Stocks represent ownership in a company and offer potential dividend income along with capital appreciation, while bonds are debt instruments providing fixed interest payments and return of principal at maturity. Investors seeking higher risk and growth potential typically favor stocks, whereas those prioritizing income stability and lower risk often prefer bonds. Portfolio diversification benefits from balancing these asset classes to optimize risk and return.

Table of Comparison

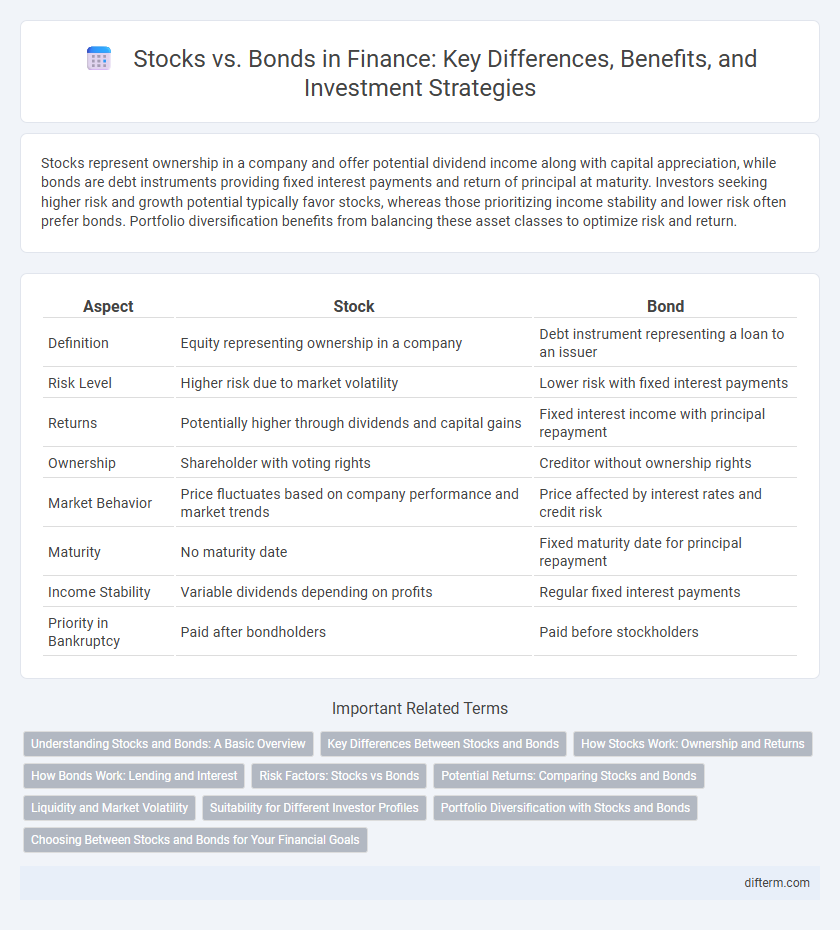

| Aspect | Stock | Bond |

|---|---|---|

| Definition | Equity representing ownership in a company | Debt instrument representing a loan to an issuer |

| Risk Level | Higher risk due to market volatility | Lower risk with fixed interest payments |

| Returns | Potentially higher through dividends and capital gains | Fixed interest income with principal repayment |

| Ownership | Shareholder with voting rights | Creditor without ownership rights |

| Market Behavior | Price fluctuates based on company performance and market trends | Price affected by interest rates and credit risk |

| Maturity | No maturity date | Fixed maturity date for principal repayment |

| Income Stability | Variable dividends depending on profits | Regular fixed interest payments |

| Priority in Bankruptcy | Paid after bondholders | Paid before stockholders |

Understanding Stocks and Bonds: A Basic Overview

Stocks represent ownership shares in a company, granting shareholders voting rights and potential dividends, while bonds are debt instruments where investors lend money to an entity in exchange for fixed interest payments and principal repayment at maturity. Stocks typically offer higher returns with greater risk due to market volatility, whereas bonds provide more stable income streams and lower risk, influenced by credit ratings and interest rate fluctuations. Understanding these fundamental differences helps investors balance portfolios based on risk tolerance, investment goals, and time horizons.

Key Differences Between Stocks and Bonds

Stocks represent ownership shares in a company, entitling investors to dividends and voting rights, while bonds are debt instruments where investors lend money to an issuer in exchange for periodic interest payments and principal repayment at maturity. Stocks typically offer higher potential returns with greater risk and price volatility, whereas bonds provide more stable income streams and lower risk due to fixed interest payments. Understanding the trade-off between equity growth potential and fixed income security is crucial for portfolio diversification and risk management.

How Stocks Work: Ownership and Returns

Stocks represent partial ownership in a company, granting shareholders voting rights and potential dividends based on the company's profitability. Shareholders earn returns through capital gains when stock prices appreciate, reflecting the company's growth and market demand. These equity investments carry higher risk compared to bonds but offer greater potential rewards tied directly to the company's financial performance.

How Bonds Work: Lending and Interest

Bonds represent a form of lending where investors provide capital to entities such as corporations or governments in exchange for periodic interest payments. These securities typically have a fixed maturity date at which the principal amount is repaid, with interest rates often predetermined or tied to market benchmarks. Understanding bond yield, coupon rates, and credit ratings is essential for evaluating bond investment risks and returns within the broader financial market.

Risk Factors: Stocks vs Bonds

Stocks carry higher risk due to market volatility and the potential for capital loss, while bonds generally pose lower risk with fixed interest payments and principal repayment at maturity. Credit risk affects bonds, as issuers may default, but stocks are subject to business performance risk impacting dividend payments. Liquidity risk varies; stocks often have higher liquidity than bonds, but this depends on the bond's type and market conditions.

Potential Returns: Comparing Stocks and Bonds

Stocks generally offer higher potential returns compared to bonds due to their ownership in companies and exposure to market growth and dividends. Bonds provide more stable and predictable income through fixed interest payments, making them less volatile but with lower yield potential. Investors seeking long-term capital appreciation often favor stocks, while those prioritizing capital preservation and steady income tend to prefer bonds.

Liquidity and Market Volatility

Stocks typically offer higher liquidity compared to bonds, as they are traded more frequently on major exchanges and can be quickly bought or sold. Bond markets often experience lower liquidity, particularly for corporate or municipal bonds, due to limited trading volume and longer settlement periods. Market volatility significantly affects stocks with rapid price fluctuations, while bonds generally exhibit lower volatility but are sensitive to interest rate changes and credit risk.

Suitability for Different Investor Profiles

Stocks suit investors seeking growth and higher returns with tolerance for market volatility, typically younger individuals or those with long-term horizons. Bonds appeal to risk-averse investors prioritizing capital preservation and steady income, often retirees or those nearing retirement. Portfolio diversification strategies commonly combine stocks and bonds to balance risk and reward based on individual financial goals.

Portfolio Diversification with Stocks and Bonds

Incorporating both stocks and bonds in a portfolio enhances diversification by balancing growth potential with income stability. Stocks offer capital appreciation and higher returns with increased volatility, while bonds provide fixed income and lower risk, mitigating overall portfolio fluctuations. This asset allocation strategy optimizes risk-adjusted returns, especially during market turbulence.

Choosing Between Stocks and Bonds for Your Financial Goals

Selecting between stocks and bonds depends on your risk tolerance, investment timeline, and income needs. Stocks offer higher growth potential but come with increased volatility, making them suitable for long-term goals and wealth accumulation. Bonds provide more stability and predictable income, ideal for conservative investors seeking capital preservation and regular interest payments.

Stock vs Bond Infographic

difterm.com

difterm.com