Revenue recognition records income when earned, aligning with accounting standards, while cash collection tracks actual receipt of funds. Companies must distinguish between these to ensure accurate financial statements and avoid misstating profitability. Proper management of both processes is critical for maintaining liquidity and reflecting true business performance.

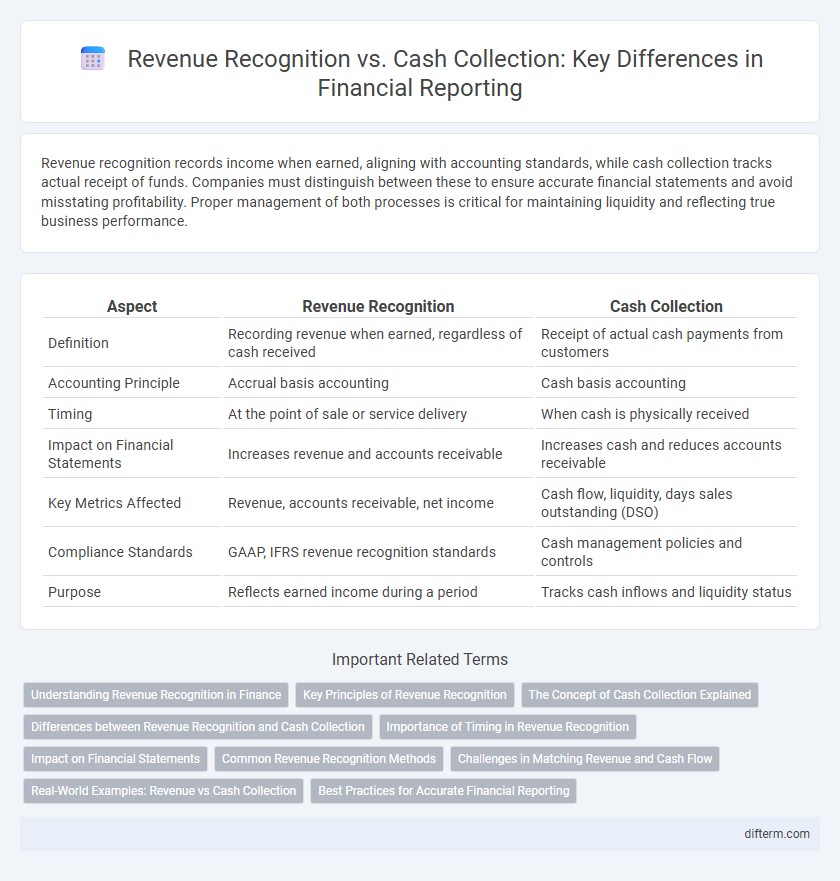

Table of Comparison

| Aspect | Revenue Recognition | Cash Collection |

|---|---|---|

| Definition | Recording revenue when earned, regardless of cash received | Receipt of actual cash payments from customers |

| Accounting Principle | Accrual basis accounting | Cash basis accounting |

| Timing | At the point of sale or service delivery | When cash is physically received |

| Impact on Financial Statements | Increases revenue and accounts receivable | Increases cash and reduces accounts receivable |

| Key Metrics Affected | Revenue, accounts receivable, net income | Cash flow, liquidity, days sales outstanding (DSO) |

| Compliance Standards | GAAP, IFRS revenue recognition standards | Cash management policies and controls |

| Purpose | Reflects earned income during a period | Tracks cash inflows and liquidity status |

Understanding Revenue Recognition in Finance

Revenue recognition in finance involves recording revenue when it is earned, regardless of when cash is received, following accounting standards such as GAAP or IFRS. This method ensures financial statements reflect the true economic activity and performance of a business by matching revenue with corresponding expenses. Differentiating revenue recognition from cash collection is crucial for accurate financial analysis and maintaining compliance with regulatory requirements.

Key Principles of Revenue Recognition

Revenue recognition requires recording revenue when earned, following criteria such as transfer of control, measurability of amount, and collectibility likelihood, rather than upon cash receipt. Key principles include identifying contracts, performance obligations, transaction price allocation, and satisfying performance obligations to recognize revenue accurately. Cash collection impacts cash flow but does not determine revenue recognition timing under accrual accounting standards like IFRS 15 and ASC 606.

The Concept of Cash Collection Explained

Cash collection refers to the actual receipt of cash from customers, distinct from revenue recognition which records income when earned regardless of payment timing. This process is critical for maintaining liquidity and managing working capital efficiently within a business. Accurate tracking of cash collections ensures effective cash flow management and supports financial stability.

Differences between Revenue Recognition and Cash Collection

Revenue recognition records income when earned, following accrual accounting principles, regardless of cash receipt timing. Cash collection tracks the actual inflow of cash from customers, reflecting liquidity rather than earnings. Key differences impact financial reporting accuracy and cash flow management, with revenue recognition aligning with accounting standards such as GAAP or IFRS, while cash collection focuses on cash flow statements.

Importance of Timing in Revenue Recognition

Accurate timing in revenue recognition is critical for aligning financial statements with economic reality and regulatory standards such as GAAP and IFRS. Recognizing revenue prematurely or delaying it can distort earnings, impacting investor decisions and compliance with audit requirements. Proper timing ensures revenue reflects actual performance and provides a true picture of a company's profitability and cash flow health.

Impact on Financial Statements

Revenue recognition impacts financial statements by recording income when earned, aligning with the accrual accounting principle, which may differ from cash collection timing. Cash collection affects the cash flow statement and liquidity position, reflecting actual cash received rather than reported revenue. Differences between recognized revenue and cash collected can influence accounts receivable and overall financial analysis.

Common Revenue Recognition Methods

Common revenue recognition methods include the percentage-of-completion, completed contract, and sales basis methods, each aligning revenue reporting with different stages of business activities. Percentage-of-completion recognizes revenue proportionally as work progresses, suitable for long-term contracts, while the completed contract method defers revenue until total project completion. In contrast, the sales basis method records revenue at the point of sale, often creating a timing difference from cash collection and impacting financial analysis.

Challenges in Matching Revenue and Cash Flow

Challenges in matching revenue recognition with cash collection arise due to timing differences in recording sales and actual cash inflows, complicating accurate financial reporting. Deferred revenue and accounts receivable create discrepancies between recognized revenue and collected cash, impacting liquidity analysis and decision-making. Effective coordination between accounting policies and cash management systems is essential to align financial statements and improve cash flow forecasting.

Real-World Examples: Revenue vs Cash Collection

Revenue recognition occurs when a company records income based on earned sales or services, such as a software firm recognizing subscription fees monthly regardless of payment timing. Cash collection happens when cash physically arrives, like a manufacturing company receiving payment 30 days after invoicing, creating timing differences between reported revenue and actual cash flow. These discrepancies impact financial analysis by highlighting outstanding receivables and cash flow management effectiveness.

Best Practices for Accurate Financial Reporting

Implementing robust revenue recognition policies aligned with accounting standards such as IFRS 15 and ASC 606 ensures accurate timing and measurement of revenue, avoiding premature or deferred recognition. Integrating automated systems that reconcile revenue with cash collection data enhances the reliability of financial statements by identifying discrepancies and minimizing errors. Regular audits and cross-functional collaboration between accounting, sales, and treasury teams foster transparency and compliance, supporting precise financial reporting and improved decision-making.

Revenue Recognition vs Cash Collection Infographic

difterm.com

difterm.com