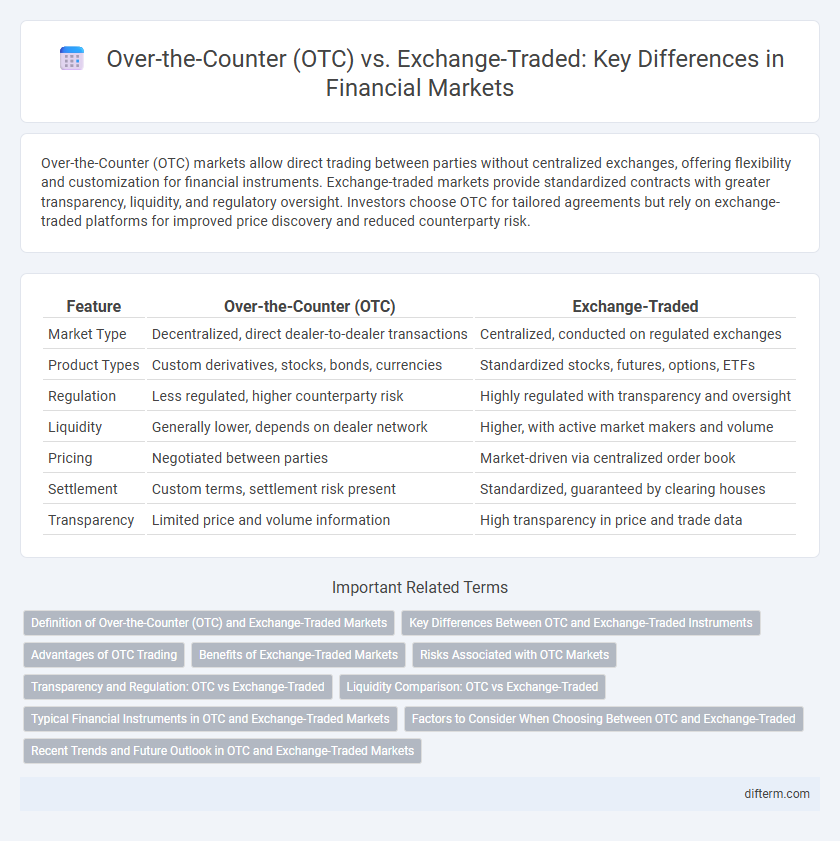

Over-the-Counter (OTC) markets allow direct trading between parties without centralized exchanges, offering flexibility and customization for financial instruments. Exchange-traded markets provide standardized contracts with greater transparency, liquidity, and regulatory oversight. Investors choose OTC for tailored agreements but rely on exchange-traded platforms for improved price discovery and reduced counterparty risk.

Table of Comparison

| Feature | Over-the-Counter (OTC) | Exchange-Traded |

|---|---|---|

| Market Type | Decentralized, direct dealer-to-dealer transactions | Centralized, conducted on regulated exchanges |

| Product Types | Custom derivatives, stocks, bonds, currencies | Standardized stocks, futures, options, ETFs |

| Regulation | Less regulated, higher counterparty risk | Highly regulated with transparency and oversight |

| Liquidity | Generally lower, depends on dealer network | Higher, with active market makers and volume |

| Pricing | Negotiated between parties | Market-driven via centralized order book |

| Settlement | Custom terms, settlement risk present | Standardized, guaranteed by clearing houses |

| Transparency | Limited price and volume information | High transparency in price and trade data |

Definition of Over-the-Counter (OTC) and Exchange-Traded Markets

Over-the-Counter (OTC) markets are decentralized platforms where securities, currencies, and derivatives are traded directly between parties without a centralized exchange. Exchange-traded markets involve standardized contracts and securities traded on regulated exchanges like the NYSE or NASDAQ, ensuring greater transparency and liquidity. OTC transactions often provide flexibility in contract terms but carry higher counterparty risk compared to exchange-traded instruments.

Key Differences Between OTC and Exchange-Traded Instruments

Over-the-counter (OTC) instruments are traded directly between parties without a centralized exchange, leading to less transparency and higher counterparty risk compared to exchange-traded instruments, which operate on regulated exchanges with standardized contracts and greater liquidity. Exchange-traded instruments benefit from price discovery due to continuous market quotes, while OTC markets offer customization and flexibility in contract terms tailored to specific investor needs. Regulatory oversight is more stringent for exchange-traded products, providing enhanced investor protection absent in many OTC transactions.

Advantages of OTC Trading

Over-the-Counter (OTC) trading offers greater flexibility by allowing parties to negotiate customized contracts tailored to their specific needs, unlike standardized exchange-traded products. OTC markets enable access to a wider range of financial instruments, including derivatives, currencies, and debt securities that may not be listed on formal exchanges. This decentralized structure often results in lower transaction costs and less regulatory oversight, enhancing privacy and efficiency for institutional investors and corporations.

Benefits of Exchange-Traded Markets

Exchange-traded markets offer enhanced transparency and standardized contract terms, reducing counterparty risk for investors. They provide greater liquidity, enabling faster execution and efficient price discovery through centralized order books. Regulatory oversight ensures market integrity and protects participants from fraud, fostering investor confidence.

Risks Associated with OTC Markets

Over-the-Counter (OTC) markets involve higher counterparty risk due to the absence of centralized clearinghouses, increasing the potential for default. Lack of standardized contracts and reduced transparency in OTC trades can lead to pricing inefficiencies and difficulties in assessing true market value. Regulatory oversight is typically less stringent in OTC markets, heightening the risk of fraud, manipulation, and limited investor protection compared to exchange-traded venues.

Transparency and Regulation: OTC vs Exchange-Traded

Exchange-traded markets offer higher transparency through centralized reporting and standardized contracts, enabling easier price discovery and regulatory oversight. Over-the-counter (OTC) markets lack centralized exchanges, resulting in less transparency and weaker regulatory enforcement, which can increase counterparty risk. Regulatory bodies impose stricter compliance and disclosure requirements on exchange-traded instruments compared to the relatively flexible and less regulated OTC markets.

Liquidity Comparison: OTC vs Exchange-Traded

Over-the-counter (OTC) markets generally exhibit lower liquidity compared to exchange-traded markets due to the absence of centralized trading platforms and standardized contracts, resulting in wider bid-ask spreads and less price transparency. Exchange-traded instruments benefit from centralized order books, attracting greater participant volume and thus enhancing liquidity and price discovery efficiency. High liquidity in exchange-traded markets reduces transaction costs and execution risk, providing investors with faster trade execution and reliable market prices.

Typical Financial Instruments in OTC and Exchange-Traded Markets

Typical financial instruments in Over-the-Counter (OTC) markets include derivatives such as swaps, forwards, and bespoke contracts tailored to specific counterparty needs. Exchange-traded markets primarily feature standardized instruments like stocks, bonds, futures, and options that are regulated and traded on formal exchanges. The OTC market offers flexibility and customization, while exchange-traded instruments benefit from greater transparency and liquidity.

Factors to Consider When Choosing Between OTC and Exchange-Traded

Liquidity and transparency are critical factors when choosing between Over-the-Counter (OTC) and exchange-traded markets; exchange-traded instruments typically offer higher liquidity and centralized pricing, reducing counterparty risk. Regulatory oversight differs significantly, with exchange-traded products subject to stringent regulations and standardized contracts, whereas OTC markets involve customized agreements but bear greater exposure to credit risk. Cost implications, including fees and spreads, along with the need for flexibility in contract terms, influence the decision based on trading objectives and risk tolerance.

Recent Trends and Future Outlook in OTC and Exchange-Traded Markets

Recent trends show a significant shift toward digital platforms and increased regulatory oversight in both Over-the-Counter (OTC) and Exchange-Traded markets, enhancing transparency and risk management. The OTC market is experiencing growth in decentralized finance (DeFi) instruments and bilateral trading of complex derivatives, while Exchange-Traded markets benefit from automated trading systems and increased participation by institutional investors. Future outlook indicates further integration of blockchain technology in OTC transactions and expanded use of artificial intelligence in Exchange-Traded environments to optimize liquidity and pricing efficiency.

Over-the-Counter (OTC) vs Exchange-Traded Infographic

difterm.com

difterm.com