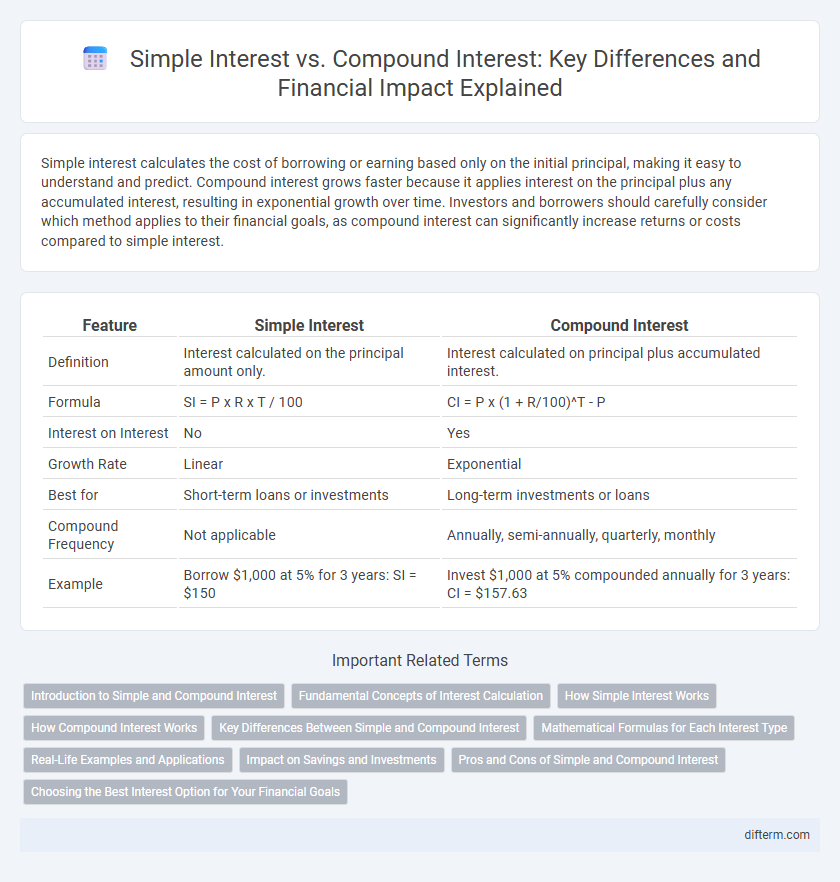

Simple interest calculates the cost of borrowing or earning based only on the initial principal, making it easy to understand and predict. Compound interest grows faster because it applies interest on the principal plus any accumulated interest, resulting in exponential growth over time. Investors and borrowers should carefully consider which method applies to their financial goals, as compound interest can significantly increase returns or costs compared to simple interest.

Table of Comparison

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Definition | Interest calculated on the principal amount only. | Interest calculated on principal plus accumulated interest. |

| Formula | SI = P x R x T / 100 | CI = P x (1 + R/100)^T - P |

| Interest on Interest | No | Yes |

| Growth Rate | Linear | Exponential |

| Best for | Short-term loans or investments | Long-term investments or loans |

| Compound Frequency | Not applicable | Annually, semi-annually, quarterly, monthly |

| Example | Borrow $1,000 at 5% for 3 years: SI = $150 | Invest $1,000 at 5% compounded annually for 3 years: CI = $157.63 |

Introduction to Simple and Compound Interest

Simple interest calculates earnings or costs based solely on the initial principal amount, using a fixed percentage rate over time, making it straightforward and easy to compute. Compound interest, on the other hand, accrues on both the initial principal and the accumulated interest from previous periods, leading to exponential growth over time. This key difference significantly impacts long-term investment returns and loan repayment amounts.

Fundamental Concepts of Interest Calculation

Simple interest calculates interest solely on the original principal amount, leading to linear growth over time, whereas compound interest calculates interest on both the principal and accumulated interest, resulting in exponential growth. Understanding the formula S.I. = P x R x T / 100 for simple interest and A = P (1 + R/100)^T for compound interest is essential for accurate financial projections. The fundamental concept lies in the compounding effect, which accelerates wealth accumulation compared to the straightforward approach of simple interest.

How Simple Interest Works

Simple interest calculates interest based solely on the original principal amount throughout the entire investment period, resulting in a fixed interest charge for each time interval. The formula for simple interest is I = P x r x t, where P is the principal, r is the annual interest rate, and t is the time in years. This method is commonly used for short-term loans and investments due to its straightforward calculation and predictability of returns.

How Compound Interest Works

Compound interest works by calculating interest on both the initial principal and the accumulated interest from previous periods, resulting in exponential growth over time. This method reinvests earned interest, which accelerates the increase of the investment or loan balance, especially with frequent compounding intervals like monthly or quarterly. Understanding compound interest is crucial for financial planning, as it maximizes returns on investments and increases costs on borrowed funds compared to simple interest.

Key Differences Between Simple and Compound Interest

Simple interest calculates earnings based solely on the original principal, applying a fixed percentage over time, while compound interest accrues on both the principal and the accumulated interest, leading to exponential growth. The formula for simple interest is I = P x r x t, where P represents principal, r is the annual interest rate, and t denotes time, whereas compound interest follows A = P(1 + r/n)^(nt), incorporating compounding frequency n. Compound interest typically yields higher returns over long periods due to interest-on-interest effects, making it ideal for savings and investment growth compared to the linear nature of simple interest.

Mathematical Formulas for Each Interest Type

Simple interest is calculated using the formula I = P x r x t, where I represents the interest earned, P is the principal amount, r is the annual interest rate, and t is the time in years. Compound interest is determined by the formula A = P (1 + r/n)^(nt), where A is the amount after interest, P is the principal, r is the annual interest rate, n is the number of compounding periods per year, and t is the time in years. Understanding these formulas helps in accurately comparing returns on investments based on the interest calculation method.

Real-Life Examples and Applications

Simple interest applies to short-term loans like personal or car loans where interest is calculated only on the principal amount, making it easier to predict total repayment. Compound interest is common in savings accounts, credit cards, and mortgages, where interest accrues on both the principal and previously earned interest, significantly increasing the amount over time. Understanding these differences helps individuals make informed decisions about borrowing, investing, and managing debt effectively.

Impact on Savings and Investments

Simple interest calculates returns based only on the original principal, resulting in linear growth over time, which limits the impact on long-term savings and investments. Compound interest reinvests earned interest, generating exponential growth by earning interest on both the principal and accumulated interest, significantly increasing investment value over extended periods. Understanding the difference deeply influences strategies for maximizing wealth accumulation in retirement plans, savings accounts, and investment portfolios.

Pros and Cons of Simple and Compound Interest

Simple interest offers clear and predictable calculations, making it easier to understand and manage for short-term loans or investments, but it typically yields lower returns compared to compound interest. Compound interest accelerates wealth growth by reinvesting earnings, which benefits long-term investments, yet it involves more complex calculations and can lead to higher total debt for borrowers. Choosing between simple and compound interest depends on factors like investment duration, risk tolerance, and financial goals.

Choosing the Best Interest Option for Your Financial Goals

Simple interest calculates returns on the original principal only, making it ideal for short-term loans or investments with a fixed duration. Compound interest reinvests earnings, generating exponential growth over time, which benefits long-term financial goals like retirement savings or education funds. Evaluate the investment timeframe, risk tolerance, and liquidity needs to select the best interest type that aligns with your financial objectives.

Simple Interest vs Compound Interest Infographic

difterm.com

difterm.com