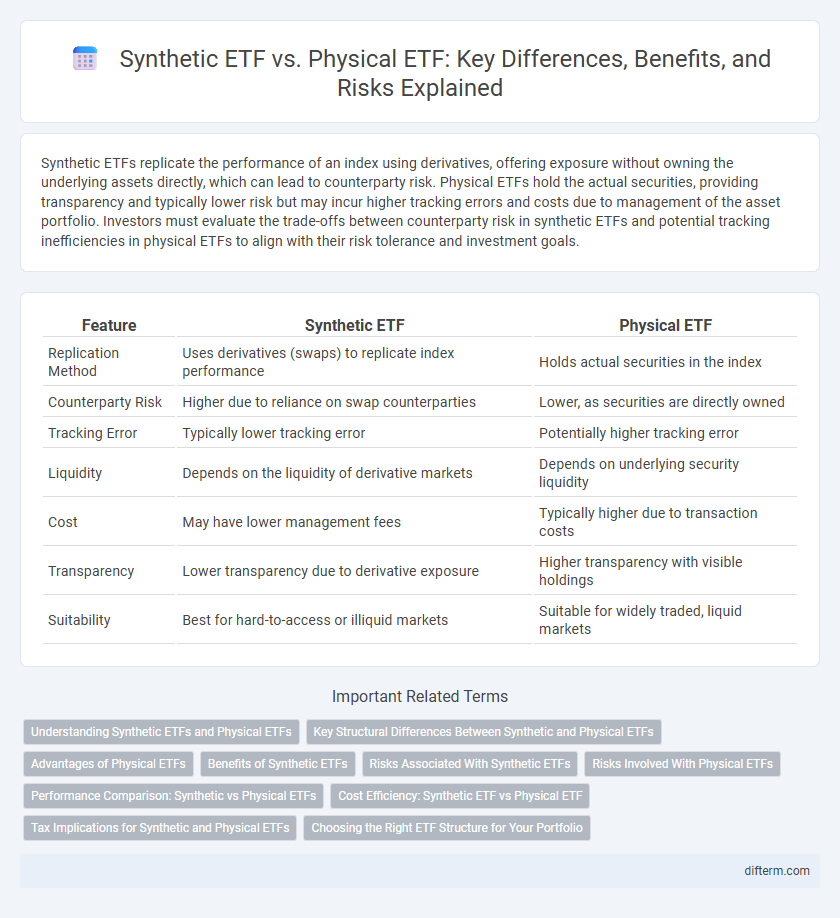

Synthetic ETFs replicate the performance of an index using derivatives, offering exposure without owning the underlying assets directly, which can lead to counterparty risk. Physical ETFs hold the actual securities, providing transparency and typically lower risk but may incur higher tracking errors and costs due to management of the asset portfolio. Investors must evaluate the trade-offs between counterparty risk in synthetic ETFs and potential tracking inefficiencies in physical ETFs to align with their risk tolerance and investment goals.

Table of Comparison

| Feature | Synthetic ETF | Physical ETF |

|---|---|---|

| Replication Method | Uses derivatives (swaps) to replicate index performance | Holds actual securities in the index |

| Counterparty Risk | Higher due to reliance on swap counterparties | Lower, as securities are directly owned |

| Tracking Error | Typically lower tracking error | Potentially higher tracking error |

| Liquidity | Depends on the liquidity of derivative markets | Depends on underlying security liquidity |

| Cost | May have lower management fees | Typically higher due to transaction costs |

| Transparency | Lower transparency due to derivative exposure | Higher transparency with visible holdings |

| Suitability | Best for hard-to-access or illiquid markets | Suitable for widely traded, liquid markets |

Understanding Synthetic ETFs and Physical ETFs

Synthetic ETFs replicate the performance of an index using derivatives such as swaps, eliminating the need to hold the actual securities, which can reduce tracking error but introduces counterparty risk. Physical ETFs, also known as traditional ETFs, hold the underlying assets of the index directly, providing greater transparency and lower counterparty risk but potentially higher tracking error due to fees or illiquid securities. Investors should evaluate the trade-offs between counterparty risk in synthetic ETFs and the direct ownership benefits in physical ETFs when selecting an investment vehicle.

Key Structural Differences Between Synthetic and Physical ETFs

Synthetic ETFs replicate index performance through derivatives such as swaps, exposing investors to counterparty risk, while Physical ETFs directly hold a basket of underlying securities, providing tangible asset ownership and reducing counterparty exposure. Synthetic ETFs offer liquidity advantages and lower tracking errors by utilizing swap structures, whereas Physical ETFs face challenges in replicating illiquid or complex indices due to actual asset acquisition. Regulatory frameworks impact both types differently, with physical ETFs typically subject to stricter transparency and custody requirements compared to synthetic variants.

Advantages of Physical ETFs

Physical ETFs offer direct ownership of underlying assets, providing transparent exposure to the actual securities in the index. They typically have lower counterparty risk compared to synthetic ETFs, which rely on swaps and derivatives. This direct asset backing enhances investor confidence by ensuring that holdings are tangible and less vulnerable to default risks.

Benefits of Synthetic ETFs

Synthetic ETFs offer precise index replication through derivatives, reducing tracking error compared to physical ETFs that rely on actual asset holdings. Their ability to access hard-to-reach markets and asset classes enhances diversification opportunities for investors. Cost efficiency is improved by lower transaction fees and reduced operational complexities inherent in synthetic structures.

Risks Associated With Synthetic ETFs

Synthetic ETFs carry counterparty risk due to their reliance on swap agreements with financial institutions, exposing investors to potential default risk. Unlike physical ETFs that hold actual securities, synthetic ETFs replicate index performance through derivatives, which may lead to liquidity issues and valuation complexities. Regulatory scrutiny and the possibility of tracking errors increase the financial risk associated with synthetic ETFs compared to their physical counterparts.

Risks Involved With Physical ETFs

Physical ETFs carry risks such as counterparty risk related to the custody of underlying securities, which can be affected by fraud or insolvency of custodian banks. Market liquidity risk is also present, as large redemptions might force asset sales at unfavorable prices, impacting fund value. Additionally, tracking error can occur if the ETF cannot perfectly replicate the performance of the benchmark index due to transaction costs or delays in asset acquisition.

Performance Comparison: Synthetic vs Physical ETFs

Synthetic ETFs replicate the performance of an index through derivatives such as swaps, often achieving lower tracking error compared to Physical ETFs, which hold the underlying assets directly. Physical ETFs may face challenges like portfolio sampling and illiquid securities, potentially resulting in greater tracking discrepancies, while synthetic ETFs rely on counterparty risk management to maintain performance fidelity. Empirical studies indicate synthetic ETFs tend to provide closer index replication and slightly better short-term performance, whereas physical ETFs offer transparency and reduced counterparty exposure over the long term.

Cost Efficiency: Synthetic ETF vs Physical ETF

Synthetic ETFs typically offer higher cost efficiency than physical ETFs by reducing expenses related to securities acquisition, custody, and management fees. By using swap agreements or derivatives to replicate index performance, synthetic ETFs avoid transaction costs and taxes associated with buying and selling underlying assets directly. However, investors should evaluate counterparty risk and the impact of these arrangements on overall expense ratios and net returns.

Tax Implications for Synthetic and Physical ETFs

Tax implications for synthetic ETFs often involve complexity due to the use of derivatives and swap agreements, which can result in different treatment of dividends and capital gains compared to physical ETFs. Physical ETFs, owning the underlying assets, generally offer clearer tax advantages such as qualified dividend income and potential tax efficiency through in-kind redemptions. Investors should consider jurisdiction-specific tax rules, as synthetic ETFs may expose them to higher withholding taxes or unexpected tax liabilities depending on the structure and domicile.

Choosing the Right ETF Structure for Your Portfolio

Synthetic ETFs replicate the performance of an index through derivatives, offering cost efficiency and access to hard-to-replicate markets, while physical ETFs hold actual securities, providing transparency and lower counterparty risk. Investors prioritizing safety and clarity may prefer physical ETFs, whereas those seeking cost-effective market exposure might consider synthetic ETFs. Evaluating factors like tracking error, counterparty risk, and portfolio objectives is crucial in selecting the right ETF structure for optimal diversification and return.

Synthetic ETF vs Physical ETF Infographic

difterm.com

difterm.com