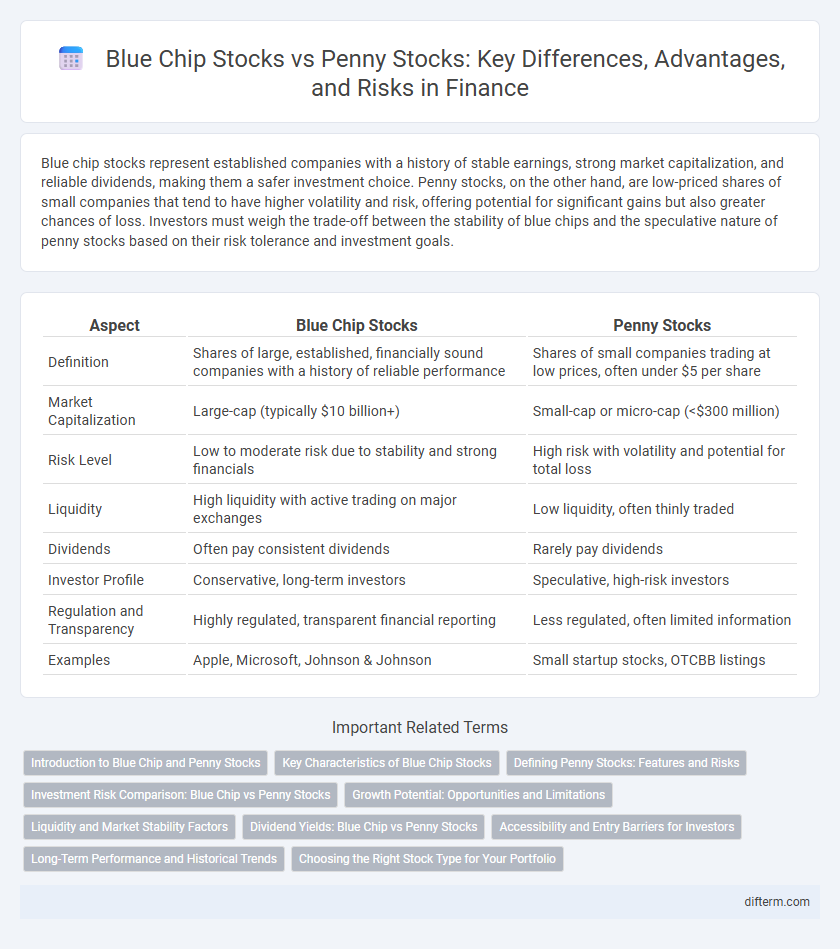

Blue chip stocks represent established companies with a history of stable earnings, strong market capitalization, and reliable dividends, making them a safer investment choice. Penny stocks, on the other hand, are low-priced shares of small companies that tend to have higher volatility and risk, offering potential for significant gains but also greater chances of loss. Investors must weigh the trade-off between the stability of blue chips and the speculative nature of penny stocks based on their risk tolerance and investment goals.

Table of Comparison

| Aspect | Blue Chip Stocks | Penny Stocks |

|---|---|---|

| Definition | Shares of large, established, financially sound companies with a history of reliable performance | Shares of small companies trading at low prices, often under $5 per share |

| Market Capitalization | Large-cap (typically $10 billion+) | Small-cap or micro-cap (<$300 million) |

| Risk Level | Low to moderate risk due to stability and strong financials | High risk with volatility and potential for total loss |

| Liquidity | High liquidity with active trading on major exchanges | Low liquidity, often thinly traded |

| Dividends | Often pay consistent dividends | Rarely pay dividends |

| Investor Profile | Conservative, long-term investors | Speculative, high-risk investors |

| Regulation and Transparency | Highly regulated, transparent financial reporting | Less regulated, often limited information |

| Examples | Apple, Microsoft, Johnson & Johnson | Small startup stocks, OTCBB listings |

Introduction to Blue Chip and Penny Stocks

Blue chip stocks represent shares of large, financially stable companies with established market reputations and consistent dividend payments, attracting conservative investors seeking long-term growth. Penny stocks trade at low prices, typically below $5 per share, and belong to smaller companies with higher volatility and risk, appealing to speculative investors aiming for rapid profits. Understanding their market capitalization, liquidity, and risk profiles assists investors in aligning portfolios with their financial goals.

Key Characteristics of Blue Chip Stocks

Blue chip stocks represent shares of well-established companies with a history of reliable earnings, strong market capitalization, and consistent dividend payments. They are known for their financial stability, lower volatility, and ability to withstand economic downturns, making them attractive to conservative investors. These stocks often belong to industry leaders with robust balance sheets and high credit ratings, reflecting long-term growth potential and reduced investment risk.

Defining Penny Stocks: Features and Risks

Penny stocks are low-priced shares of small companies typically trading below $5 per share, often listed on over-the-counter markets rather than major exchanges. These stocks exhibit high volatility and low liquidity, resulting in significant price fluctuations and increased difficulty in buying or selling shares quickly. Investors face elevated risks due to limited financial information, potential for market manipulation, and lack of regulatory oversight compared to blue-chip stocks.

Investment Risk Comparison: Blue Chip vs Penny Stocks

Blue chip stocks represent established companies with strong financial performance, offering lower investment risk and more stable returns compared to penny stocks. Penny stocks are highly volatile and speculative, often lacking liquidity and transparent financials, which significantly increases investment risk. Investors seeking capital preservation and consistent dividends typically prefer blue chip stocks, whereas penny stocks attract those willing to accept higher risk for potential rapid gains.

Growth Potential: Opportunities and Limitations

Blue chip stocks offer steady growth potential supported by large market capitalization, strong financial performance, and established market presence, appealing to conservative investors seeking long-term wealth accumulation. Penny stocks present high growth opportunities due to their low price and market volatility but carry significant risk from limited liquidity, lack of transparency, and potential for price manipulation. Investors must weigh the stability and predictable returns of blue chip companies against the speculative, rapid gains possible with penny stocks when considering portfolio growth strategies.

Liquidity and Market Stability Factors

Blue chip stocks exhibit high liquidity due to their large market capitalization and consistent trading volume, facilitating easy buying and selling without significant price fluctuations. Penny stocks, characterized by low liquidity and minimal market activity, often experience volatile price movements and increased bid-ask spreads, posing higher risks for investors. Market stability is stronger in blue chip stocks thanks to their established companies and reliable financial performance, whereas penny stocks are more prone to rapid price swings driven by speculative trading and limited market depth.

Dividend Yields: Blue Chip vs Penny Stocks

Blue chip stocks typically offer stable and attractive dividend yields, reflecting their established market presence and consistent profitability. Penny stocks rarely provide dividends due to their higher risk profiles and focus on capital gains rather than income generation. Investors seeking reliable dividend income typically favor blue chip stocks over penny stocks, which often lack consistent cash flow for dividend payments.

Accessibility and Entry Barriers for Investors

Blue chip stocks offer high accessibility for investors due to their established market presence, liquidity, and regulatory transparency, making entry barriers relatively low even for beginners. Penny stocks, often traded over-the-counter, present higher entry barriers due to limited liquidity, increased volatility, and less stringent disclosure requirements, which may deter risk-averse investors. Institutional investors typically prefer blue chip stocks for portfolio stability, while penny stocks attract speculators seeking high-risk, high-reward opportunities despite accessibility challenges.

Long-Term Performance and Historical Trends

Blue chip stocks, characterized by established companies with strong financials and consistent dividend payments, generally exhibit stable long-term performance and resilience during market downturns. Penny stocks, often associated with small-cap firms, show high volatility and speculative behavior, resulting in unpredictable and frequently lower historical returns. Long-term investment strategies typically favor blue chip stocks for portfolio growth due to their proven track record and reduced risk profile.

Choosing the Right Stock Type for Your Portfolio

Blue chip stocks offer stability, consistent dividends, and long-term growth, making them ideal for conservative investors seeking reliable returns. Penny stocks, while highly volatile and risky, provide opportunities for substantial gains in high-growth sectors but require thorough research and risk tolerance. Balancing these stock types based on your investment goals and risk appetite ensures a diversified and resilient portfolio.

Blue chip vs Penny stock Infographic

difterm.com

difterm.com