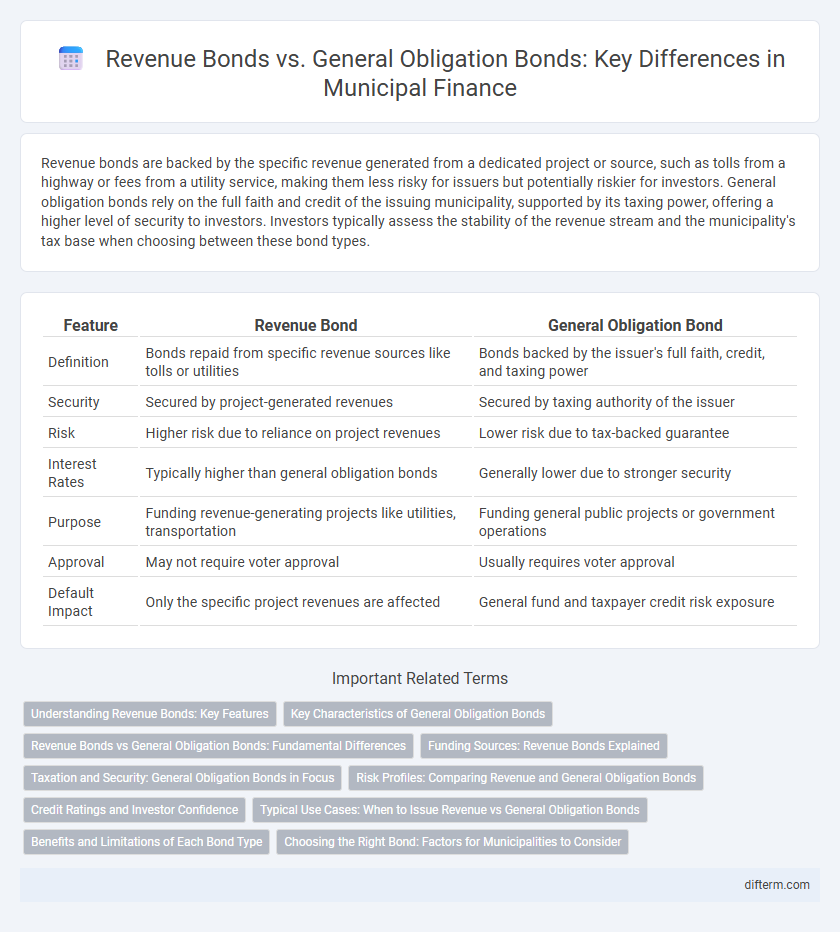

Revenue bonds are backed by the specific revenue generated from a dedicated project or source, such as tolls from a highway or fees from a utility service, making them less risky for issuers but potentially riskier for investors. General obligation bonds rely on the full faith and credit of the issuing municipality, supported by its taxing power, offering a higher level of security to investors. Investors typically assess the stability of the revenue stream and the municipality's tax base when choosing between these bond types.

Table of Comparison

| Feature | Revenue Bond | General Obligation Bond |

|---|---|---|

| Definition | Bonds repaid from specific revenue sources like tolls or utilities | Bonds backed by the issuer's full faith, credit, and taxing power |

| Security | Secured by project-generated revenues | Secured by taxing authority of the issuer |

| Risk | Higher risk due to reliance on project revenues | Lower risk due to tax-backed guarantee |

| Interest Rates | Typically higher than general obligation bonds | Generally lower due to stronger security |

| Purpose | Funding revenue-generating projects like utilities, transportation | Funding general public projects or government operations |

| Approval | May not require voter approval | Usually requires voter approval |

| Default Impact | Only the specific project revenues are affected | General fund and taxpayer credit risk exposure |

Understanding Revenue Bonds: Key Features

Revenue bonds are municipal bonds secured by specific revenue sources such as tolls, utility fees, or lease payments rather than general tax revenues. These bonds typically finance projects that generate a dedicated income stream, allowing repayment directly from the associated revenues. Investors assess the reliability of the revenue source and project cash flows to evaluate the bond's credit risk and potential returns.

Key Characteristics of General Obligation Bonds

General obligation bonds are secured by the full faith and credit of the issuing municipality, relying on the government's taxing power for repayment, which generally makes them lower risk compared to revenue bonds. These bonds do not depend on specific project revenues but on general taxes such as property or income taxes, providing a stable and predictable source of funds. Investors prefer general obligation bonds for their strong credit backing and lower default risk, making them attractive in public finance.

Revenue Bonds vs General Obligation Bonds: Fundamental Differences

Revenue bonds are repaid solely from specific revenue sources generated by the financed project, such as tolls from a bridge or fees from a utility system, reducing the issuer's reliance on general taxation. General obligation bonds are backed by the full faith and credit of the issuing government, supported by its taxing authority, making them generally considered lower risk for investors. The key difference lies in revenue bonds' project-specific repayment and limited recourse, while general obligation bonds represent a broader financial commitment secured by the issuer's overall fiscal capacity.

Funding Sources: Revenue Bonds Explained

Revenue bonds are repaid from specific revenue streams generated by the financed project, such as tolls from a highway or fees from a utility service, ensuring dedicated funding sources. Unlike general obligation bonds, which rely on the issuer's taxing power for repayment, revenue bonds do not impose a tax burden on the general population. Investors evaluate revenue bonds based on the project's projected income, making the bond's creditworthiness closely tied to the operational success of the underlying asset.

Taxation and Security: General Obligation Bonds in Focus

General Obligation Bonds (GOs) are secured by the issuer's taxing authority, making them a safer investment due to the government's ability to levy taxes for repayment. These bonds typically benefit from tax-exempt status on interest income at the federal and often state levels, enhancing their appeal to investors seeking tax advantages. In contrast, Revenue Bonds rely solely on project-generated revenues for repayment, lacking the broad tax-backed security that characterizes General Obligation Bonds.

Risk Profiles: Comparing Revenue and General Obligation Bonds

Revenue bonds carry higher risk due to their reliance on specific project revenues for debt repayment, subjecting investors to fluctuations in cash flow from tolls, utilities, or fees. General obligation bonds offer lower risk backed by the issuing government's taxing power and creditworthiness, providing more stable and secure returns. Investors typically demand higher yields on revenue bonds to compensate for increased credit and revenue variability compared to the more reliable general obligation bonds.

Credit Ratings and Investor Confidence

Revenue bonds are backed by specific revenue streams from projects, often resulting in credit ratings that reflect the financial health of the revenue source, which can vary significantly and impact investor confidence. General obligation bonds are supported by the full taxing power of the issuer, typically earning higher credit ratings due to the broad tax base, thereby enhancing investor confidence. Investors generally perceive general obligation bonds as lower risk compared to revenue bonds, influencing demand and interest rates in the municipal bond market.

Typical Use Cases: When to Issue Revenue vs General Obligation Bonds

Revenue bonds are typically issued to finance specific projects that generate their own income streams, such as toll roads, utilities, or airports, allowing repayment directly from project revenues. General obligation bonds are backed by the full faith and credit of the issuing government and are commonly used for public works like schools, parks, or infrastructure improvements that benefit the general public. Governments choose revenue bonds when project-specific funding is feasible without tapping into general tax revenues, while general obligation bonds are preferred for broad community investments requiring taxpayer support.

Benefits and Limitations of Each Bond Type

Revenue bonds provide targeted funding by generating repayment through specific project revenues, minimizing impact on taxpayers but carrying higher risk if project cash flows fall short. General obligation bonds offer broader security backed by taxing authority, typically resulting in lower interest rates and higher credit ratings, though they may increase taxpayer burden and are subject to voter approval. Understanding these trade-offs is essential for municipalities balancing financial flexibility, risk tolerance, and community support.

Choosing the Right Bond: Factors for Municipalities to Consider

Municipalities must evaluate creditworthiness, pledged revenue sources, and project-specific benefits when choosing between revenue bonds and general obligation bonds. Revenue bonds rely on income from specific projects, requiring strong revenue forecasts and dedicated repayment streams to mitigate investor risk. General obligation bonds depend on the issuer's full taxing authority, offering lower yields but enhanced credit security and voter approval requirements.

Revenue bond vs general obligation bond Infographic

difterm.com

difterm.com