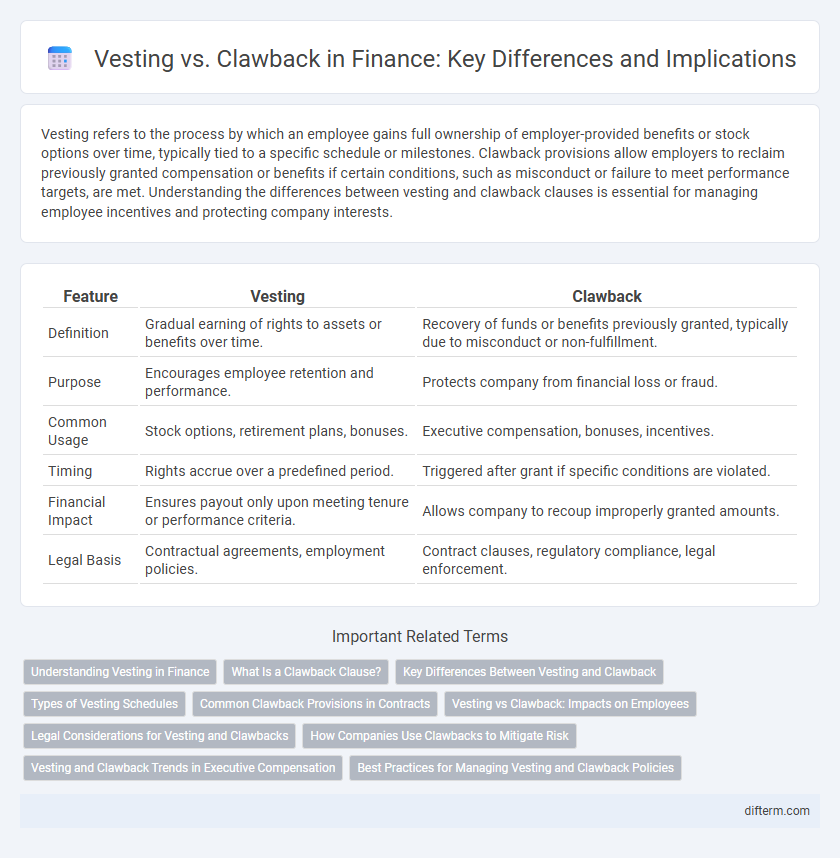

Vesting refers to the process by which an employee gains full ownership of employer-provided benefits or stock options over time, typically tied to a specific schedule or milestones. Clawback provisions allow employers to reclaim previously granted compensation or benefits if certain conditions, such as misconduct or failure to meet performance targets, are met. Understanding the differences between vesting and clawback clauses is essential for managing employee incentives and protecting company interests.

Table of Comparison

| Feature | Vesting | Clawback |

|---|---|---|

| Definition | Gradual earning of rights to assets or benefits over time. | Recovery of funds or benefits previously granted, typically due to misconduct or non-fulfillment. |

| Purpose | Encourages employee retention and performance. | Protects company from financial loss or fraud. |

| Common Usage | Stock options, retirement plans, bonuses. | Executive compensation, bonuses, incentives. |

| Timing | Rights accrue over a predefined period. | Triggered after grant if specific conditions are violated. |

| Financial Impact | Ensures payout only upon meeting tenure or performance criteria. | Allows company to recoup improperly granted amounts. |

| Legal Basis | Contractual agreements, employment policies. | Contract clauses, regulatory compliance, legal enforcement. |

Understanding Vesting in Finance

Vesting in finance refers to the process by which an employee earns the right to full ownership of employer-provided benefits, such as stock options or retirement contributions, over a specified period. The vesting schedule dictates the timeline and conditions under which these benefits become non-forfeitable, aligning employee incentives with company growth. Understanding vesting is essential to evaluate the timing of asset ownership and potential tax implications related to deferred compensation plans.

What Is a Clawback Clause?

A clawback clause is a contractual provision that allows an employer to reclaim bonuses, stock options, or other incentives from employees if certain conditions are not met, such as misconduct or failure to meet performance targets. This mechanism protects companies from financial losses due to employee actions that negatively impact the organization after compensation has been awarded. Clawback clauses are increasingly common in executive compensation agreements to ensure accountability and align incentives with long-term company performance.

Key Differences Between Vesting and Clawback

Vesting refers to the process by which an employee earns rights to employer-provided benefits or stock options over time, solidifying their ownership based on predefined schedules. Clawback provisions allow a company to reclaim previously granted compensation or benefits if certain conditions, such as fraud or violation of company policies, are met. Unlike vesting, which establishes entitlement, clawbacks serve as a risk management tool to recover funds after distribution.

Types of Vesting Schedules

Types of vesting schedules include Cliff Vesting, where employees receive 100% of their benefits after a specific period, and Graded Vesting, which grants incremental ownership over time, typically annually. Hybrid Vesting combines elements of both, requiring an initial cliff period before graded vesting begins. These schedules impact employee retention and equity distribution in finance, influencing strategic compensation planning.

Common Clawback Provisions in Contracts

Common clawback provisions in finance contracts typically require executives to return bonuses or incentives if financial statements are restated due to misconduct or error. These provisions protect companies by ensuring compensation aligns with long-term performance and ethical standards. Clawbacks often complement vesting schedules by imposing post-vesting conditions that reinforce accountability and risk management.

Vesting vs Clawback: Impacts on Employees

Vesting establishes employees' rights to stock options or retirement benefits over time, promoting long-term commitment and retention. Clawback provisions empower employers to recover previously granted compensation due to misconduct or failure to meet performance metrics, which can deter unethical behavior. The interplay between vesting schedules and clawback clauses shapes employee motivation, job security perception, and overall trust in the compensation system.

Legal Considerations for Vesting and Clawbacks

Legal considerations for vesting and clawbacks hinge on well-drafted contractual agreements that clearly define the conditions under which equity or compensation is earned or can be reclaimed. Vesting schedules must comply with employment laws and securities regulations to ensure enforceability, while clawback provisions require explicit terms detailing misconduct or financial restatements that trigger repayment. Courts generally uphold clawbacks when they are reasonable, transparent, and supported by documented policies aligned with corporate governance standards.

How Companies Use Clawbacks to Mitigate Risk

Companies implement clawback provisions to reclaim executive compensation in cases of financial restatements, misconduct, or failure to meet performance targets. These clawback mechanisms deter fraudulent activities and ensure alignment between management incentives and long-term shareholder interests. By enforcing clawbacks, firms reduce risk exposure and promote accountability in executive compensation structures.

Vesting and Clawback Trends in Executive Compensation

Vesting schedules in executive compensation have increasingly emphasized longer earning periods to align leadership incentives with sustained company performance, reflecting a broader trend toward performance-based equity awards. Clawback provisions are becoming more prevalent, especially as regulatory scrutiny intensifies, allowing companies to recover bonuses and stock options following accounting restatements or ethical violations. Together, these mechanisms promote accountability and shareholder value by ensuring executives are rewarded only for authentic, long-term achievements and liable for misconduct.

Best Practices for Managing Vesting and Clawback Policies

Establish clear, transparent vesting schedules aligned with employee performance and company goals to enhance motivation and retention while minimizing disputes. Implement clawback provisions with precise triggers, such as financial restatements or misconduct, and communicate these policies effectively to ensure accountability and legal compliance. Regular audits and updates of vesting and clawback policies help address regulatory changes and evolving business risks.

Vesting vs Clawback Infographic

difterm.com

difterm.com