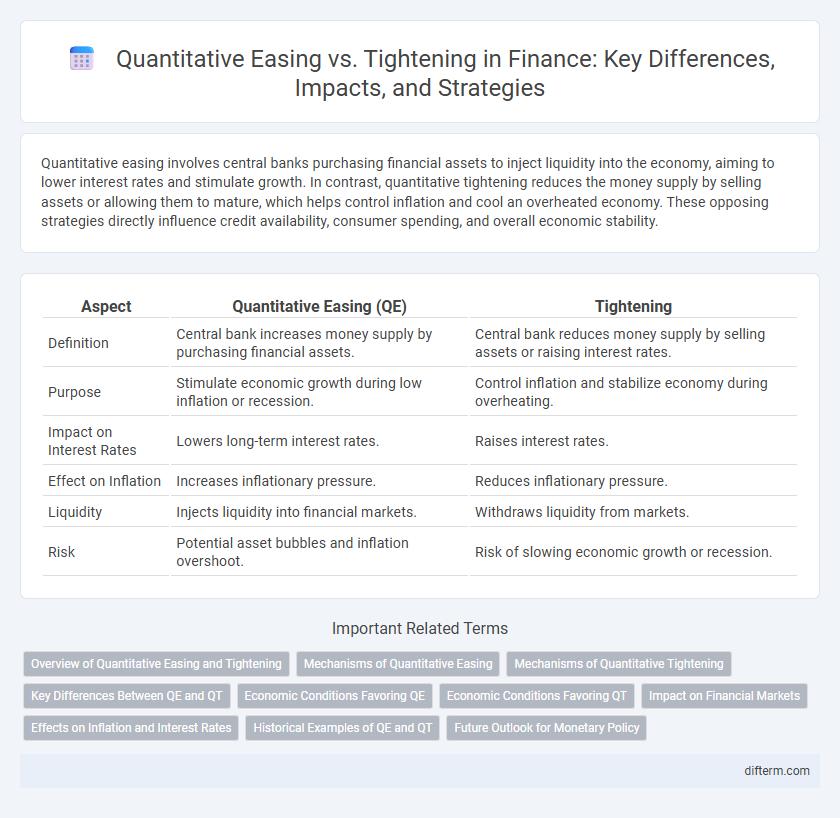

Quantitative easing involves central banks purchasing financial assets to inject liquidity into the economy, aiming to lower interest rates and stimulate growth. In contrast, quantitative tightening reduces the money supply by selling assets or allowing them to mature, which helps control inflation and cool an overheated economy. These opposing strategies directly influence credit availability, consumer spending, and overall economic stability.

Table of Comparison

| Aspect | Quantitative Easing (QE) | Tightening |

|---|---|---|

| Definition | Central bank increases money supply by purchasing financial assets. | Central bank reduces money supply by selling assets or raising interest rates. |

| Purpose | Stimulate economic growth during low inflation or recession. | Control inflation and stabilize economy during overheating. |

| Impact on Interest Rates | Lowers long-term interest rates. | Raises interest rates. |

| Effect on Inflation | Increases inflationary pressure. | Reduces inflationary pressure. |

| Liquidity | Injects liquidity into financial markets. | Withdraws liquidity from markets. |

| Risk | Potential asset bubbles and inflation overshoot. | Risk of slowing economic growth or recession. |

Overview of Quantitative Easing and Tightening

Quantitative easing (QE) refers to central banks increasing money supply by purchasing government securities to stimulate economic growth and lower interest rates. Quantitative tightening (QT) involves central banks reducing their balance sheets by selling those securities or allowing them to mature, aiming to control inflation and stabilize the economy. The balance between QE and QT directly influences liquidity, asset prices, and overall financial market conditions.

Mechanisms of Quantitative Easing

Quantitative easing (QE) operates by central banks purchasing government bonds and other financial assets to increase the money supply and lower interest rates, stimulating economic activity. This mechanism injects liquidity directly into the financial system, encouraging lending and investment by reducing the cost of borrowing. Unlike quantitative tightening, which involves selling assets to withdraw liquidity, QE aims to combat deflation and support economic growth during periods of slow demand.

Mechanisms of Quantitative Tightening

Quantitative tightening (QT) reduces the central bank's balance sheet by selling government bonds and other securities, thereby decreasing the money supply and increasing interest rates. This mechanism absorbs excess liquidity from the financial system, tightening credit conditions and slowing economic growth to counter inflation. By reversing quantitative easing (QE), QT helps restore normal monetary policy and stabilize inflation expectations.

Key Differences Between QE and QT

Quantitative easing (QE) involves central banks purchasing government securities to increase money supply and stimulate economic growth, while quantitative tightening (QT) entails selling those assets or allowing them to mature, reducing liquidity and curbing inflation. QE lowers interest rates and encourages lending, whereas QT raises interest rates and tightens credit availability to slow down overheating economies. The key differences lie in their opposite objectives: QE aims to combat recessionary pressures, and QT targets inflation control and financial stability.

Economic Conditions Favoring QE

Economic conditions favoring quantitative easing include low inflation rates, sluggish economic growth, and elevated unemployment, where traditional monetary policy tools have limited effectiveness. Central banks implement QE to inject liquidity, lower long-term interest rates, and stimulate borrowing and investment during recessionary or deflationary periods. Markets experiencing credit tightening and reduced consumer spending patterns also benefit from aggressive asset purchases under QE frameworks.

Economic Conditions Favoring QT

Economic conditions favoring quantitative tightening (QT) include rising inflation rates, robust economic growth, and labor market strength, which reduce the need for stimulative monetary policies. Central banks typically initiate QT to decrease excess liquidity, increase interest rates, and stabilize financial markets during periods of overheating economies. Elevated asset prices and expanding credit growth also prompt QT to mitigate risks of financial bubbles and maintain long-term economic stability.

Impact on Financial Markets

Quantitative easing (QE) increases liquidity by expanding central bank asset purchases, leading to lower interest rates and higher asset prices across equities and bonds. In contrast, quantitative tightening (QT) contracts the money supply through asset sales or reduced reinvestment, often causing rising yields and declining market valuations. Financial markets react to QE with improved risk appetite and credit conditions, while QT tends to tighten financial conditions, increasing volatility and impacting borrowing costs.

Effects on Inflation and Interest Rates

Quantitative easing typically lowers interest rates by increasing money supply, which often leads to higher inflation as borrowing becomes cheaper and consumer spending rises. Conversely, quantitative tightening reduces money supply, driving up interest rates and helping to curb inflation by making loans more expensive and slowing economic activity. Central banks use these policies strategically to balance inflation targets and stabilize economic growth.

Historical Examples of QE and QT

Quantitative easing (QE) historically expanded central bank balance sheets during crises, such as the Federal Reserve's response to the 2008 financial crash where it purchased over $4 trillion in assets to stabilize markets. In contrast, quantitative tightening (QT) occurred when the Fed reduced its balance sheet from $4.5 trillion in 2017 to about $3.8 trillion by 2019, aiming to normalize monetary policy by selling securities or allowing them to mature. These divergent approaches illustrate central banks' strategic use of balance sheet adjustments to influence liquidity, interest rates, and economic growth.

Future Outlook for Monetary Policy

Central banks are expected to navigate a cautious path between quantitative easing and tightening, balancing economic growth with inflation control. Future monetary policy will likely prioritize data-driven adjustments to interest rates and asset purchases to stabilize markets and support recovery. Market analysts anticipate gradual tightening measures as inflation targets near, enabling more flexible responses to global economic fluctuations.

Quantitative easing vs Tightening Infographic

difterm.com

difterm.com