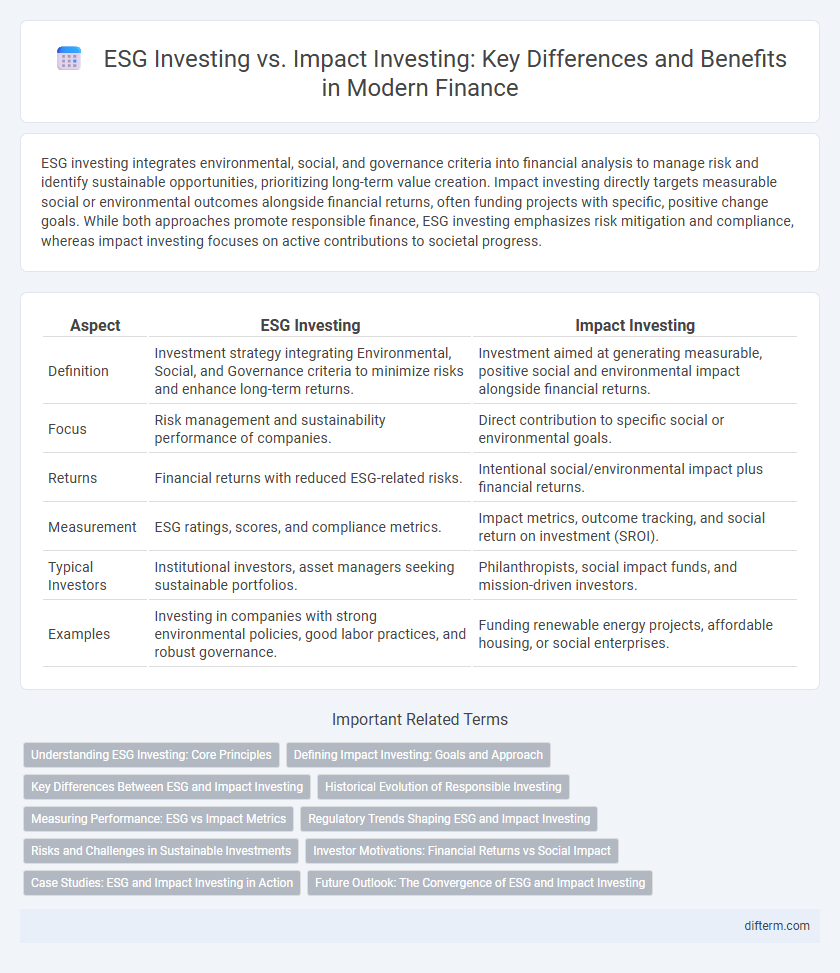

ESG investing integrates environmental, social, and governance criteria into financial analysis to manage risk and identify sustainable opportunities, prioritizing long-term value creation. Impact investing directly targets measurable social or environmental outcomes alongside financial returns, often funding projects with specific, positive change goals. While both approaches promote responsible finance, ESG investing emphasizes risk mitigation and compliance, whereas impact investing focuses on active contributions to societal progress.

Table of Comparison

| Aspect | ESG Investing | Impact Investing |

|---|---|---|

| Definition | Investment strategy integrating Environmental, Social, and Governance criteria to minimize risks and enhance long-term returns. | Investment aimed at generating measurable, positive social and environmental impact alongside financial returns. |

| Focus | Risk management and sustainability performance of companies. | Direct contribution to specific social or environmental goals. |

| Returns | Financial returns with reduced ESG-related risks. | Intentional social/environmental impact plus financial returns. |

| Measurement | ESG ratings, scores, and compliance metrics. | Impact metrics, outcome tracking, and social return on investment (SROI). |

| Typical Investors | Institutional investors, asset managers seeking sustainable portfolios. | Philanthropists, social impact funds, and mission-driven investors. |

| Examples | Investing in companies with strong environmental policies, good labor practices, and robust governance. | Funding renewable energy projects, affordable housing, or social enterprises. |

Understanding ESG Investing: Core Principles

ESG investing integrates environmental, social, and governance criteria into financial analysis to identify sustainable and ethical investment opportunities. Core principles emphasize evaluating corporate transparency, resource efficiency, labor practices, and board diversity to mitigate risks and promote long-term value. Investors use ESG metrics to align portfolios with sustainability goals while maintaining competitive financial returns.

Defining Impact Investing: Goals and Approach

Impact investing focuses on generating measurable social and environmental benefits alongside financial returns by targeting projects and companies with clear, positive impacts. It prioritizes investments in sectors such as renewable energy, affordable housing, and education, aligning capital deployment with specific societal goals. Measurement frameworks like the Impact Reporting and Investment Standards (IRIS) are essential for tracking progress and ensuring accountability.

Key Differences Between ESG and Impact Investing

ESG investing emphasizes integrating environmental, social, and governance criteria into financial analysis to manage risk and enhance long-term returns, focusing on sustainability factors within existing companies. Impact investing targets generating measurable social or environmental outcomes alongside financial returns by actively supporting projects or companies committed to specific positive impacts. The primary difference lies in ESG's risk management approach versus impact investing's intentional pursuit of quantifiable social or environmental benefits.

Historical Evolution of Responsible Investing

ESG investing emerged in the early 2000s as corporations and investors integrated environmental, social, and governance criteria to enhance long-term financial performance and risk management. Impact investing traces back to philanthropic traditions of the 1960s and evolved into a distinct strategy by the 2000s, emphasizing measurable social and environmental outcomes alongside financial returns. Both approaches reflect a growing recognition since the 1990s of responsible investing's potential to align financial goals with ethical and sustainable development priorities.

Measuring Performance: ESG vs Impact Metrics

ESG investing evaluates companies based on environmental, social, and governance criteria using standardized metrics like carbon emissions, board diversity, and ethical business practices. Impact investing focuses on tangible outcomes, measuring success through specific social or environmental improvements such as reduced poverty levels or increased renewable energy adoption. While ESG metrics quantify risk and sustainability integration, impact metrics assess the direct positive change driven by investments.

Regulatory Trends Shaping ESG and Impact Investing

Regulatory trends are increasingly influencing ESG and impact investing by enforcing stricter disclosure requirements and standardized reporting frameworks to enhance transparency and comparability. The European Union's Sustainable Finance Disclosure Regulation (SFDR) and the SEC's proposed climate risk disclosures in the United States are pivotal in shaping how asset managers integrate ESG factors and measure impact. These regulations drive capital towards sustainable investments by mandating clear definitions and accountability, reducing greenwashing risks across financial markets.

Risks and Challenges in Sustainable Investments

ESG investing faces risks related to inconsistent data standards, greenwashing, and regulatory uncertainties that can undermine the credibility and effectiveness of sustainable portfolios. Impact investing encounters challenges in measuring tangible social and environmental outcomes, balancing financial returns with mission goals, and managing illiquidity or higher risk profiles in niche markets. Both investment approaches demand rigorous due diligence and transparent reporting to mitigate risks and enhance long-term value creation in sustainability efforts.

Investor Motivations: Financial Returns vs Social Impact

ESG investing prioritizes financial returns by integrating environmental, social, and governance factors into traditional investment analysis to manage risk and identify sustainable growth opportunities. Impact investing focuses primarily on generating measurable social or environmental benefits alongside financial returns, appealing to investors motivated by both impact and profit. Investor motivations differ as ESG investing targets risk-adjusted financial performance, while impact investing emphasizes achieving specific positive societal outcomes.

Case Studies: ESG and Impact Investing in Action

Case studies of ESG investing highlight companies like Unilever, which improved sustainability and governance to enhance long-term shareholder value while reducing environmental impact. Impact investing case studies, such as the growth of microfinance institutions like Grameen Bank, demonstrate successful social and environmental outcomes alongside financial returns. Both approaches illustrate how targeted capital allocation drives measurable benefits in corporate responsibility and community development.

Future Outlook: The Convergence of ESG and Impact Investing

ESG investing and impact investing are increasingly converging as investors demand both measurable financial returns and positive societal outcomes. Advanced data analytics and AI-driven tools enhance transparency, enabling better assessment of environmental, social, and governance factors alongside direct impact metrics. This integration is expected to drive capital flows towards solutions that address climate change, social equity, and sustainable development goals, reshaping the future of responsible finance.

ESG Investing vs Impact Investing Infographic

difterm.com

difterm.com