Underwriting involves a financial institution assuming the risk of buying securities from an issuer and reselling them to investors, ensuring capital raise is secured. Syndication distributes this risk across multiple financial institutions, allowing for shared participation in large financing deals like loans or bond issuances. Both underwriting and syndication are critical in managing risk and maximizing capital efficiency in complex financial transactions.

Table of Comparison

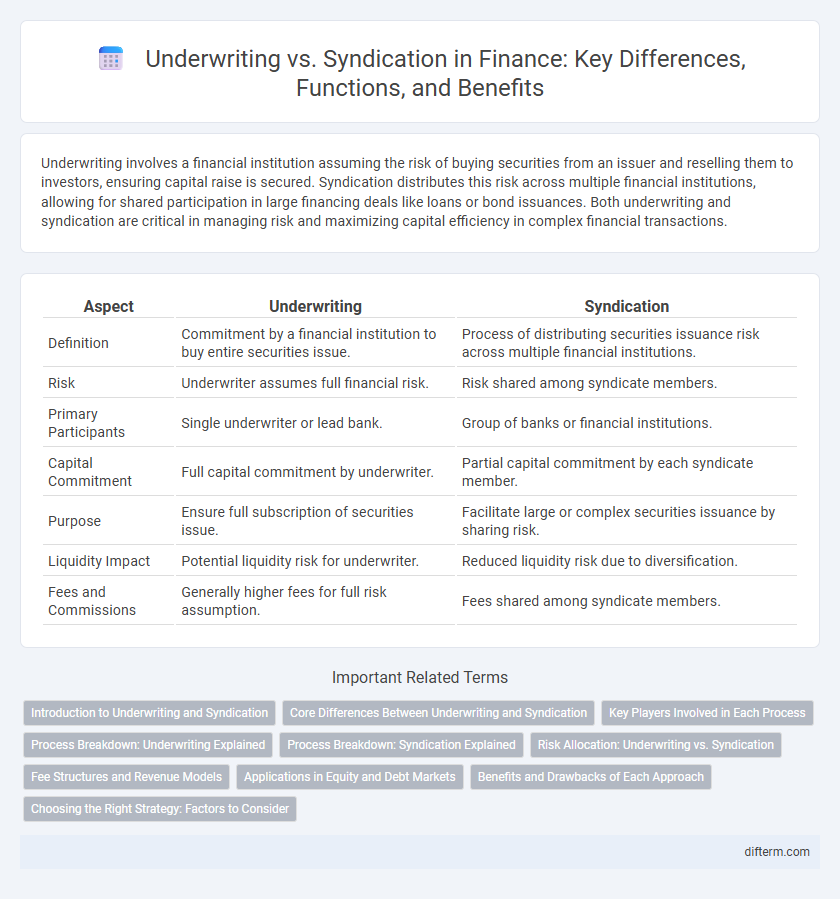

| Aspect | Underwriting | Syndication |

|---|---|---|

| Definition | Commitment by a financial institution to buy entire securities issue. | Process of distributing securities issuance risk across multiple financial institutions. |

| Risk | Underwriter assumes full financial risk. | Risk shared among syndicate members. |

| Primary Participants | Single underwriter or lead bank. | Group of banks or financial institutions. |

| Capital Commitment | Full capital commitment by underwriter. | Partial capital commitment by each syndicate member. |

| Purpose | Ensure full subscription of securities issue. | Facilitate large or complex securities issuance by sharing risk. |

| Liquidity Impact | Potential liquidity risk for underwriter. | Reduced liquidity risk due to diversification. |

| Fees and Commissions | Generally higher fees for full risk assumption. | Fees shared among syndicate members. |

Introduction to Underwriting and Syndication

Underwriting in finance involves a financial institution assessing and assuming the risk of new securities issuance, guaranteeing the sale by purchasing the entire issue before reselling it to investors. Syndication refers to a group of banks or financial institutions collaborating to underwrite and distribute large loans or securities, sharing the risk and capital requirements. Both processes are crucial for raising capital efficiently while managing risk exposure in complex financial transactions.

Core Differences Between Underwriting and Syndication

Underwriting involves a financial institution assuming full risk by purchasing an entire securities issue before reselling to investors, ensuring capital is raised promptly. Syndication distributes underwriting risk among multiple financial entities by forming a group that collectively finances and markets the securities offering. The core difference lies in risk allocation: underwriting centralizes risk with one underwriter, while syndication spreads exposure across several participants, enhancing capital mobilization and mitigating individual financial risk.

Key Players Involved in Each Process

Underwriting in finance primarily involves investment banks or financial institutions that assess risk and commit capital to purchase securities before selling them to investors, ensuring the issuer receives the necessary funds. Syndication, on the other hand, includes a group of banks or lenders collaborating to share the risk and distribute the loan or bond issuance among multiple parties, typically coordinated by a lead arranger or agent bank. Key players in underwriting are lead underwriters and co-managers, while syndication features lead arrangers, participant banks, and sometimes institutional investors as downstream buyers.

Process Breakdown: Underwriting Explained

Underwriting in finance involves assessing the risk and establishing the terms for issuing securities, typically bonds or stocks, by evaluating the issuer's financial health and market conditions. The underwriter commits to purchasing the entire issue at a predetermined price, assuming the risk of selling the securities to investors. This process ensures capital availability for issuers while transferring risk to underwriters who manage pricing, regulatory compliance, and distribution.

Process Breakdown: Syndication Explained

Syndication is a collaborative process where multiple financial institutions jointly underwrite and distribute a large loan or bond issuance to spread risk and increase funding capacity. The lead underwriter structures the deal and negotiates terms, while syndicate members commit capital and share in the lending or investment proportionally. This process enhances liquidity, diversifies credit exposure, and enables access to larger financing deals than a single institution could manage alone.

Risk Allocation: Underwriting vs. Syndication

Underwriting involves a single financial institution assuming the entire risk of a security issuance, ensuring full commitment but higher exposure. Syndication spreads the risk by involving multiple investors or banks, reducing individual liability and enhancing capital distribution. This allocation strategy influences the stability and capacity of the issuance market.

Fee Structures and Revenue Models

Underwriting fees typically include a percentage of the total capital raised, offering direct compensation for risk assumption and capital commitment, usually ranging from 1% to 3% of the deal size. Syndication generates revenue through arranged fees and management fees, often involving a smaller underwriting commitment but earning ongoing income from managing portions of the loan or securities. Both models balance upfront fees and ongoing revenue streams, impacting the overall profitability and risk exposure for financial institutions.

Applications in Equity and Debt Markets

Underwriting in equity and debt markets involves a financial institution purchasing securities directly from the issuer to assume risk and guarantee capital raising, commonly seen in initial public offerings (IPOs) and bond issuances. Syndication, often used in debt markets, entails multiple lenders or investors jointly financing a large loan or bond issuance to spread risk and increase funding capacity, frequently applied in leveraged buyouts and infrastructure projects. Both processes enable efficient capital mobilization but differ in risk distribution, with underwriting concentrating risk on the lead underwriter, while syndication disperses it across multiple parties.

Benefits and Drawbacks of Each Approach

Underwriting offers issuers the benefit of guaranteed capital by having the underwriter purchase the entire issue, providing certainty and swift access to funds, but it involves higher risk for the underwriter and can lead to increased costs for the issuer due to fees and potential pricing discounts. Syndication spreads risk among multiple financial institutions, allowing for larger deals and diversified exposure while reducing the burden on any single entity, though it may result in longer deal execution times and complex coordination. Choosing between underwriting and syndication depends on factors such as risk tolerance, deal size, market conditions, and the issuer's need for speed versus flexibility.

Choosing the Right Strategy: Factors to Consider

Choosing the right strategy between underwriting and syndication involves evaluating factors such as risk tolerance, capital availability, and market conditions. Underwriting suits firms aiming for higher control and immediate capital commitment, while syndication distributes risk among multiple participants, enhancing funding capacity. Assessing deal size, investor appetite, and cost implications guides optimal strategy selection for financial transactions.

Underwriting vs Syndication Infographic

difterm.com

difterm.com