Recourse loans allow lenders to pursue the borrower's personal assets if the loan defaults, providing greater security for lenders but higher risk for borrowers. Non-recourse loans limit the lender's recovery to the collateral only, typically the financed asset, offering more protection to borrowers but stricter qualification criteria. Understanding the differences between recourse and non-recourse loans is crucial for managing financial risk and making informed borrowing decisions.

Table of Comparison

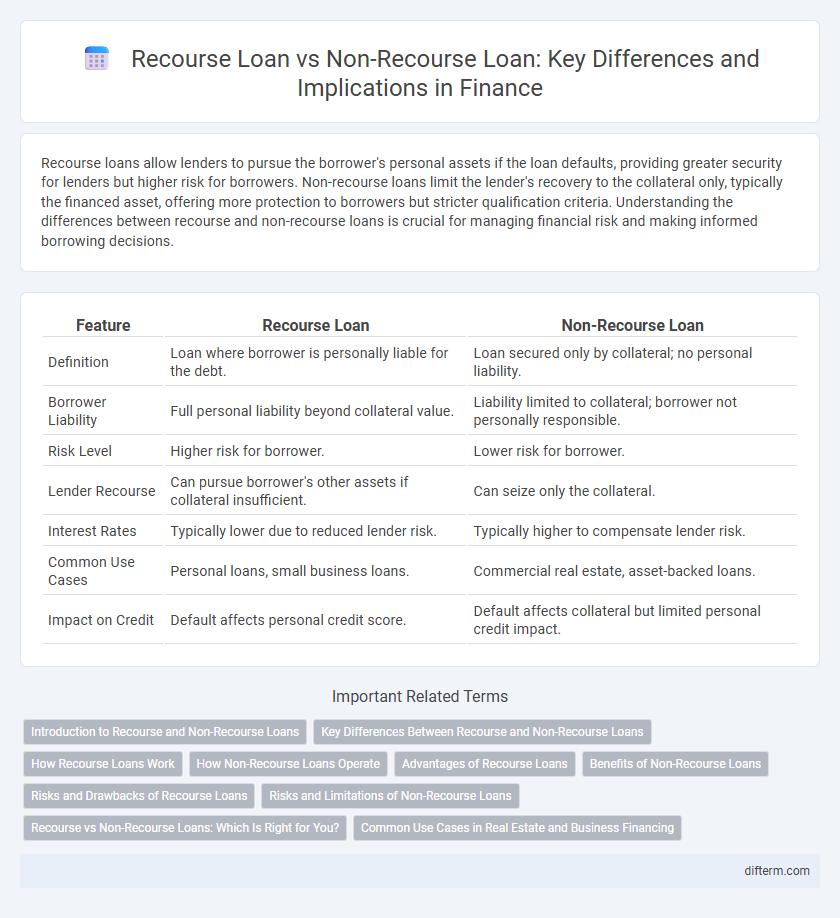

| Feature | Recourse Loan | Non-Recourse Loan |

|---|---|---|

| Definition | Loan where borrower is personally liable for the debt. | Loan secured only by collateral; no personal liability. |

| Borrower Liability | Full personal liability beyond collateral value. | Liability limited to collateral; borrower not personally responsible. |

| Risk Level | Higher risk for borrower. | Lower risk for borrower. |

| Lender Recourse | Can pursue borrower's other assets if collateral insufficient. | Can seize only the collateral. |

| Interest Rates | Typically lower due to reduced lender risk. | Typically higher to compensate lender risk. |

| Common Use Cases | Personal loans, small business loans. | Commercial real estate, asset-backed loans. |

| Impact on Credit | Default affects personal credit score. | Default affects collateral but limited personal credit impact. |

Introduction to Recourse and Non-Recourse Loans

Recourse loans require the borrower to personally guarantee repayment, meaning lenders can pursue the borrower's other assets if loan collateral is insufficient. Non-recourse loans limit lender recovery to the collateral exclusively, protecting the borrower's personal assets from claims beyond the secured property. Understanding the distinctions between these loan types is critical for risk management and financial planning in lending agreements.

Key Differences Between Recourse and Non-Recourse Loans

Recourse loans allow lenders to pursue the borrower's personal assets beyond the collateral if the loan defaults, increasing the borrower's financial liability. Non-recourse loans restrict lender recovery to the collateral alone, limiting borrower risk but often resulting in higher interest rates due to increased lender exposure. Key differences include borrower liability extent, risk allocation, and collateral enforcement in these financing options.

How Recourse Loans Work

Recourse loans allow lenders to claim the borrower's assets beyond the collateral if the loan defaults, providing greater security for lenders. Borrowers remain personally liable, meaning the lender can pursue wage garnishment or other assets to recover outstanding debt. This type of loan typically offers lower interest rates due to reduced lender risk compared to non-recourse loans.

How Non-Recourse Loans Operate

Non-recourse loans operate by limiting the lender's claim strictly to the collateral specified in the loan agreement, often real estate or other tangible assets, without the borrower's personal assets at risk. In these loans, if the borrower defaults, the lender can seize the collateral but cannot pursue the borrower's other properties or income. This structure provides borrowers protection against additional financial liability beyond the collateral's value, influencing risk assessment and interest rate determination in the finance industry.

Advantages of Recourse Loans

Recourse loans offer lenders greater security by allowing them to pursue the borrower's personal assets beyond the collateral, reducing credit risk and potentially resulting in lower interest rates. Borrowers may benefit from more flexible financing terms and increased loan availability due to the higher lender confidence. These loans also incentivize responsible borrowing and repayment behavior, aligning the interests of both parties.

Benefits of Non-Recourse Loans

Non-recourse loans limit borrower liability to the collateral, protecting personal assets from claims if the loan defaults. This feature reduces risk exposure, making non-recourse loans attractive for real estate investors seeking asset protection. Lenders typically charge higher interest rates to compensate for increased risk, but the borrower benefits from capped financial responsibility.

Risks and Drawbacks of Recourse Loans

Recourse loans expose borrowers to significant personal liability, as lenders can pursue personal assets beyond the collateral if the loan defaults. This increased risk often results in stricter lending terms and higher interest rates compared to non-recourse loans. Borrowers may face greater financial instability and potential legal consequences under recourse loan agreements.

Risks and Limitations of Non-Recourse Loans

Non-recourse loans limit borrower liability to the collateral securing the loan, exposing lenders to higher credit risk and often resulting in stricter eligibility criteria and higher interest rates. Borrowers face constraints in loan amounts and property types due to lenders' reduced ability to recover losses beyond the collateral. The risk of potential default impacts lender willingness, affecting loan availability and terms in real estate and corporate financing contexts.

Recourse vs Non-Recourse Loans: Which Is Right for You?

Recourse loans require the borrower to personally guarantee repayment, allowing lenders to pursue personal assets if the loan defaults, which increases lender protection but higher borrower risk. Non-recourse loans restrict lender claims to the collateral only, limiting borrower liability but often entail higher interest rates or stricter approval criteria. Choosing between recourse vs non-recourse loans depends on your risk tolerance, asset protection priorities, and willingness to accept potential higher borrowing costs.

Common Use Cases in Real Estate and Business Financing

Recourse loans are commonly used in real estate investments where lenders seek personal guarantees, allowing them to pursue the borrower's personal assets if the collateral defaults, typical in residential and small commercial property financing. Non-recourse loans are preferred in large commercial real estate projects and business acquisitions, limiting lender recovery strictly to the collateral and protecting the borrower's other assets. Businesses often choose recourse loans for lower interest rates and better terms, while non-recourse loans offer risk mitigation when project viability is uncertain.

Recourse Loan vs Non-Recourse Loan Infographic

difterm.com

difterm.com